Atul Ltd | Annual Report 2016-17

(

`

cr)

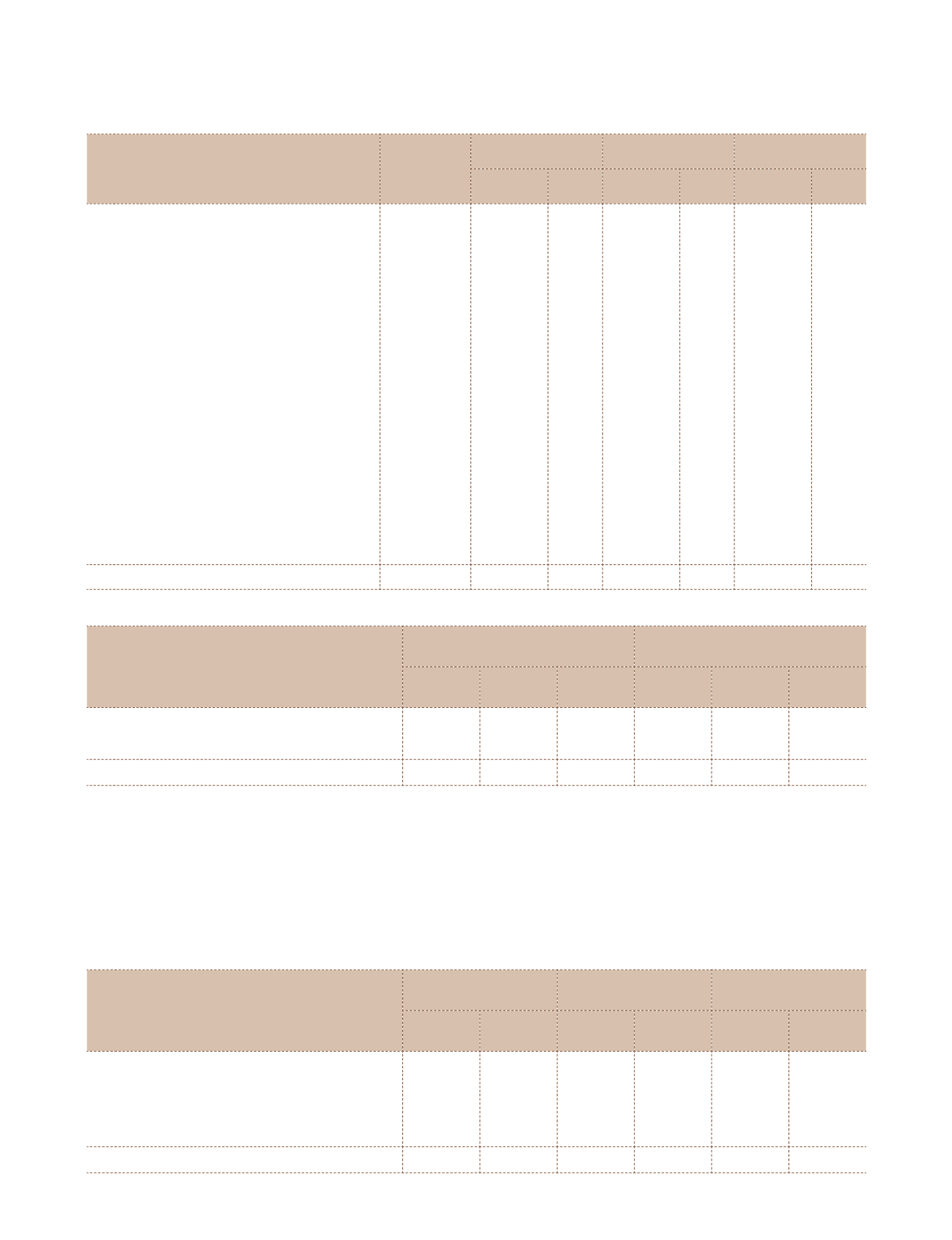

Note 5 Non-current investments

(continued)

Face

value

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Number

of shares

Number

of shares

Number

of shares

b) Investment in Preference shares (fully

paid-up)

Subsidiary company measured at FVPL

Unquoted

Atul Bioscience Ltd

6% Cumulative Redeemable Preference shares

100

–

–

–

– 2,00,000

2.00

10% Cumulative Redeemable Preference shares

100

–

–

–

–

40,400

0.40

Subsidiary company measured at

amortised cost

1, 6

Unquoted

Amal Ltd (0% Redeemable Preference shares)

10 1,00,00,000

7.10 1,00,00,000

6.43 1,00,00,000

5.81

c) Investments in Government or Trust

securities measured at amortised cost

6 Years National Savings Certificates (deposited

with the Government departments)

88,000

– 0.01

– 0.01

– 0.01

d) Share application money

–

–

– 1.96

– 0.51

530.78

445.81

487.86

(

`

cr)

Particulars

Book value

As at

Market value

As at

March 31,

2017

March 31,

2016

April 01,

2015

March 31,

2017

March 31,

2016

April 01,

2015

Quoted

2

432.43

355.85

394.25

418.74

338.91

377.00

Unquoted

98.35

89.96

93.61

–

–

–

530.78

445.81

487.86

418.74

338.91

377.00

¹ Associate company up to November 30, 2016

2

includes equity component recognised from 0% finance provided to Amal Ltd

3

carrying value of

`

12,040 (March 31, 2016:

`

7,720 and April 01, 2015:

`

7,850)

4

Sale of Equity shares under the buy back offer

5

Under liquidation

6

Includes

`

1 cr due for redemption as on March 31, 2017

Refer Note 7.12 of Corporate Governance Report for details of Equity shares in unclaimed suspense account.

(

`

cr)

Note 6 Loans

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Current

Non-

current

Current

Non-

current

Current

Non-

current

a) Loan to subsidiary companies | associate

company (refer Note 27.4 and 27.13)

i)

Secured, considered good

0.59

7.01

–

6.41

–

5.41

ii) Unsecured, considered good

4.59

–

–

7.26

–

6.77

5.18

7.01

– 13.67

– 12.18

Notes

to the Financial Statements