Atul Ltd | Annual Report 2014-15

Particulars

Status

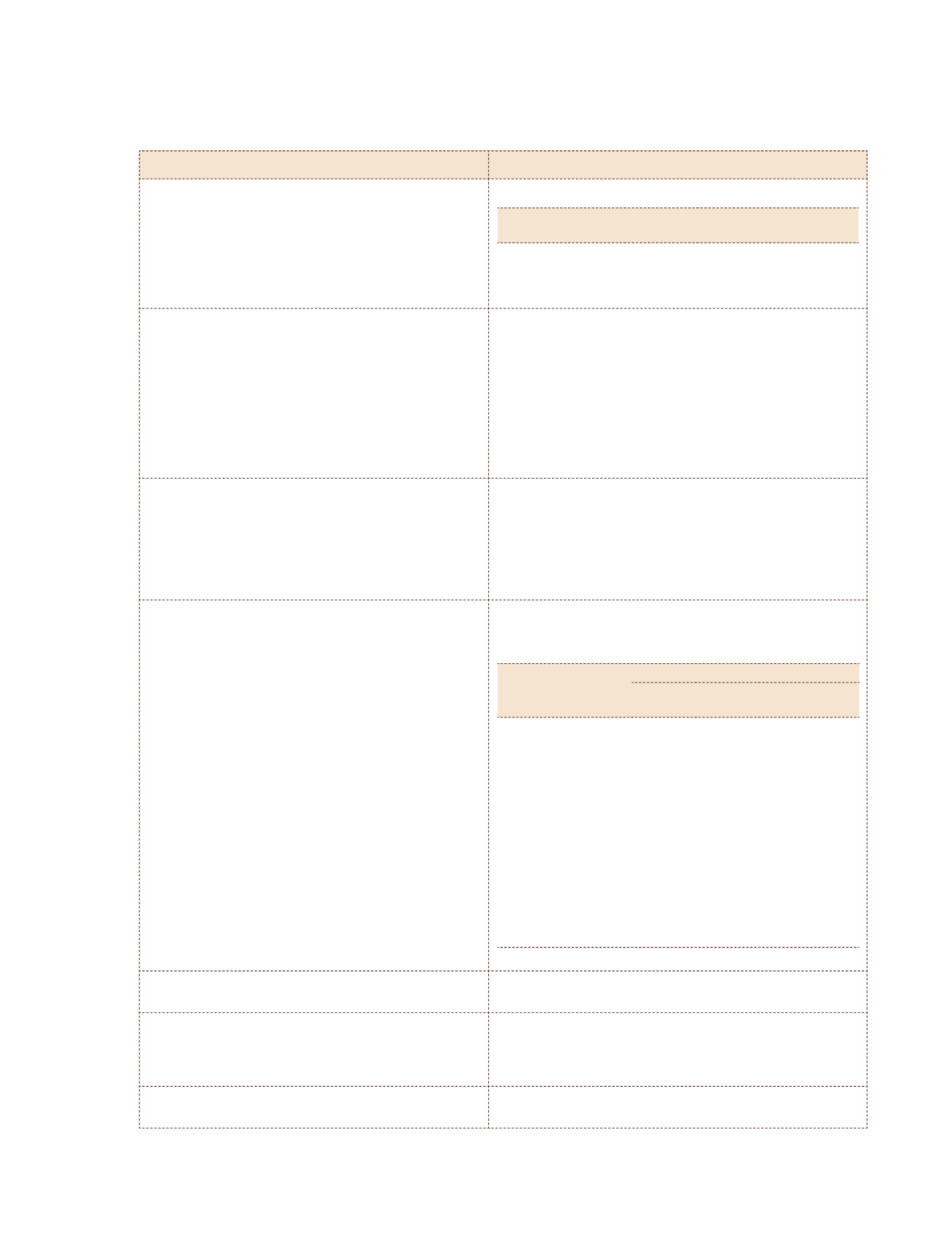

vi)

Comparison of the remuneration of the Key Managerial

Personnel against the performance of the Company

(

`

cr)

2013-14 2014-15 % increase

|

decrease

Sales

2,307.00 2,510 .00

9.00

PBT

297.00 312.00

5.00

Remuneration

8.09

9.57

10.00

vii) Variations in the market capitalisation of the Company,

price earnings ratio as at the closing date of the

current financial year and previous financial year and

percentage increase or decrease in the market

quotations of the shares of the Company in comparison

to the rate at which the Company came out with the

last public offer in case of listed companies and in case

of unlisted companies, the variations in the net worth

of the Company as at the close of the current financial

year and previous financial year

During 2014-15, market capitalisation increased from

`

1,286 cr

to

`

3,345 cr.

Price earnings ratio increased from 6.04 to 15.38.

As compared to last public offer price of

`

45 in 1994, the market

price was

`

1,128 as on March 31, 2015.

viii) Average percentile increase already made in the salaries

of employees other than the managerial personnel

in the last financial year and its comparison with the

percentile increase in the managerial remuneration

and justification thereof and point out if there are

any exceptional circumstances for increase in the

managerial remuneration

Average increase for Key Managerial Personnel and for other

employees was about 10%.

There is no exceptional increase in remuneration of Key Managerial

Personnel.

ix)

Comparison of the remuneration of each Key

Managerial Personnel against the performance of the

Company

During 2014-15, sales grew by 9%, PBT by 5% and the

remuneration of KMPs increased by 10%.

(

`

cr)

Remuneration

2013-14 2014-15 % increase

|

decrease

Chairman and

Managing Director

S S Lalbhai

4.45

4.98

12.00

Managing Director

S A Lalbhai

1.52

1.74

14.00

Whole-time Director

B N Mohanan

0.94

0.86

(8.00)

S R Nammalvar

0.01

0.48 Part of the year

Whole-time Director

and Chief Financial

Officer

T R Gopi Kannan

1.16

1.33

14.00

Company Secretary

L P Patni

–

0.20

NA

NA = Not Applicable

x)

Key parameters for any variable component of

remuneration availed by the Directors

Linked with the Company performance. Mainly, profit growth

xi)

Ratio of the remuneration of the highest paid Director

to that of the employees who are not Directors but

receive remuneration in excess of the highest paid

Director during the year

There are no such employees

xii) Affirmation that the remuneration is as per the

Remuneration Policy of the Company

It is affirmed that the remuneration is as per the Remuneration

Policy of the Company

*Read with the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 and forming part of the Directors’ Report for the year

ended March 31, 2015.