Atul Ltd | Annual Report 2014-15

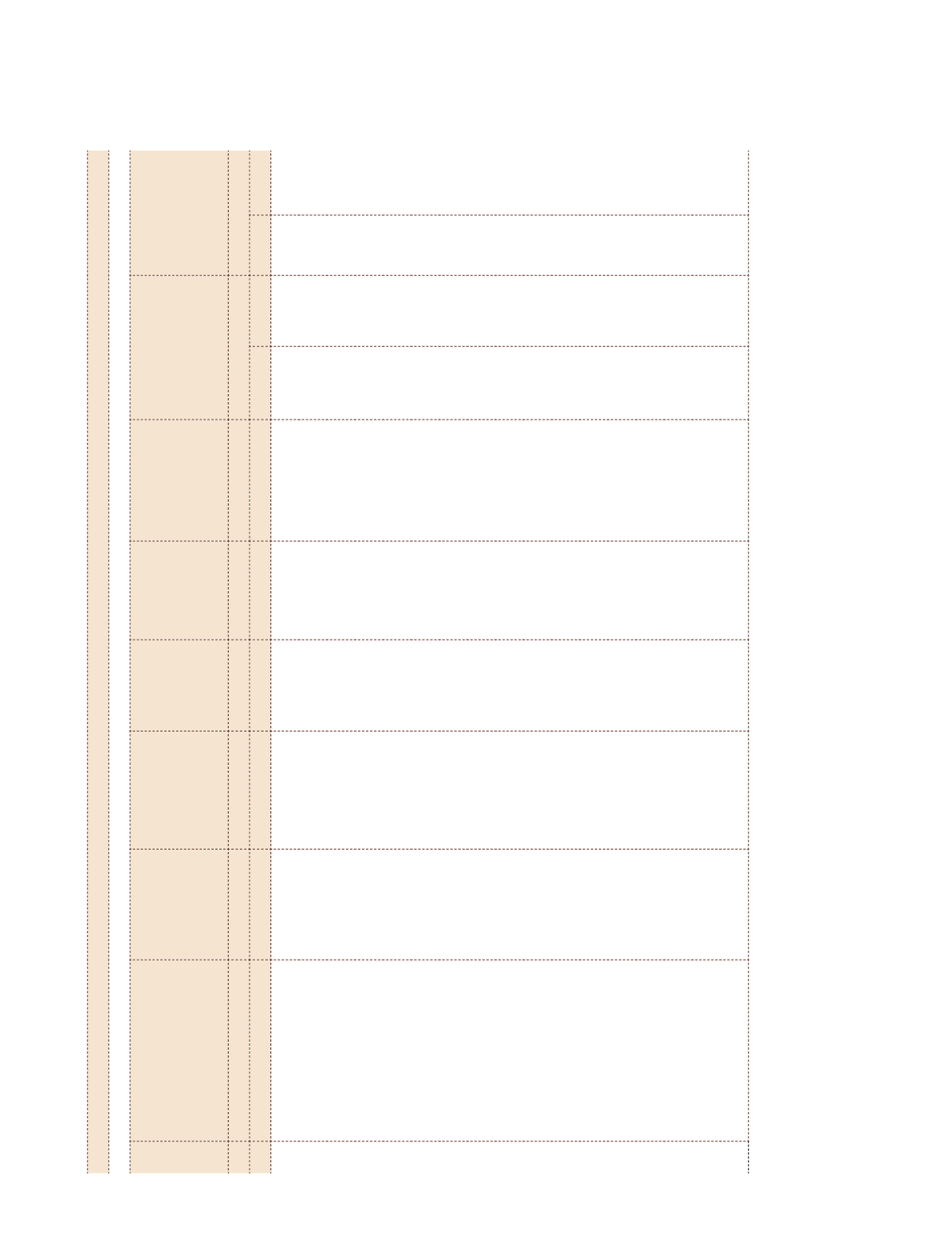

NOTE 28.8 DETAILS OF ASSOCIATE COMPANIES CONSIDERED IN CONSOLIDATION:

(

`

cr)

No.

Name of associate

companies

Country of

incorporation

Main

industries

Ownership

interest

and voting

power

Original

cost of

investments

Amount of

goodwill |

(Capital reserve)

included in

original cost

Accumulated loss

| (gain) at the year

ended March 31,

2015

Carrying

amount of

investments at

the year ended

March 31, 2015

A

B

C

D

E

F

G

H

I

2015 2014 2015 2014

01 Amal Ltd

India

Chemical

36.75% 5.15

(19.67) 34.39 33.84

–

–

02 Anchor Adhesives Pvt Ltd India

Adhesives

49.99% 1.47

1.27

0.20

0.15 1.46

1.48

03 AtRo Ltd

1

India

Agriculture

50.00% 0.50

–

0.33

0.33

–

–

04 Atul (Retail) Brands Ltd India

Retail

20.00% 0.01

–

–

– 0.01

0.01

05 Atul Ayurveda Ltd

India

Ayurvedic

50.00% 0.03

–

–

– 0.03

0.03

06 Atul Clean Energy Ltd India

Energy

20.00% 0.01

–

–

– 0.01

0.01

07 Atul Crop Care Ltd

India

Agriculture

50.00% 0.02

–

(0.29)

(0.13) 0.15

0.08

08 Atul Elkay Polymer Ltd

India

Polymers

50.00% 0.03

–

0.02

0.01 0.02

0.02

09 Atul Entertainment Ltd India

Entertainment

50.00% 0.03

–

–

– 0.03

0.03

10 Atul Hospitality Ltd

India

Hospitality

50.00% 0.02

–

–

– 0.02

0.02

11 Atul Medical Care Ltd India

Health Care

50.00% 0.03

–

–

– 0.03

0.03

12 Atul Seeds Ltd

India

Agriculture

50.00% 0.02

–

–

– 0.02

0.02

13 Jayati Infrastructure Ltd India

Infrastructure

50.00% 0.03

–

–

– 0.03

0.03

14 Lapox Polymer Ltd

India

Polymers

20.00% 0.01

(0.06)

(0.39)

(0.29) 0.03

0.01

15 M. Dohmen S.A.

2

Switzerland Textiles

50.00% 14.21

(45.72)

–

6.56

–

–

16 Osia Dairy Ltd

India

Dairy

50.00% 0.02

–

–

– 0.02

0.02

17 Osia Infrastructure Ltd India

Infrastructure

48.00% 0.02

–

–

– 0.02

0.02

1

Company under liquidation. Figures are based on May 31, 2014.

2

Investment in M. Dohmen S.A. has been sold during the year.

Notes

to the Consolidated Financial Statements