Atul Ltd | Annual Report 2015-16

(

`

cr)

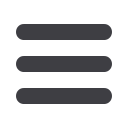

Note 28.1 Contingent liabilities

As at

March 31, 2016

As at

March 31, 2015

i) Claims against the Company not acknowledged as debts in

respects of:

a) Excise

7.70

7.25

b) Income tax

7.52

8.33

c) Sales tax

0.67

0.67

d) Customs

0.18

0.18

e) Water charges

89.65

79.84

f) Others

14.42

14.93

g) In respect of a customer claim amounting to

`

32.35 cr, the

Company, based on a legal opinion, believes that the claim

will not sustain.

Note: Future cash outflows in respect of (a) to (g) above are

determinable on receipt of judgements | decisions pending with

various forums | authorities.

ii) Guarantees given by the Company:

Corporate guarantee to a bank on behalf of a subsidiary company

for facilities availed by it

–

9.25

(

`

cr)

Note 28.2 Commitments

As at

March 31, 2016

As at

March 31, 2015

Estimated amount of contracts remaining to be executed on capital

accounts and not provided for (net of advances)

44.96

121.86

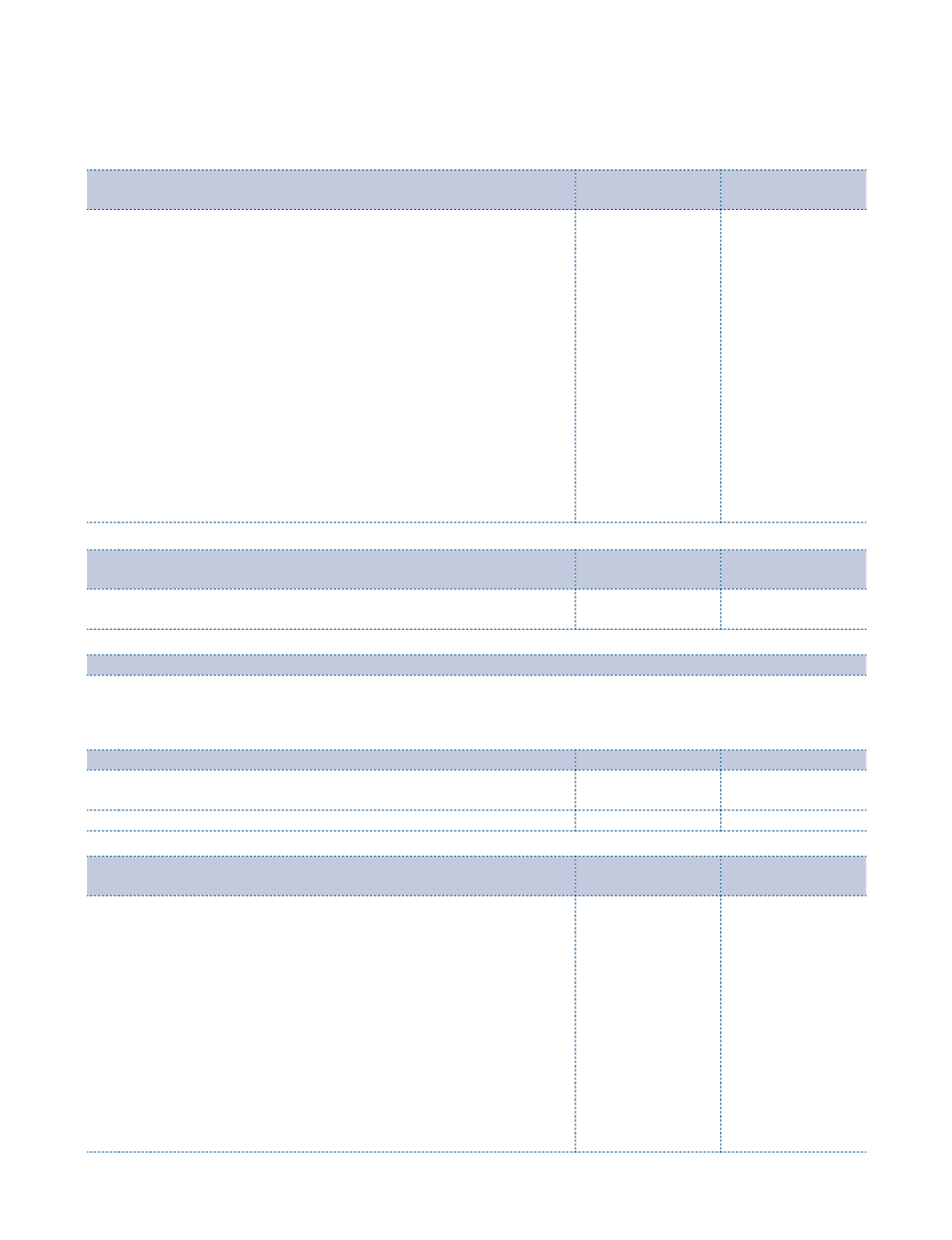

Note 28.3 Research and Development

Details of expenditure incurred on in-house Research and Development facilities approved by the Department of

Scientific and Industrial Research, Ministry of Science and Technology, Government of India under Section 35 (2AB)

of Income tax Act, 1961.

(

`

cr)

Particulars

2015-16

2014-15

Capital expenditure

1.32

1.59

Recurring expenditure

18.16

17.94

19.48

19.53

(

`

cr)

Note 28.4 CIF value of import, expenditure, remittances and

earnings in foreign currency

2015-16

2014-15

a) CIF value of imports:

Raw materials

351.05

371.05

Trading finished goods

6.79

15.91

Capital goods

15.67

5.83

b) Expenditure in foreign currency:

Commission

3.87

3.04

Legal and professional charges

0.03

0.03

Finance costs

4.18

4.68

Other matters

11.10

10.84

c) Other remittances:

Loan repayments

132.58

64.35

d) Earnings in foreign currency:

FOB value of exports

1,148.03

1,163.41

Dividend income

15.69

–

Others

8.79

–

Notes

to the Financial Statements