141

(

`

cr)

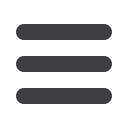

NOTE 14 LONG-TERM LOANS AND ADVANCES

As at

March 31, 2015

As at

March 31, 2014

a) Loans and advances to related parties: (refer Note 28.10)

i) Secured, considered good

11.29

11.29

ii) Unsecured, considered good

3.59

5.02

b) Others:

i) Capital advances

23.01

5.71

ii) Security deposits

0.62

6.35

38.51

28.37

(

`

cr)

NOTE 15 OTHER NON-CURRENT ASSETS

As at

March 31, 2015

As at

March 31, 2014

a) Balance with bank in fixed deposits, with maturity beyond 12 months

0.02

0.02

b) Balance with the Government departments:

Tax paid under protest

16.80

20.52

Tax paid in advance, net of provisions

0.35

4.20

VAT receivable

29.84

30.13

Prepaid expenses

0.05

0.06

Security deposit {refer Note 12 (e)}

2.01

2.02

c) Mark-to-Market gains on derivatives

5.47

7.69

54.54

64.64

(

`

cr)

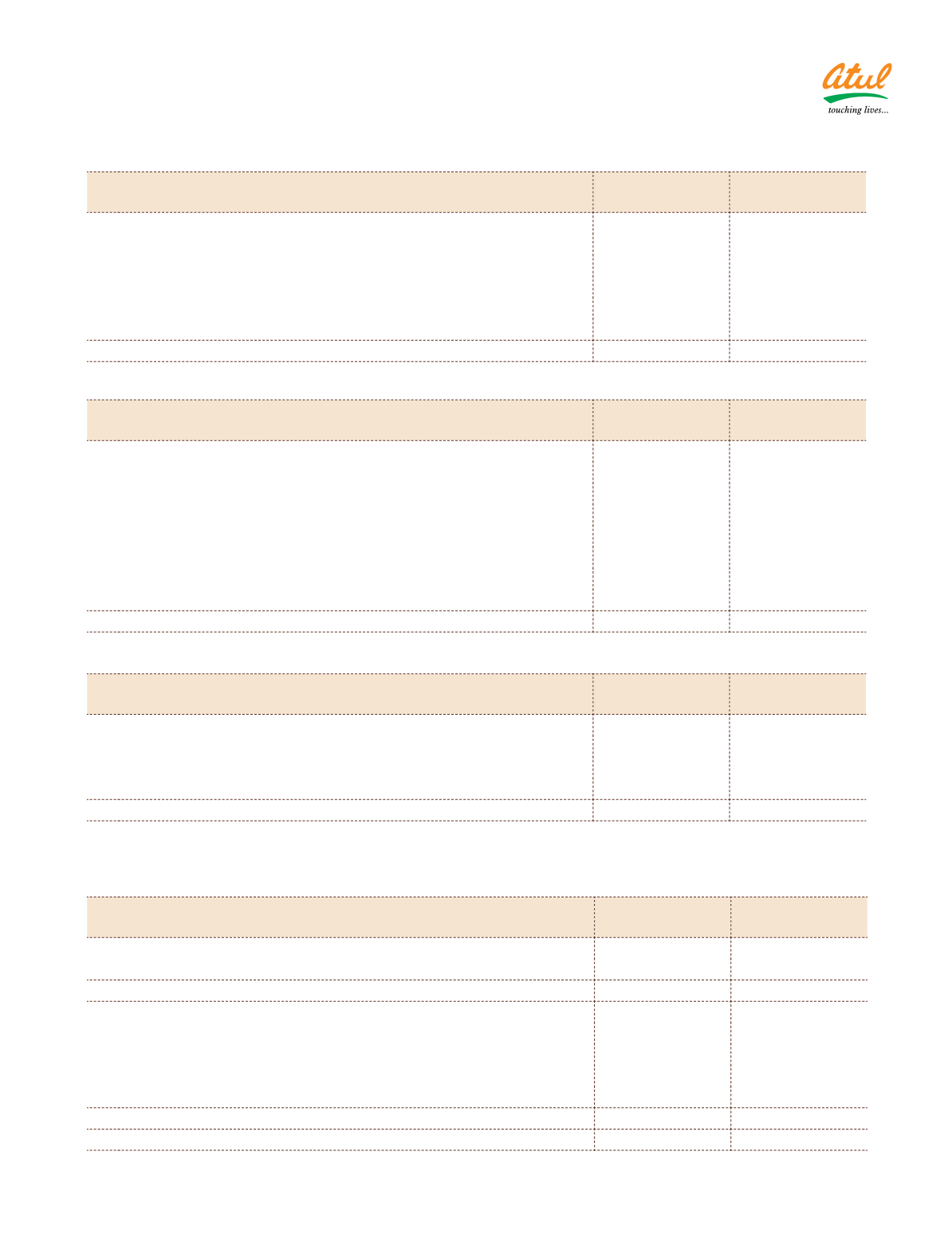

NOTE 16 CURRENT INVESTMENTS

As at

March 31, 2015

As at

March 31, 2014

Investment in Mutual Fund (unquoted) *

At cost or market value whichever is less

18,21,827 units (Previous year: Nil) of HDFC Liquid Fund

1.86

–

7,976.75 units (Previous year: Nil) of SBI Premier Liquid Fund

0.80

–

2.66

–

NAV of current investments

2.66

–

*At cost or market value whichever is less.

(

`

cr)

NOTE 17 INVENTORIES*

As at

March 31, 2015

As at

March 31, 2014

a) Raw materials and packing materials

85.38

92.05

Add: Goods-in-transit

22.43

24.58

107.81

116.63

b) Work-in-progress

115.27

106.81

c) Finished goods

159.53

181.39

d) Stock-in-trade

4.46

3.05

e) Stores, spares and fuel

21.07

22.13

Add: Goods-in-transit

7.13

4.16

28.20

26.29

415.27

434.17

*Goods-in-transit at cost to date and others at cost or net realisable value whichever is lower.

Notes

to the Consolidated Financial Statements