Atul Ltd | Annual Report 2014-15

(

`

cr)

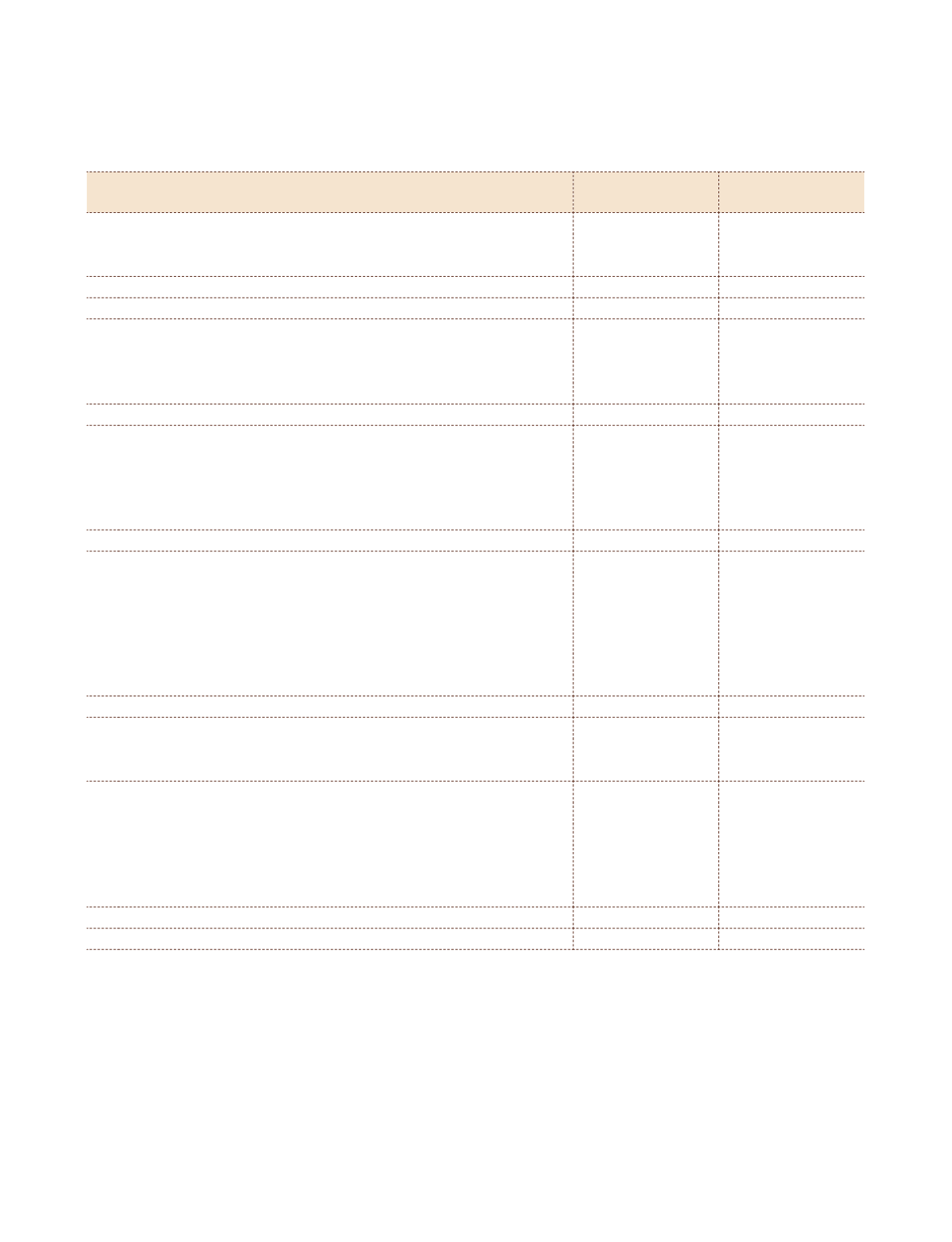

NOTE 3 RESERVES AND SURPLUS

As at

March 31, 2015

As at

March 31, 2014

a) Capital reserve:

Balance as at the beginning of the year

4.73

6.68

Less: Transferred to the General reserve

*

0.21

1.95

Balance as at the end of the year

4.52

4.73

b) Securities premium account

34.66

34.66

c) Revaluation reserve:

Balance as at the beginning of the year

102.40

104.46

Less: Transferred to the Statement of Profit and Loss

–

2.06

Less: Reversed in current year {refer Note 12(b)}

102.40

–

Balance as at the end of the year

–

102.40

d) Hedging reserve {refer Note 28.9 (c)}:

Balance as at the beginning of the year

1.54

0.74

Add: Transferred to the Statement of Profit and Loss

(1.54)

(0.74)

Less: Effect of foreign exchange rate variation on hedging

instruments outstanding at the end of the year

(0.11)

(1.54)

Balance as at the end of the year

0.11

1.54

e) General reserve:

Balance as at the beginning of the year

104.65

81.42

Less: Carrying amount of the assets (where the remaining useful

life of assets is Nil) after retaining the residual value (net of

deferred tax

`

4.80 cr) {refer Note 12(c)}

9.06

–

Add: Transferred from Capital reserve

*

0.21

1.95

Add: Transferred from the Statement of Profit and Loss

–

21.28

Balance as at the end of the year

95.80

104.65

f) Surplus in the Statement of Profit and Loss:

Balance as at the beginning of the year

663.93

498.45

Add: Profit for the year

217.42

212.79

Amount available for appropriation

881.35

711.24

Less: Appropriations

General reserve

–

21.28

Proposed dividend on Equity shares for the year

{at

`

8.50 per share (March 31, 2014

`

7.50 per share)}

25.21

22.25

Dividend distribution tax on proposed dividend

5.13

3.78

Balance as at the end of the year

851.01

663.93

986.10

911.91

*

The fair value of the assets received free of cost in the past, was credited to ‘Capital reserve’; it represents amount equivalent

to the depreciation of the respective assets charged to the Statement of Profit and Loss.

Notes

to the Financial Statements