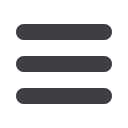

Schedule forming part of Consolidated Balance Shee

t

As at March 31, 2009

(Rs in lacs)

(Rs in lacs)

Advances recoverable in cash or in kind

or for value to be recovered

Good

5,786.07

5,855.10

Doubtful

780.90

305.44

Less: Provision

780.90

305.44

-

-

5,786.07

5,855.10

Balances with Customs, Bombay Port Trust, Excise etc.

899.75

3,160.66

Sundry deposits

804.58

707.85

MAT credit entitlement

638.00

519.00

Tax paid in advance, net of provisions

644.60

1,184.16

11,106.73

11,622.84

56,399.18

63,709.58

* Includes Rs13.92 lacs deposit, receipt of which is endorsed in favour of Government Departments. (previous year Rs13.92 lacs)

SCHEDULE 7

CURRENT ASSETS, LOANS

AND ADVANCES

(Contd.)

As at March 31, 2009

As at March 31, 2008

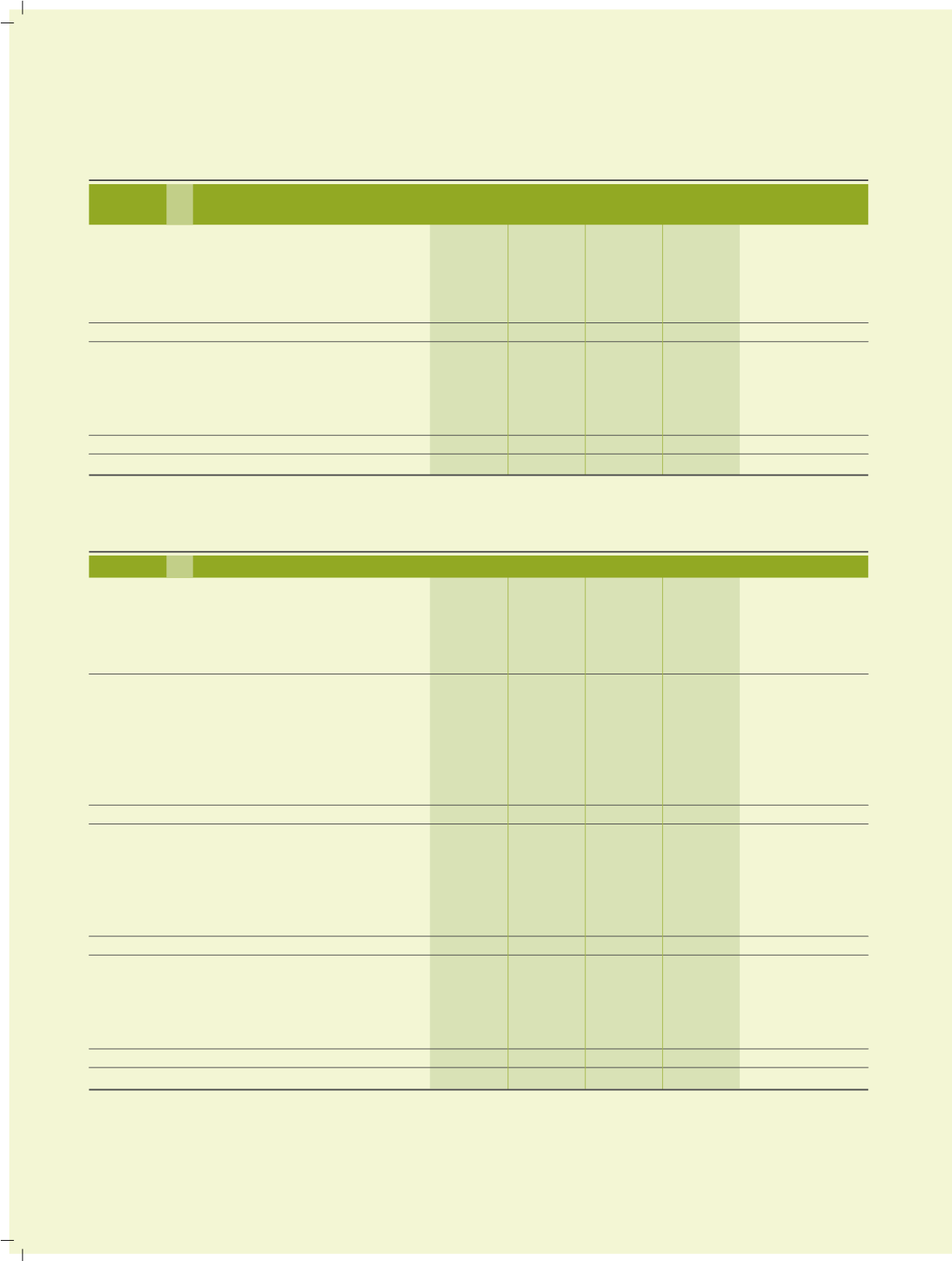

(a) Liabilities:

Acceptances

2,980.21

2,231.13

Sundry creditors:

(i) Due to Micro, Small and Medium Enterprise

24.14

6.17

(ii) Due to others

16,047.53

20,262.21

16,071.67

20,268.38

Over drawn current accounts as per books

-

2.52

Investors Education and Protection Fund shall be

credited by the following (see Note below):

Unclaimed dividends

69.32

60.28

Matured fixed deposits

0.10

0.10

Interest payable on fixed deposits

14.62

15.42

84.04

75.80

Interest accrued but not due on loans

141.10

63.04

Unclaimed amount of sale proceeds of

fractional coupons of bonus shares of

erstwile The Atul Products Ltd

9.64

9.64

Unclaimed amount of sale proceeds of

fractional coupons of bonus shares

1.38

1.38

19,288.04

22,651.89

(b) Provisions:

For contingencies

274.87

274.55

For unencashed leave

1,222.49

1,156.37

For dividend tax

151.23

151.23

Proposed dividend

889.85

889.85

2,538.44

2,472.00

21,826.48

25,123.89

Note:

There is no amount due and outstanding to be credited to Investor Education and Protection fund as at March 31, 2009

SCHEDULE 8 CURRENT LIABILITIES AND PROVISIONS

As at March 31, 2009

As at March 31, 2008

98