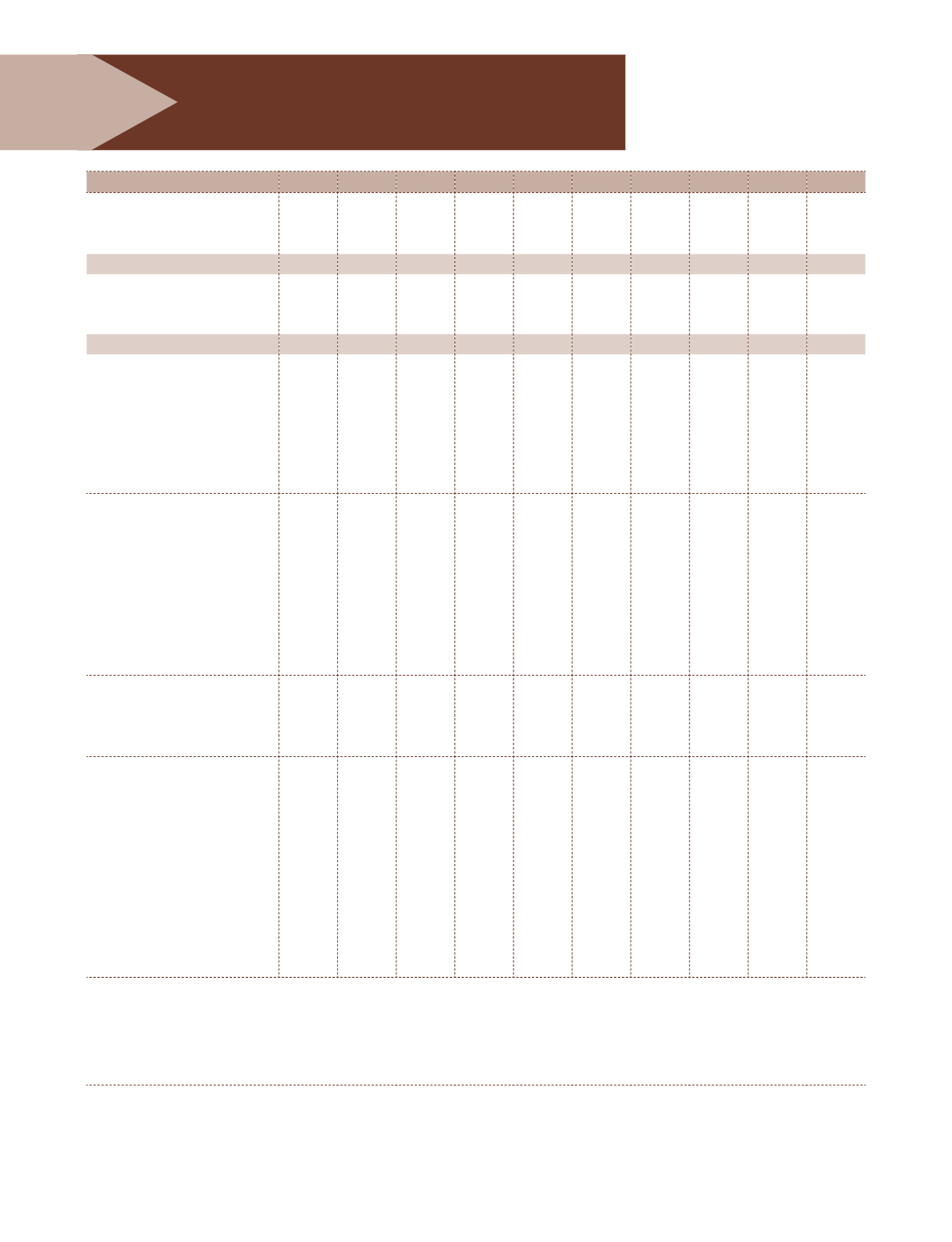

Atul Ltd | Annual Report 2012-13

(

`

cr)

