Atul Ltd | Annual Report 2013-14

(

`

cr)

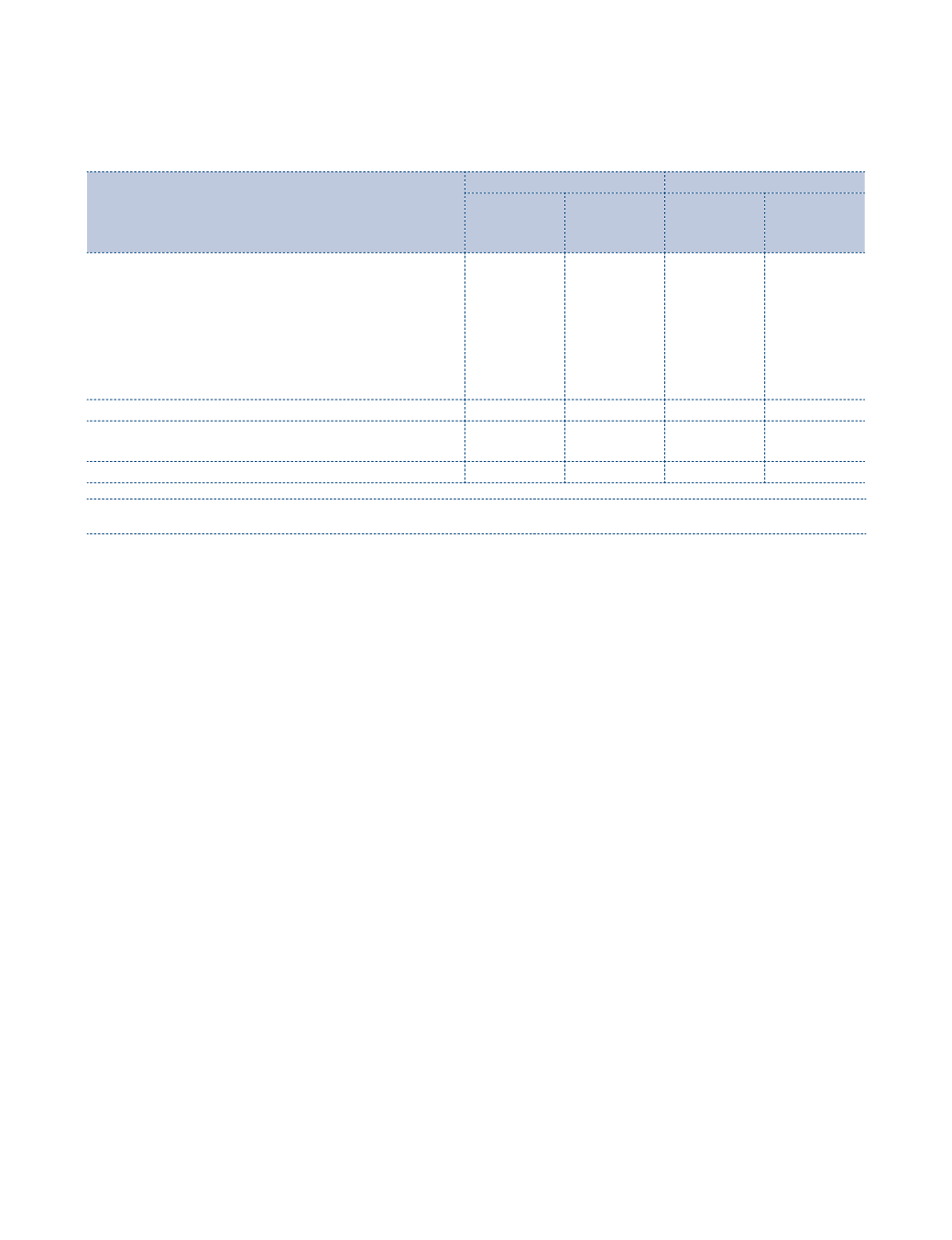

NOTE 4 LONG-TERM BORROWINGS

Non-current

Current maturities

As at

March 31,

2014

As at

March 31,

2013

As at

March 31,

2014

As at

March 31,

2013

Secured:

(i) Rupee term loan from a foreign financial institution

31.25

41.66

10.42

10.42

(ii) Foreign currency term loans from banks

59.47

69.69

17.53

6.80

(iii) Foreign currency term loan from a foreign financial

institution

22.54

43.06

25.04

22.66

Unsecured:

(iv) Rupee term loans from a bank

0.10

0.02

0.16

0.34

113.36

154.43

53.15

40.22

Amount disclosed under the head ‘Other Current

Liabilities’ (see Note 9)

(53.15)

(40.22)

113.36

154.43

–

–

Sr No

Type of loan | Nature of security

Terms of repayment

(i)

Rupee term loan from a foreign financial institution

amounting to

`

41.67 cr (Previous year:

`

52.08 cr) is

secured by first

pari passu

charge by way of hypothecation

of all movable fixed assets and mortgage of immovable

properties of the Company, present and future, excluding

specific assets with exclusive charge and second charge

on entire current assets of the Company, present and

future.

15 equal half yearly installments beginning

from January 14, 2011 along with interest

ranging from 6.99% p.a. to 7.46% p.a.

(balance installments payable-8 of

`

5.21

cr each ).

(ii)

a) Foreign currency term loan from a foreign bank

amounting to

`

16.90 cr (Previous year:

`

22.10

cr) is secured by first

pari passu

charge by way of

hypothecation of all movable fixed assets and

mortgage of immovable properties of the Company,

present and future, excluding specific assets with

exclusive charge and second charge on entire current

assets of the Company, present and future.

16 equal quarterly installments beginning

from July 31, 2012 along with interest @

3 Month LIBOR + 225 bps p.a. (balance

installments payable-9 of

`

1.88 cr each).

b) Foreign currency term loan from a bank amounting

to

`

60.10 cr (Previous year:

`

54.39 cr) is secured

by first

pari passu

charge on the entire movable

and immovable fixed assets of the Company, both

present and future.

12 equal quarterly installments beginning

from December 29, 2014 along with

interest @ 3 Month LIBOR + 290 bps p.a.

(balance installments payable-12 of

`

5.01

cr each).

Notes

to the Financial Statements