Schedules forming part of the Consolidated Account

s

2009 2008 2009 2008 2009 2008 2009 2008

Buildings

3.80

3.80

3.80

3.80

-

-

-

-

Plant & machinery

127.50 127.50 61.52 48.34 65.98 79.16 13.18 13.18

Total

131.30 131.30 65.32 52.14 65.98 79.16 13.18 13.18

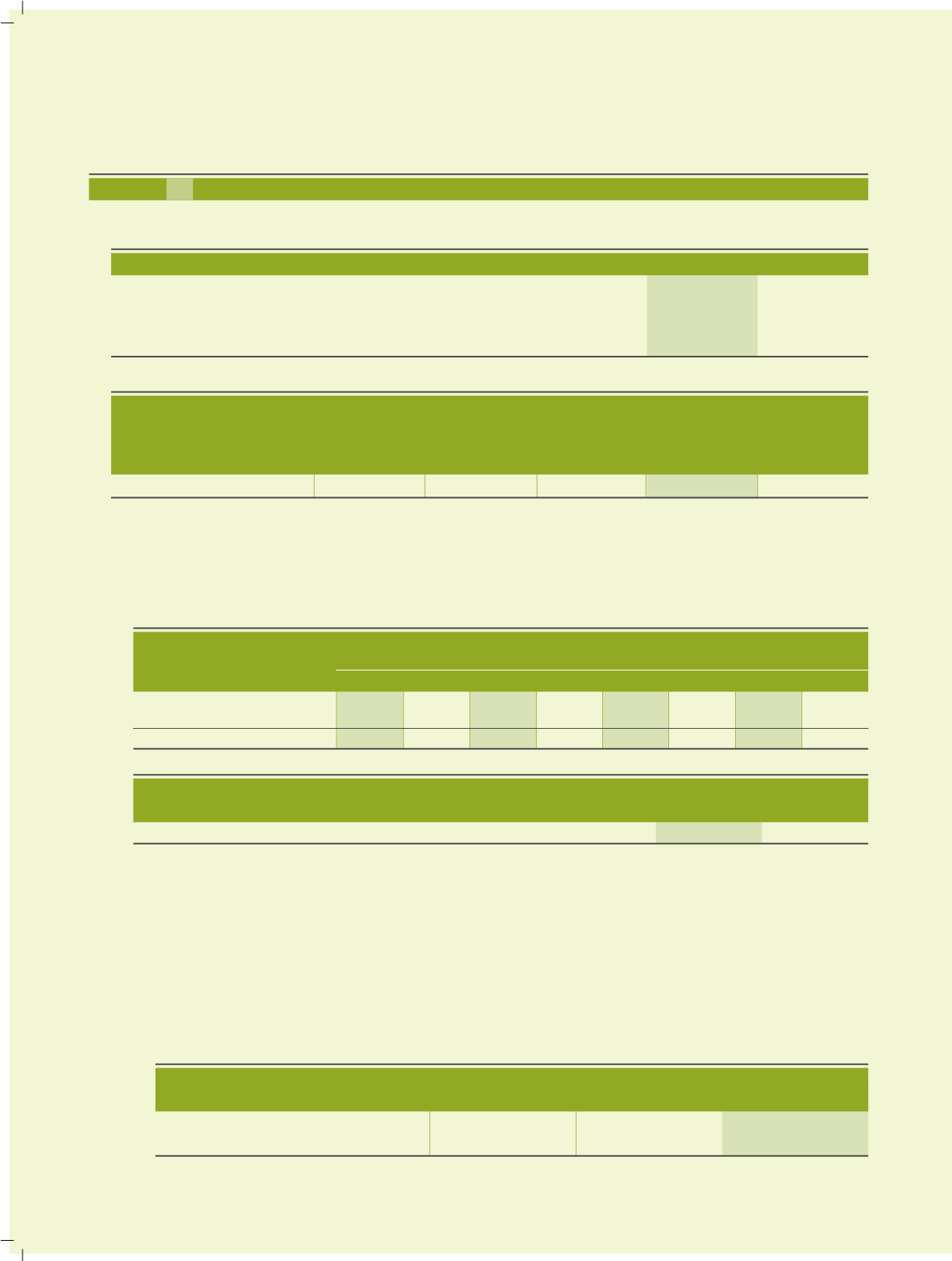

12 Lease:

(a) The Company has taken various residential and office premises under operation lease or leave and license agreements. These

are generally cancellable, having a term between 11 months and 3 years and have no specific obligation for renewal. Lease

payments are recognised in the Profit and Loss Account under rent in Schedule 15.

(b) The Company has given a building and plant & machinery on operating lease, the detail of which are as under:

(Rs in lacs)

Assets

Gross block

Depreciation fund Written down

Depreciation for

value

the year

Particulars

As at

As at

March 31, 2009 March 31, 2008

Not later than one year

23.53

23.53

The future minimum lease payments to be received under the non-cancellable leases are as follows:

(Rs in lacs)

Particulars

March 31, 2009 March 31, 2008

Profit for the year attributable to the equity shareholders

Rs in lacs

4,237.82

3,046.95

Basic | weighted average number of equity shares outstanding during the year

2,96,61,733

2,96,61,733

Nominal value of equity share

Rs

10

10

Basic and diluted Earning per Share

Rs

14.29

10.27

10 Earning per Share :

Earning per Share (EPS) - The numerators and denominators used to calculate basic and diluted Earning per Share:

11 Provisions:

Name of the provision

Balance

Accrued

Payments

Provision

Closing

carried

during

during

reversed |

balance

as at

the year

the year

written

carried as at

March 31, 2008

back March 31, 2009

Leave encashment

1,156.37

302.52

236.40

-

1,222.49

13

(a) Suppliers and customers balances are subject to confirmation.

(b) Depots debtors as per depots books and Head office books are in the process of reconciliation, adjustments, if any, will be made

on completion of the reconciliation. Due to this, sundry debtors related to depots sales are disclosed as per Head office books

of account.

14

The use of derivative instruments is governed by the policies of the Company, approved by the Board of Directors, which provide

written principles on the use of such financial derivatives consistent with the risk management strategy of the Company.

(1) The Company has entered into the following derivatives:

(a) The Company uses foreign currency forward contracts to hedge its risks associated with foreign currency fluctuations

relating to certain firm commitments and highly probable forecast transactions.

The following are the outstanding forward exchange contracts entered into by the Company:

As at

No of

Type

US$ equivalent

contracts

(lacs)

March 31, 2008

33

Sell

400.00

March 31, 2009

31

Sell

57.00

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(Contd.)

106