Atul Ltd | Annual Report 2010-11

Schedules

forming part of the Consolidated accounts

10 Included under Loans and Advances is an amount of

`

11.29 crores (Previous year

`

21.29 crores) given to an

associate company. The said company is registered under BIFR and is implementing its revival plan. First charge

over all their assets has been assigned exclusively in favour of the Company. The Company has also given an

unsecured loan of

`

3.59 crores (Previous year

`

Nil) as Promoters contribution (repayable in two equal instalments

in financial year 2015-16 and 2016-17). Considering the progress of the revival plan, the present market value of

assets, etc these amounts included under loans and advances are considered as good and recoverable.

11 The Company has revalued (i) Leasehold land and (ii) Commercial land & building at Ahmedabad, Mumbai

and Delhi as at March 31, 2008 at fair market value as determined by an independent valuer appointed

for the purpose. Resultant increase in book value amounting to

`

107.47 crores has been transferred to

Revaluation Reserve.

12 In the opinion of the management, the diminution in the value of the investment in shares (see Schedule 6) held

by the Company is temporary in nature and accordingly, no provision is considered necessary by the management.

13 Significant accounting policies followed by the Company are as stated in the statement annexed to this

Schedule.

14 Figures of the previous year have been regrouped | recast | reclassified wherever necessary.

15 Figures less than

`

50000 has been shown at actual in bracket as the figures have been rounded off to

nearest crores.

As per our attached report of even date

For and on behalf of the Board of Directors

For Dalal & Shah

Firm Registration No. 102020W

Sunil S Lalbhai

Chartered Accountants

Chairman & Managing Director

G S Patel

S S Baijal

B S Mehta

H S Shah

S Venkatesh

S M Datta

Partner

R A Shah

Samveg A Lalbhai

Membership No. F-037942

T R Gopi Kannan

V S Rangan

Managing Director

Mumbai

President, Finance &

B N Mohanan

Mumbai

May 13, 2011

Company Secretary

Directors

May 13, 2011

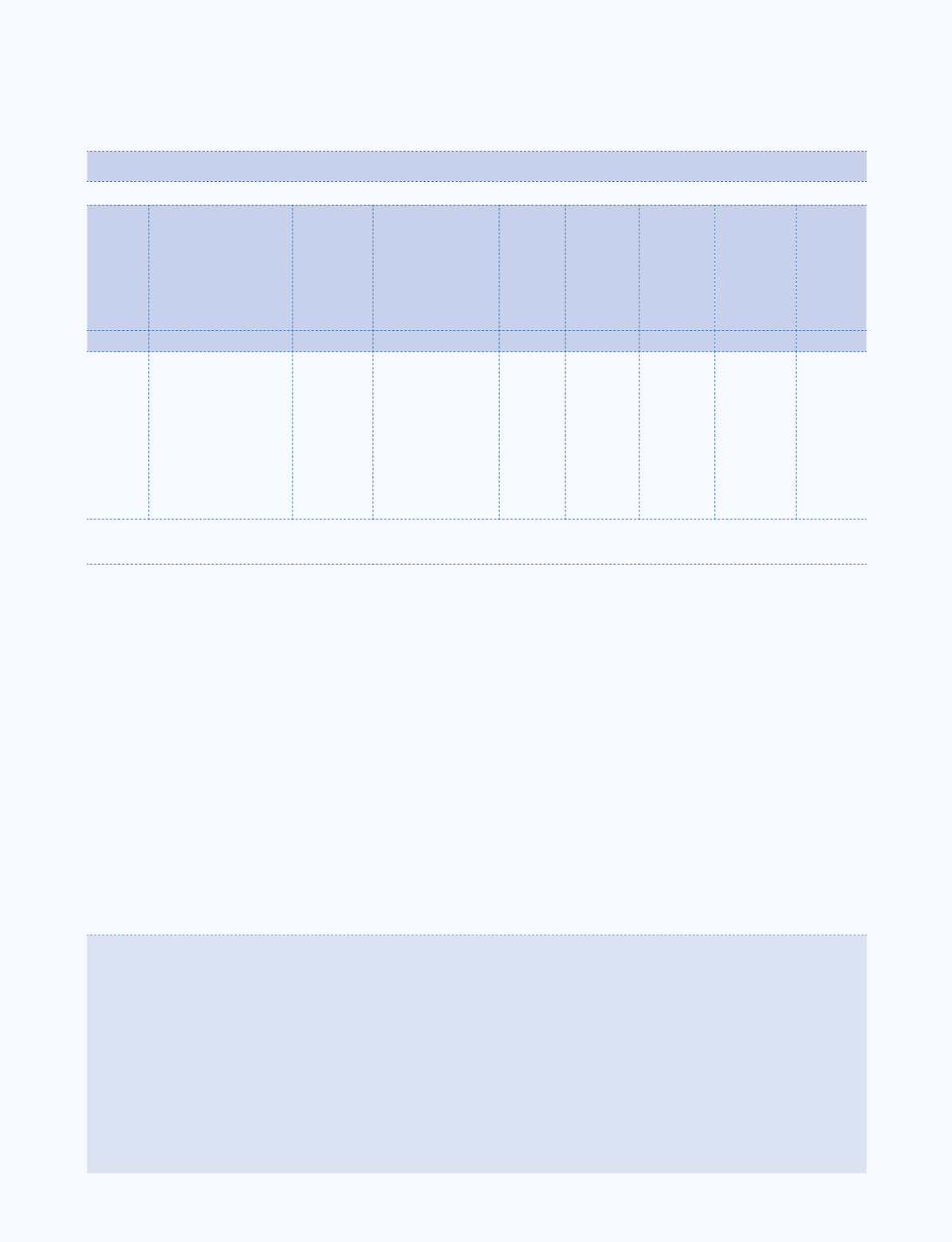

(b) Details of associates considered in consolidation :

(

`

crores)

Sr.

No.

Name of associate

Country of

incorporation

Main activities

Ownership

interest

and voting

power

Original

cost of

Investments

Amount of

goodwill

/ (capital

reserve)

included in

original cost

Accumulated

loss / (gain)

at the year

end March

31, 2011

Carrying

amount of

investments

at the year

end

A

B

C

D

E

F

G

H

I

1 Atul Bioscience Ltd

India

Pharmaceuticals

49.99% 2.75

(0.91)

3.59

2.75

2 M. Dohmen S.A.

Switzerland Trade in Textiles Dyes

50% 14.21

(45.72)

(26.09)

14.21

3 Amal Ltd

India Dye Intermediates

36.75% 5.15

-

30.53

0.24

4 Gujarat Synthwood Ltd

India

PVC sheets and panels 35.03% 1.30

-

17.08

0.07

5 AtRo Ltd

India

Agrochemicals

50%

0.5

-

0.43

0.50

6 Anchor Adhesives Pvt Ltd India Adhesives

49.99% 1.47

1.27

0.19 1.47

7 Atul Infotech Pvt Ltd

India

Information

Technology Support

33.97% 0.00

(0.08)

(0.31)

-

Note:

Value of investment in Atul Infotech Pvt Ltd under column “F” is

`

33,980

SCHEDULE 16 NOTES FORMING PART OF THE CONSOLIDATED ACCOUNTS

(contd)