Atul Ltd | Annual Report 2016-17

No. Particulars

Reason for

change

Shareholding as at

April 01, 2016

Cumulative shareholding

during 2016-17

Number of

shares

% of total

shares of the

Company

Number of

shares

% of total

shares of the

Company

12. S A Panse

At the beginning of the year

50

–

50

–

Increase | Decrease during the year

At the end of the year

50

–

50

–

13. B R Arora

At the beginning of the year

100

–

100

–

Increase | Decrease during the year

At the end of the year

100

–

100

–

14. L P Patni

At the beginning of the year

–

–

–

–

Increase | Decrease during the year

At the end of the year

–

–

–

–

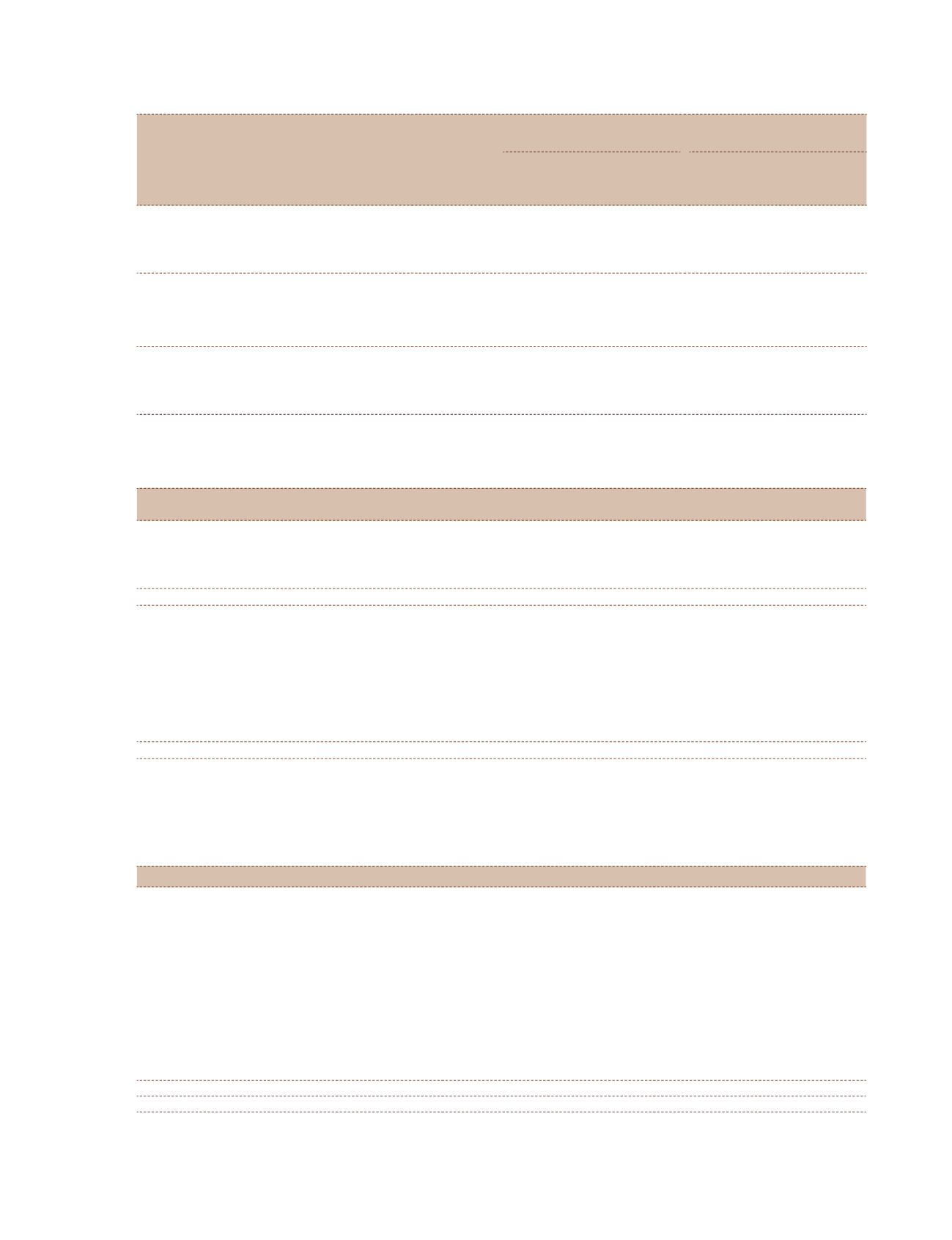

4.5 Indebtedness

Indebtedness of the Company including interest outstanding | accrued, but not due for payment

(

`

cr)

Particulars

Secured loans

excluding deposits

Unsecured

loans

Deposits

Total

indebtedness

Indebtedness at the beginning of the financial year

i)

Principal amount

132.97

168.69

–

301.67

ii)

Interest due, but not paid

–

–

–

–

iii)

Interest accrued, but not due

0.42

–

–

0.42

Total i) + ii) + iii)

133.39

168.69

–

302.09

Change in indebtedness during the financial year

Addition

–

–

–

–

Reduction

103.83

42.87

–

146.69

Net change

103.83

42.87

–

146.69

Indebtedness at the end of the financial year

i)

Principal amount

29.39

125.83

–

155.22

ii)

Interest due, but not paid

–

–

–

–

iii)

Interest accrued, but not due

0.18

–

–

0.18

Total i) + ii) + iii)

29.57

125.83

–

155.40

Note: As on March 31, 2017, 2 Deposits of

`

0.005 cr from each of the Directors, Mr B S Mehta and Mr R A Shah were lying with

the Company.

4.6 Remuneration of the Directors and the Key Managerial Personnel

4.6.1 Remuneration to the Managing Director, the Whole-time Directors and | or the Manager

(

`

)

No. Particulars

S S Lalbhai

1

S A Lalbhai

B N Mohanan T R Gopi Kannan

2

Total amount

01.

Gross salary

Salary as per provisions

under Section 17(1) of the

Income-tax Act, 1961

2,86,67,129

89,09,469

1,09,79,918

1,45,94,999

6,31,51,515

Value of perquisites

under Section 17(2) of the

Income-tax Act, 1961

77,744

5,91,619

7,99,691

39,600

15,08,654

Profits in lieu of salary

under Section 17(3) of the

Income-tax Act, 1961

–

–

–

–

–

02.

Stock option

–

–

–

–

–

03.

Sweat Equity

–

–

–

–

–

04.

Commission

4,19,80,070

3

1,30,64,250

4

–

–

5,50,44,320

05.

Others

–

–

–

–

–

06.

Total (A)

7,07,24,943

2,25,65,338

1,17,79,609

1,46,34,599

11,97,04,489

07.

Overall ceiling as per the Act

41,98,07,000

1

CMD (CEO)

2

WTD (CFO)

3

1% of profit (

`

4,19,80,070/-) or 60 months basic salary (

`

7,16,85,000/-) whichever is lower

4

0.50% of profit (

`

2,09,90,035/-) or 30 months basic salary (

`

1,30,64,250/-) whichever is lower.