Atul Ltd | Annual Report 2015-16

(

`

cr)

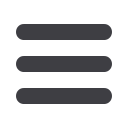

Note 20 Short-term loans and advances

As at

March 31, 2016

As at

March 31, 2015

Loans and advances, unsecured, considered good to:

a) Related parties

0.17

4.13

b) Others:

i) Advances recoverable in cash or kind

108.18

86.57

ii) Balances with statutory authorities

20.77

26.46

iii) Sundry deposits

0.63

0.84

iv) Others

0.69

0.23

130.44

118.23

(

`

cr)

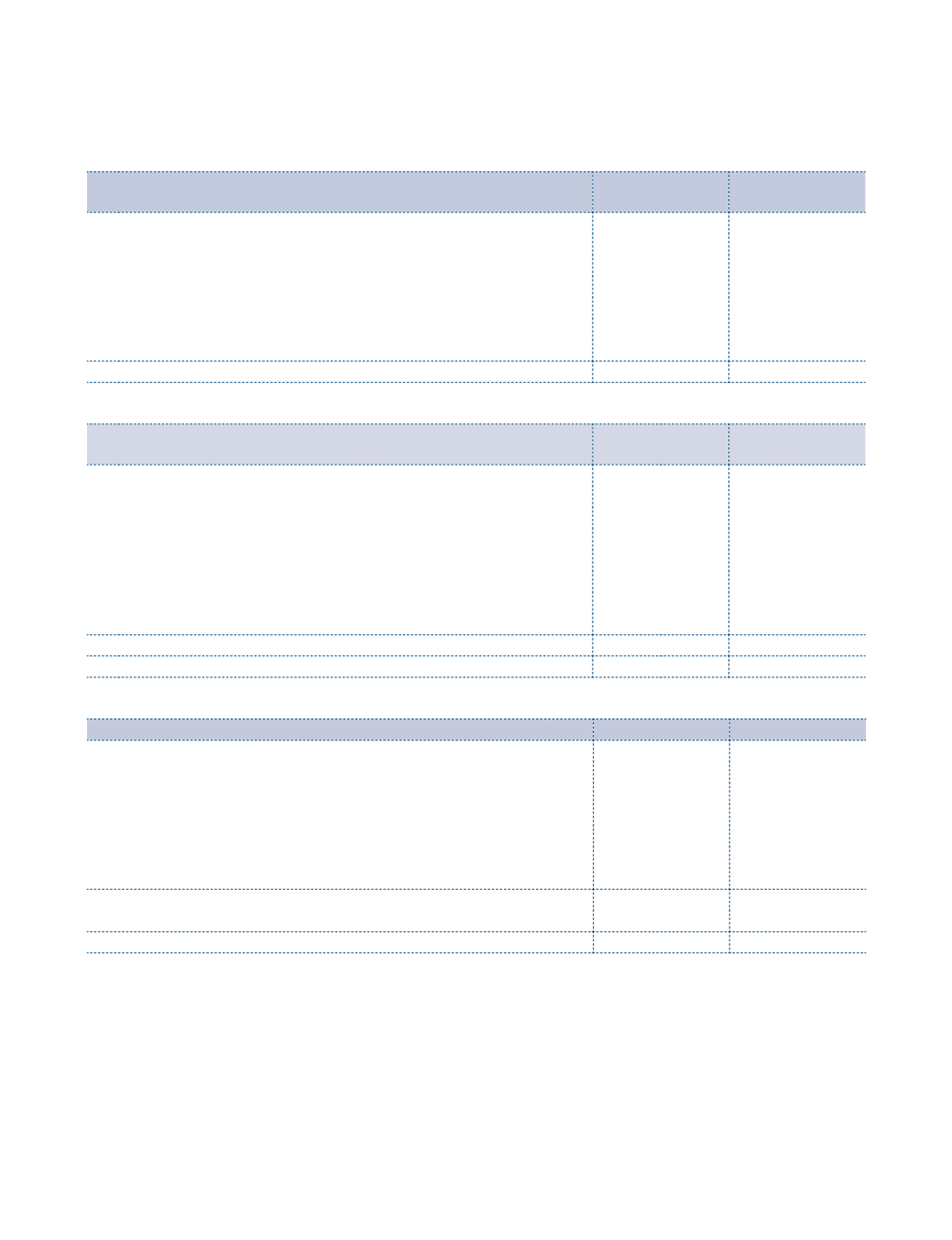

Note 21 Other current assets

As at

March 31, 2016

As at

March 31, 2015

Unsecured, considered good unless otherwise stated

a) Export incentive receivable

27.87

21.53

b) Mark-to-Market gains on derivatives

3.55

3.34

c) Dividend receivable

0.45

0.11

d) Asset held for sale

–

0.59

e) Sundry receivable

Doubtful

0.19

0.19

Less: Provision for doubtful receivable

0.19

0.19

–

–

31.87

25.57

(

`

cr)

Note 22 Revenue from operations

2015-16

2014-15

Sale of products

2,713.50

2,782.02

Sale of services

0.55

0.21

Other operating revenue:

Export incentives

37.98

34.38

Scrap sales

5.70

6.01

Commission

0.21

0.26

Processing charges

8.30

4.59

2,766.24

2,827.47

Less: Excise duty

164.80

171.08

2,601.44

2,656.39

Notes

to the Consolidated Financial Statements