120 /

Atul Ltd

|

Annual Report 2009-10

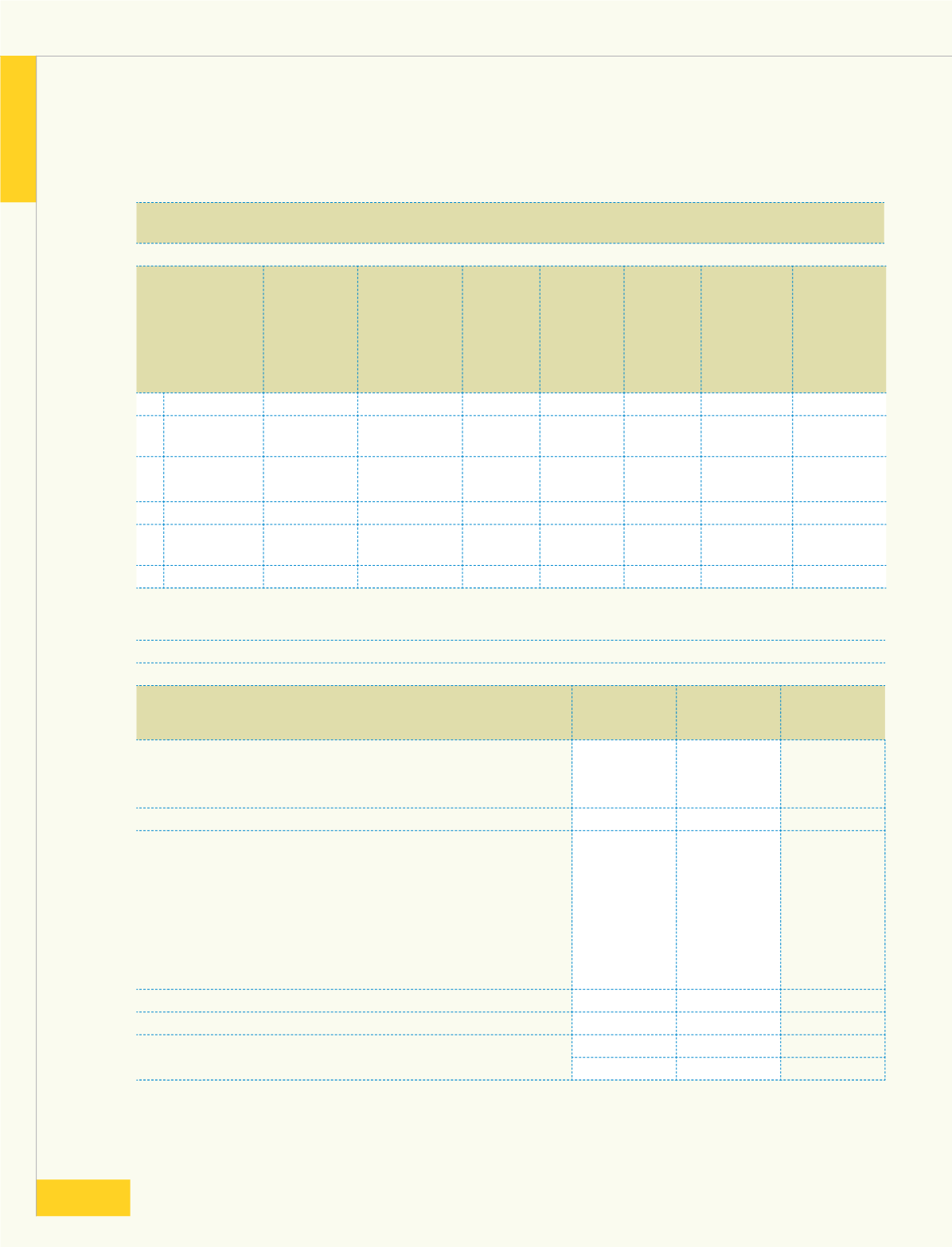

5 Details of associates considered in consolidation:

(Rs crores)

Name of associate Country of

incorporation

Main activities Ownership

interest

and voting

power

Original

cost of

investments

Amount of

goodwill

/ capital

reserve

included

in original

cost

Accumulated

Loss at the

year end

March 31,

2009

Carrying

amount of

investments

at the year

end (see

Note (1)

below)

1

2

3

4

5

6

7

8

(a) Amal Ltd

India

Dye

Intermediates

36.75%

5.15

-

55.61

0.24

(b) Gujarat

Synthwood Ltd

India

PVC sheets and

Panels

34.64%

1.30

-

17.08

0.07

(c) AtRo Ltd

India

Agrochemicals

50.00%

0.50

-

0.43

0.50

(d) Atul Bioscience

Ltd

India

Pharmaceuticals

28.00%

-

3.85

6.95

-

76.97

0.81

Note: (i) After provision for diminution in value of investments in case of 'a' and 'b'.

(ii) Value of investment in Atul Bioscience Ltd under column '5' and '8' is Rs 140

6 Deferred Tax adjustments recognised in the financial statements:

(Rs crores)

Particulars

Balance

As at

March 31, 2010

Charge | credit

Balance

As at

March 31, 2009

During the year

Deferred tax liabilities:

On account of timing difference in

(a) Depreciation | impairment loss

29.05

(1.94)

30.99

29.05

(1.94)

30.99

Deferred tax assets:

On account of timing difference in

(a) Provision for leave encashment

4.36

0.22

4.14

(b) 43 B expenses allowable

0.42

(0.19)

0.61

(c) Provision for doubtful debts

-

(2.28)

2.28

(d) Provision for doubtful advances

0.06

(3.39)

3.45

(e) Payment under VRS

1.63

(1.16)

2.79

6.47

(6.80)

13.27

22.58

4.86

17.72

(f) Deferred tax assets of subsidiaries

(0.01)

(0.01)

(0.01)

Net deferred tax liability | (assets)

22.57

4.85

17.71

Schedule

forming part of the Consolidated accounts

SCHEDULE 16 NOTES FORMING PART OF THE CONSOLIDATED ACCOUNTS

(contd)

121