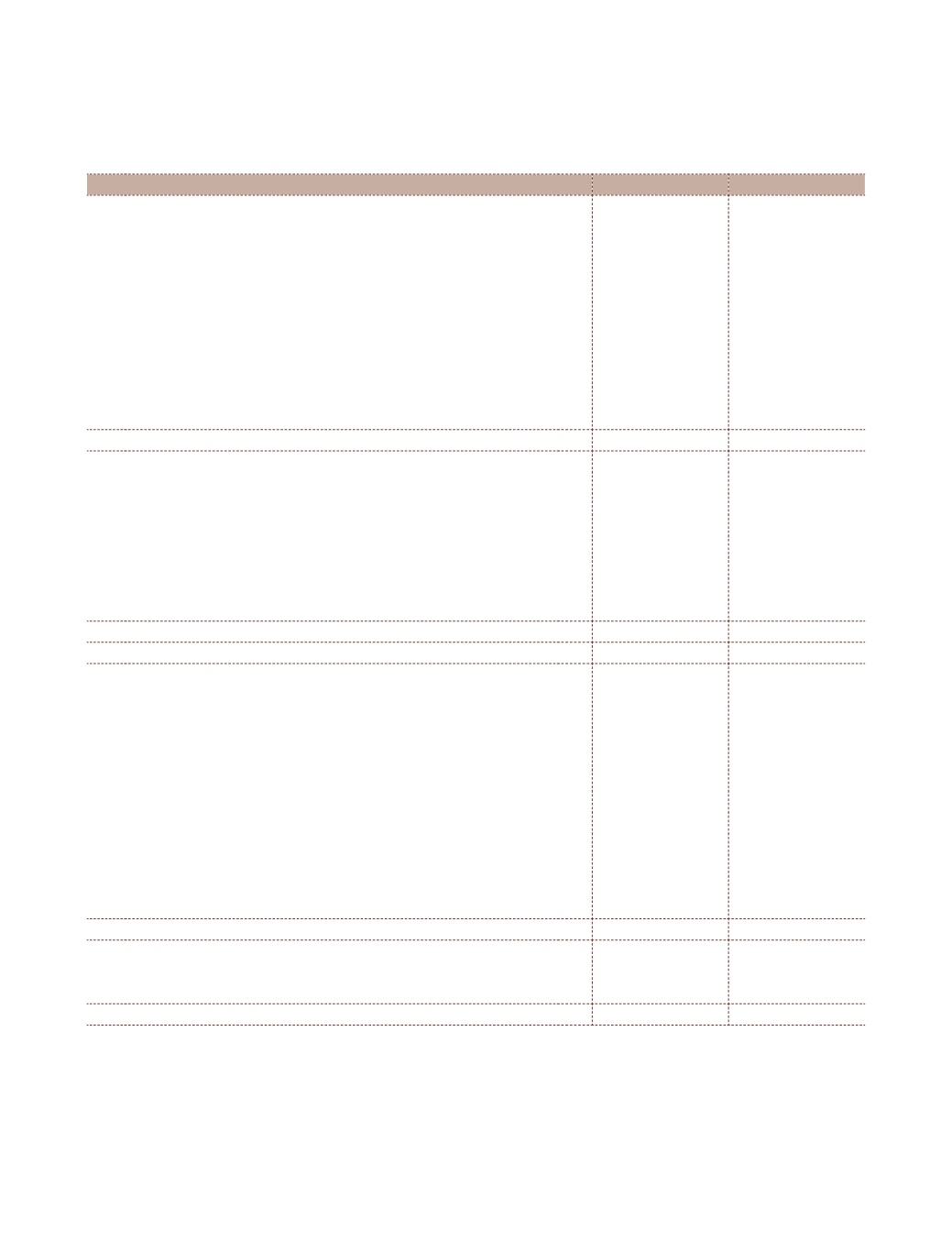

Atul Ltd | Annual Report 2012-13

Consolidated Cash Flow Statement

for the year ended

March 31, 2013

(

`

cr)

Particulars

2012-13

2011-12

(A) CASH FLOW FROM OPERATING ACTIVITIES

3URÀW EHIRUH WD[

186.37

130.07

Adjustments for:

Add:

Depreciation and amortisation expenses

51.40

44.02

Finance costs

34.88

43.31

Loss on assets sold or discarded

0.17

0.06

Unrealised exchange rate difference (net)

2.33

(3.57)

Bad debts and irrecoverable balances written off

0.57

3.01

Provision for doubtful debts

1.68

0.79

Provision for diminution of value of investment

0.07

-

91.10

87.62

277.47

217.69

Less:

Dividend received

3.41

1.59

Interest received

0.29

1.24

Provisions no longer required

5.17

3.69

5HYHUVDO RI SUHYLRXV \HDU ÀQDQFH FRVWV

5.38

-

Exchange difference on consolidation

(14.90)

17.00

6XUSOXV RQ VDOH RI À[HG DVVHWV

0.86

0.28

0.21

23.80

2SHUDWLQJ SURÀW EHIRUH ZRUNLQJ FDSLWDO FKDQJHV

277.26

193.89

Adjustments for:

Inventories

(33.33)

(49.57)

Trade receivables

4.95

(72.68)

Short-term loans and advances

(21.86)

11.49

Other current assets

(0.31)

(4.52)

Non-current assets

(5.76)

(3.99)

Long-term loans and advances

0.10

(1.97)

Long-term provisions

1.59

0.94

Trade payables

27.02

43.71

Other current liabilities

3.14

11.05

Minority interest

1.40

0.49

Short-term provision

(10.90)

1.75

(33.96)

(63.30)

Cash generated from operations

243.30

130.59

Less:

Direct taxes (refund) | paid

54.59

41.98

Net cash flow from operating activities

A

188.71

88.61