87

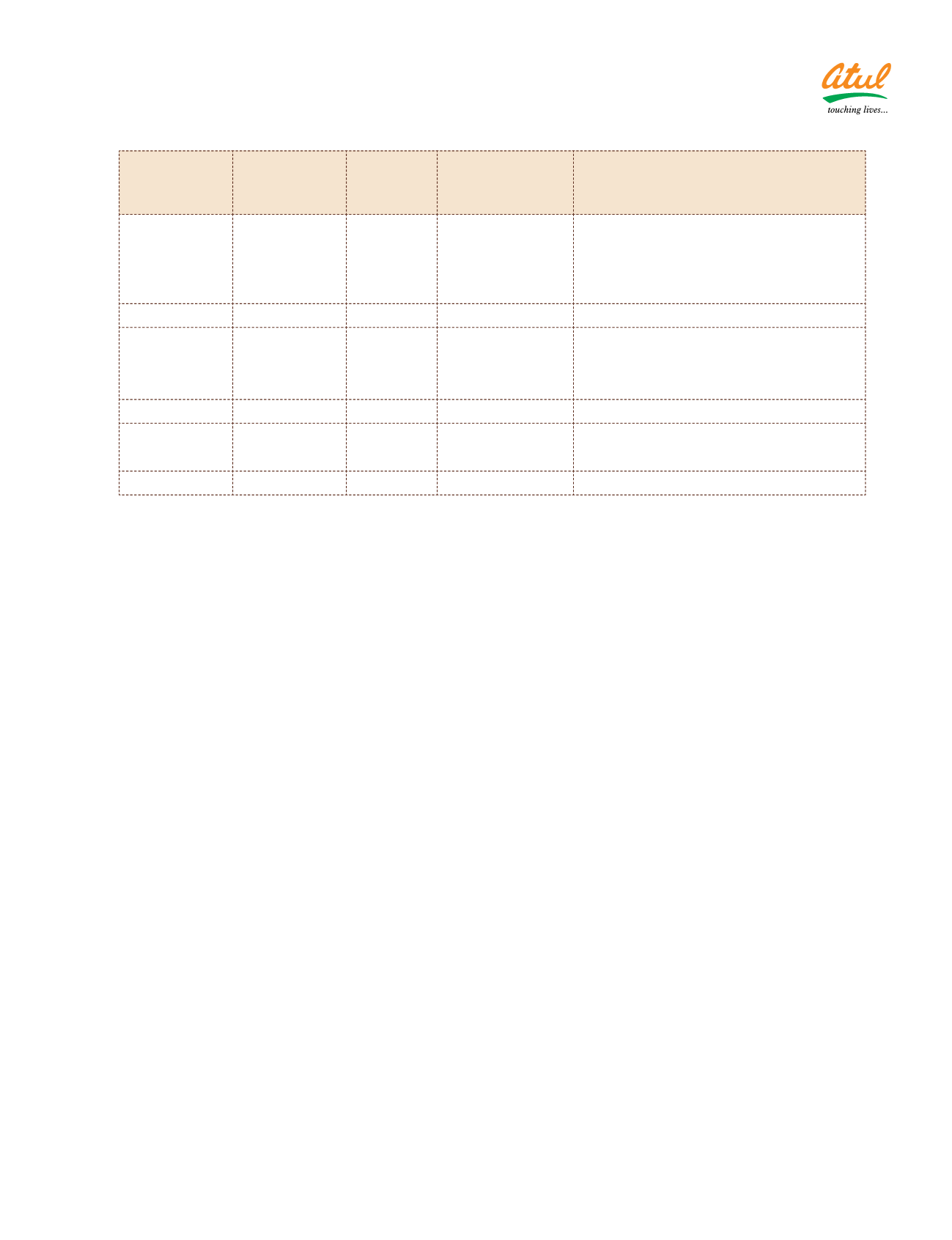

Name of the

statute

Nature of

dues

Amount

(

`

cr)

1

Period to which

the amount

relates

Forum where the dispute is

pending

2

Central Excise

Act, 1944

Excise and

service tax

0.49

7.72

3.53

1986 to 2014

1992 to 2010

1993-94

Commissioner (Appeals)

Customs, Excise and Service Tax Appellate

Tribunal

High Court

11.74

Customs Act,

1962

Customs duty

0.59

1.76

1995 to 2009

1997-98

Commissioner (Appeals)

Customs, Excise and Service Tax Appellate

Tribunal

2.35

Income Tax Act,

1961

Income tax

1.13

0.95

2006-07

2010-11

Commissioner of Income Tax (Appeals)

Income Tax Appellate Tribunal

2.08

1

Net of amounts deposited. |

2

Necessary stay received from respective authorities.

c) The amount required to be transferred to

Investor Education and Protection Fund has

been transferred within the stipulated time

in accordance with the provisions of the

Companies Act, 1956 and the rules made

thereunder.

viii) The Company has no accumulated losses as at the

end of the financial year and it has not incurred any

cash losses in the financial year ended on that date

or in the immediately preceding financial year.

ix) According to the records of the Company examined

by us and the information and explanations given

to us, the Company has not defaulted in repayment

of dues to any financial institution or bank. The

Company has not issued any debenture as at the

Balance Sheet date.

x) In our opinion, and according to the information

and explanations given to us, the terms and

conditions of the guarantees given by the Company

for loans taken by others from banks or financial

institutions during the year are not prejudicial to

the interest of the Company.

xi) In our opinion, and according to the information

and explanations given to us, the term loans have

been applied for the purposes for which they were

obtained.

xii) During the course of our examination of the

books and records of the Company, carried out in

accordance with the generally accepted auditing

practices in India and according to the information

and explanations given to us, we have neither come

across any instance of material fraud on or by the

Company, noticed or reported during the year, nor

have we been informed of any such case by the

Management.

For Dalal & Shah Chartered Accountants LLP

Firm Registration Number: 102020W| W-100040

S Venkatesh

Mumbai

Partner

April 30, 2015

Membership Number: 037942