As per our attached report of even date

For and on behalf of the Board of Directors

For Dalal & Shah

Firm Registration No. 102020W

Sunil S Lalbhai

Chartered Accountants

Chairman & Managing Director

G S Patel

S S Baijal

B S Mehta

H S Shah

S Venkatesh

S M Datta

Partner

R A Shah

Samveg A Lalbhai

Membership No. F-037942

T R Gopi Kannan

V S Rangan

Managing Director

Mumbai

President, Finance &

B N Mohanan

Mumbai

May 13, 2011

Company Secretary

Directors

May 13, 2011

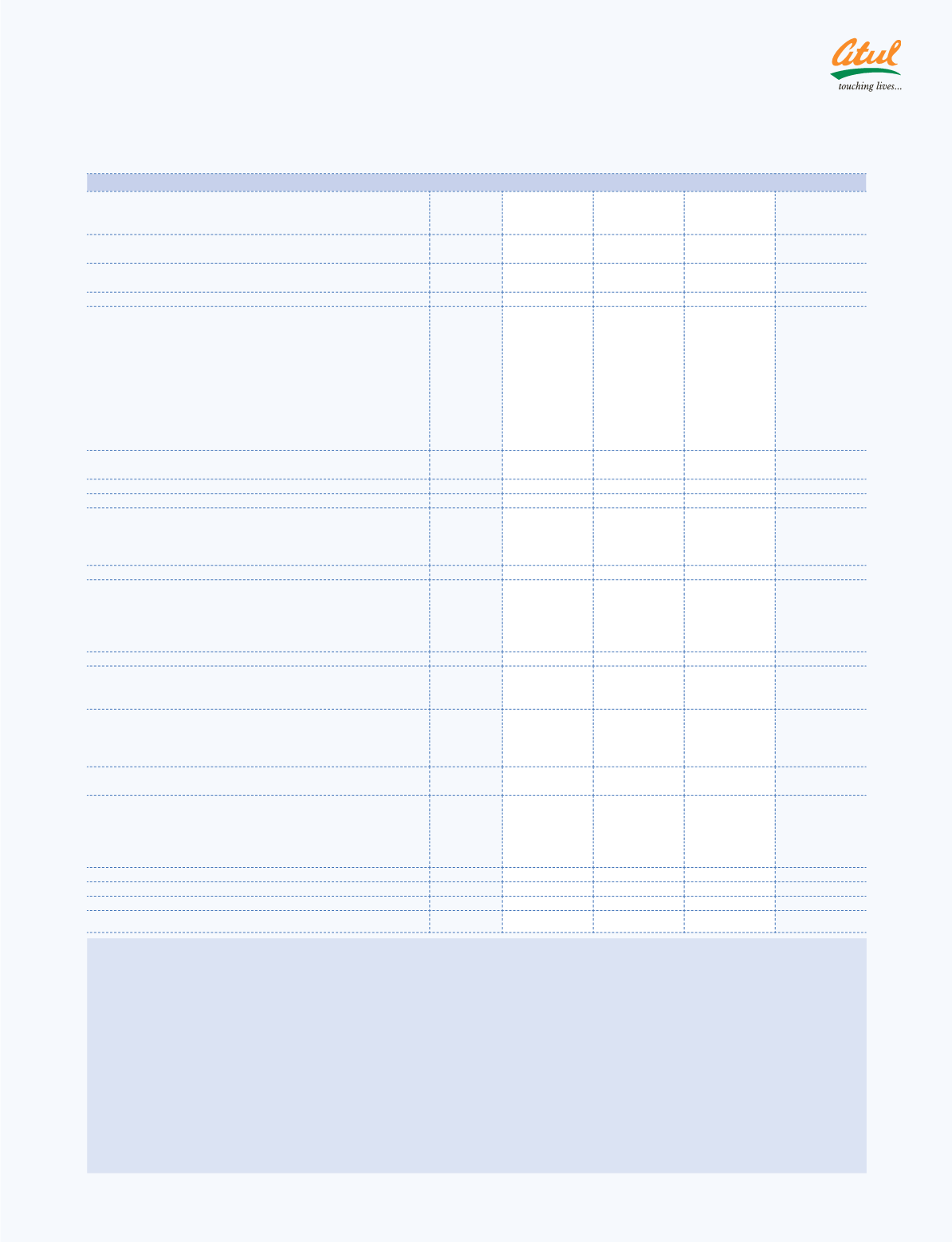

Consolidated Profit and Loss Account

for the year ended March 31, 2011

(

`

crores)

Particulars

Schedule

2010-11

2009-10

INCOME

Gross sales

1,616.68

1,249.82

Less: Excise duty

86.56

57.84

Net sales

1,530.12 1,191.98

Operating income

9

39.70

31.75

Sales and operating income

1,569.82 1,223.73

Other income

10

5.43

5.38

1,575.25 1,229.11

EXPENDITURE

Cost of goods sold and materials consumed

11

897.62

674.75

Manufacturing expenditure

12

225.97

181.88

Employees’ emoluments

13

108.20

106.12

Interest and finance charges

14

25.54

25.76

Others

15

141.53

115.42

Exchange rate difference

8.87

8.86

Depreciation

39.64

38.58

Amortisation of leasehold land

0.28

0.28

Amortisation of computer software

0.78

0.62

40.70

39.48

Less: Amount withdrawn from revaluation reserve

2.06

2.06

38.64

37.42

1,446.37 1,150.21

Profit before tax and exceptional items

128.88

78.90

Exceptional items

Gain on settlement of long-term export advance

8.20

–

Recovery of advance written off in earlier years

1.90

–

10.10

–

Profit before tax

138.98

78.90

Provision for tax

Current tax

42.62

22.29

Deferred tax

0.47

4.85

Wealth tax

0.11

0.10

43.20

27.24

Profit for the year

95.78

51.66

Share of profit in associate companies

0.54

–

Minority interest

(0.04)

0.08

96.36

51.58

Add | (Less): Tax adjustments for the earlier years

Income tax and wealth tax

(6.11)

0.04

Additional MAT entitlement for the earlier years

–

3.89

Net profit for the year

90.25

55.51

As per last account

265.21

229.22

Net profit available for appropriation

355.46

284.73

Appropriations

General reserve

5.68

5.68

Proposed dividend

13.35

11.87

Corporate dividend tax on above

2.16

1.97

15.51

13.84

Balance carried to Balance Sheet

334.27

265.21

Basic | diluted earning per share (see Note 8)

`

30.43

`

18.71

Notes forming part of the Accounts

16

98 | 99