Particulars

2012-13 2011-12 2010-11 2009-10 2008-09 2007-08 2006-07 2005-06 2004-05 2003-04

Operating results

Net Sales

1,964

1,746

1,508

1,168

1,159

998

895

817

682

568

Revenues

2,020

1,792

1,553

1,204

1,196

1,033

925

837

710

604

Operating PBIDT

269

203

194

143

124

97

85

78

68

56

Interest

33

43

26

26

41

33

28

29

22

22

Operating PBDT

236

160

168

117

83

64

57

49

46

34

Depreciation

49

44

39

37

32

29

31

29

27

27

Operating PBT

187

116

129

80

51

35

26

20

19

7

([FHSWLRQDO LQFRPH _ H[SHQVHV

5

6

10

-

3

-

63

-

-

3URÀW EHIRUH WD[

192

122

139

80

46

38

26

83

19

7

7D[DWLRQ

56

34

43

27

10

3

1

3

5

1HW SURÀW

136

88

96

53

36

35

25

84

16

2

'LYLGHQGV LQFOXVLYH RI GLYLGHQG

GLVWULEXWLRQ WD[

21

16

16

14

10

10

10

10

7

5

Financial position

*URVV EORFN

1,202

1,100

1,002

986

967

936

771

730

685

666

1HW EORFN

526

474

420

424

443

433

295

273

249

276

Net current and other assets

585

550

474

355

384

428

374

349

312

310

Capital employed

1,111

1,024

894

779

827

861

669

622

561

586

Equity Share capital

30

30

30

30

30

30

30

30

30

30

Reserves and surplus

726

612

537

455

429

403

270

243

170

255

Shareholders’ fund

756

642

567

485

459

433

300

273

200

285

Borrowings

355

382

327

295

368

428

369

349

361

300

Per Equity Share (

`

)

Dividend

6.00

4.50

4.50

4.00

3.00

3.00

3.00

3.00

2.00

1.50

%RRN 9DOXH

255

216

191

164

155

146

101

92

67

96

EPS

45.69 29.70 30.34 19.15 12.77 12.35 9.98 28.00 6.07 1.18

Key Indicators

Operating PBDIT %

13.70 11.63 12.86 12.24 10.70 9.72 9.50 9.55 9.97 9.86

Operating PBDT %

12.02 9.16 11.14 10.02 7.16 6.41 6.37 6.00 6.74 5.99

Operating PBT %

9.52 6.64 8.55 6.85 4.40 3.51 2.91 2.45 2.79 1.23

Employee cost as % to sales

6.52 6.70 6.76 8.82 7.85 8.12 8.04 10.40 9.97 13.56

Interest cost as % to sales

1.68 2.46 1.72 2.23 3.54 3.31 3.13 3.55 3.23 3.87

Debt-Equity ratio

0.47 0.60 0.58 0.61 0.80 0.99 1.23 1.28 1.81 1.05

Interest coverage ratio

8.15 4.72 7.46 5.50 3.02 2.94 3.04 2.69 3.09 2.55

Asset turnover ratio

1.63 1.59 1.50 1.18 1.20 1.07 1.16 1.12 1.00 0.85

5R&(

21.13 16.93 18.46 13.09 11.19 9.42 8.81 8.41 6.98 4.88

5R1:

18.74 13.56 16.35 11.23 8.95 8.80 8.73 8.56 6.60 0.70

3D\PHQW WR H[FKHTXHU

262

195

170

105 104

103

102

82

70

56

Notes:

,QFOXGLQJ FDSLWDO ZRUN LQ SURJUHVV

([FXGLQJ H[FHSWLRQDO LQFRPH _ H[SHQVHV DQG FDSLWDO ZRUN LQ SURJUHVV

([FOXGLQJ H[FHSWLRQDO LQFRPH _ H[SHQVHV

Figures for the year prior to 2010-11 are as per old schedule VI

Ten Year Review

, QHYHU VHH WKDW KDV EHHQ GRQH , RQO\ VHH ZKDW UHPDLQV WR EH GRQH

² %XGGKD