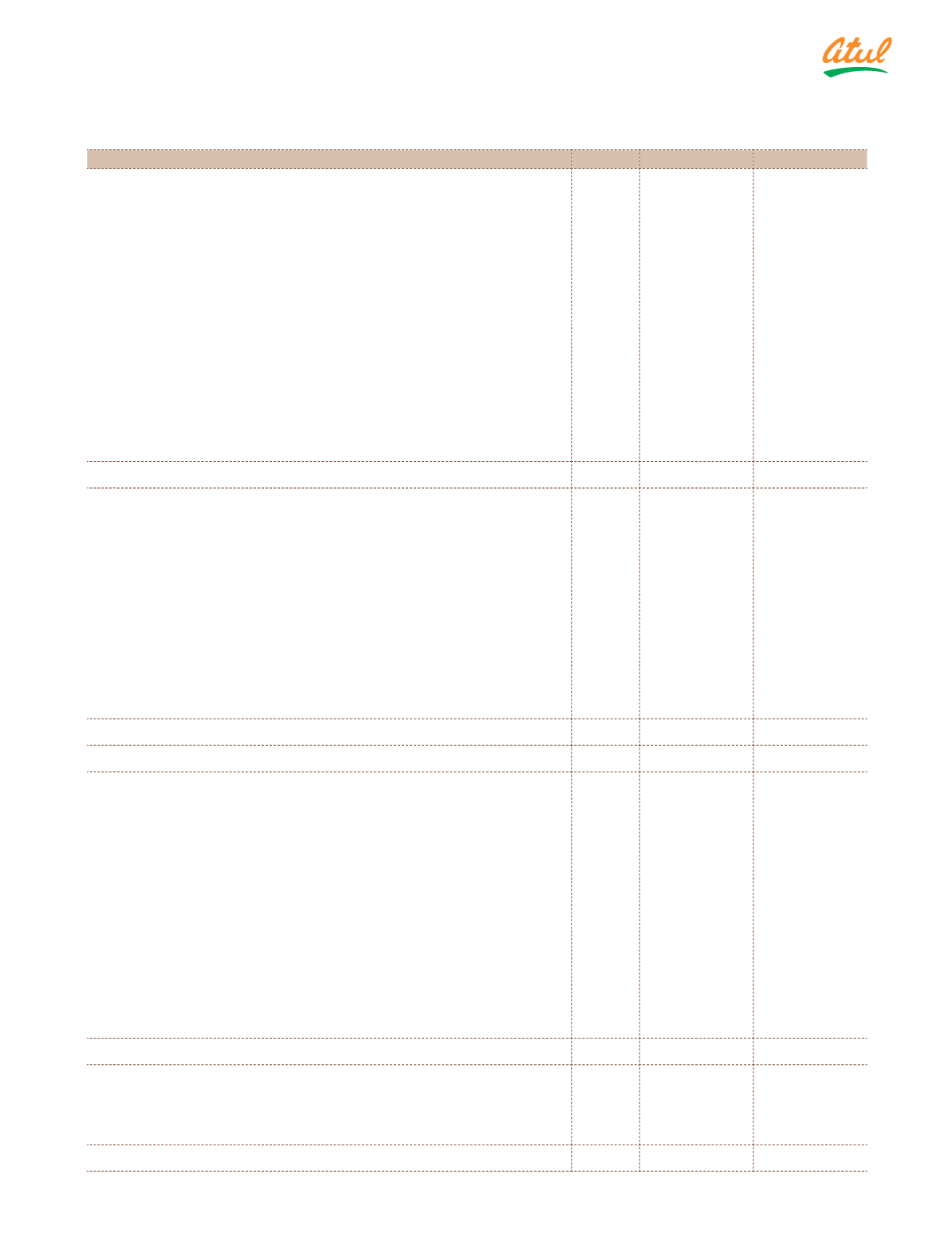

159

Consolidated Statement of Cash Flows

for the year ended March 31, 2017

(

`

cr)

Particulars

Note

2016-17

2015-16

A Cash flow from operating activities

Profit before tax

446.06

404.49

Adjustments for:

Add:

Depreciation and amortisation expenses

2, 4

95.44

66.07

Finance costs

27

25.17

27.53

Loss on disposal of property, plant and equipment

28

0.20

1.62

Unrealised exchange rate difference (net)

4.64

3.75

Effect of exchange rates on translation of operating cashflows

5.78

9.12

Share of profit on joint venture company

4.65

4.46

Allowance for doubtful debts

28

–

1.24

135.88

113.79

581.94

518.28

Less:

Dividend received

23

7.25

4.79

Interest income from financial assets measured at amortised cost

0.04

0.01

Remeasurement to fair value of existing equity interest acquired in business

combination

23

30.98

–

Changes in fair value of biological assets

23

1.78

1.25

Gain on disposal of equity investment measured at cost

23

–

0.01

Gain on disposal of property, plant and equipment

23

3.71

1.27

43.76

7.33

Operating profit before change in operating assets and liabilities

538.18

510.95

Adjustments for:

(Increase) | Decrease in inventories

9

(2.28)

(16.27)

(Increase) | Decrease in trade receivables

(82.20)

(7.21)

(Increase) | Decrease in other financial assets

5.14

5.63

(Increase) | Decrease in other assets

20.00

(22.53)

Increase | (Decrease) in trade payables

21.38

34.12

Increase | (Decrease) in other financial liabilities

(0.32)

10.85

Increase | (Decrease) in other current liabilities

(19.77)

(4.41)

Increase | (Decrease) in current provisions

3.56

(1.79)

Increase | (Decrease) in non-current provisions

2.85

1.40

(51.64)

(0.21)

Cash generated from operations

486.54

510.74

Less:

Income tax paid (net of refund)

84.81

109.77

Net cash flows from operating activities

A

401.73

400.97