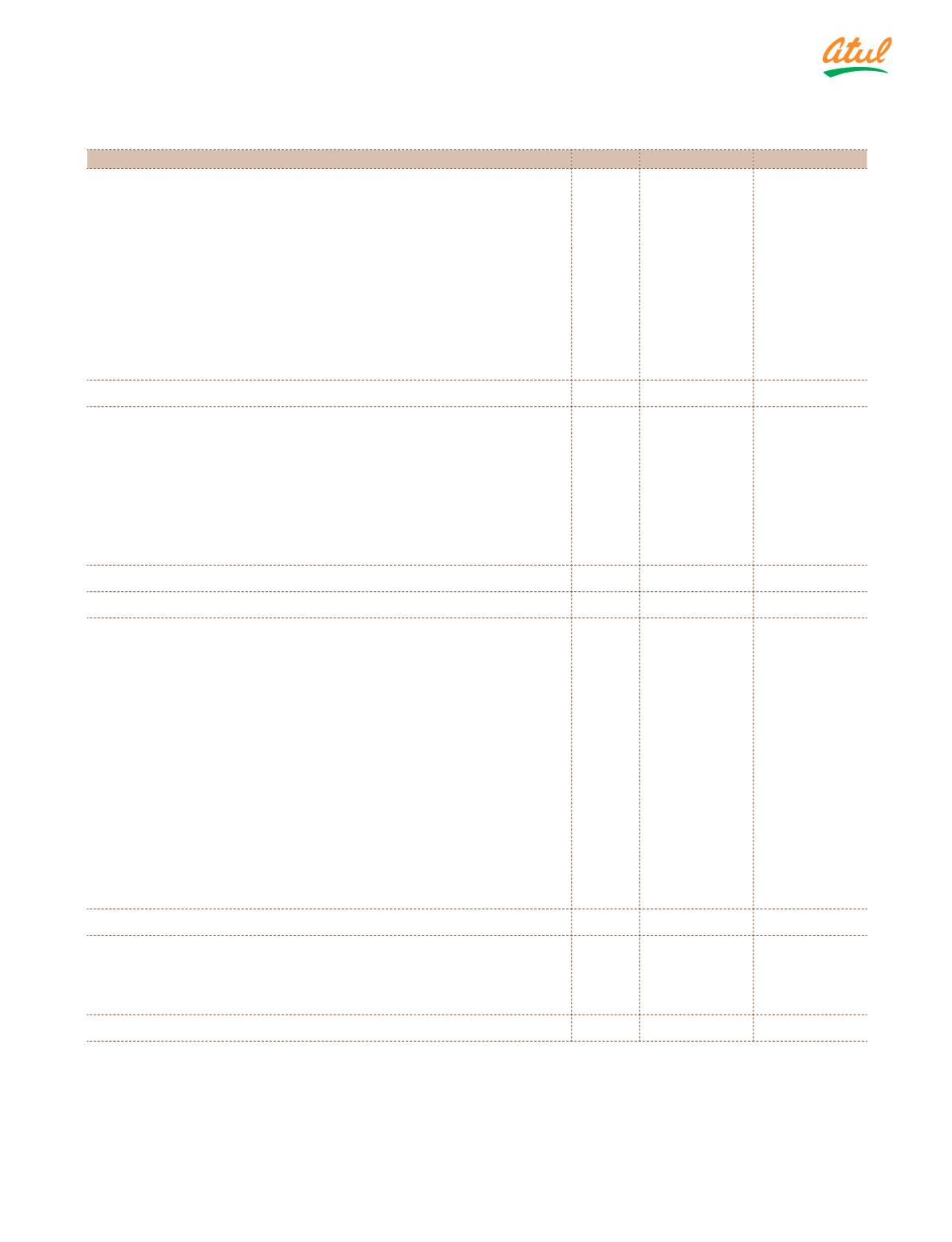

95

Statement of Cash Flows

for the year ended March 31, 2017

(

`

cr)

Particulars

Note

2016-17

2015-16

A Cash flow from operating activities

Profit before tax

400.52

400.20

Adjustments for:

Add:

Depreciation and amortisation expenses

2, 4

91.12

61.92

Finance costs

25

21.02

25.84

Loss on disposal of property, plant and equipment

26

0.20

1.01

Unrealised exchange rate difference (net)

0.95

3.86

113.29

92.63

513.81

492.83

Less:

Dividend received

21

22.27

10.64

Interest income from financial assets measured at amortised cost

2.87

2.54

Gain on disposal of equity instruments measured at cost

21

–

0.03

Gain on disposal of property, plant and equipment

21

3.71

1.27

28.85

14.48

Operating profit before change in operating assets and liabilities

484.96

478.35

Adjustments for:

(Increase) | Decrease in inventories

9

6.28

(24.52)

(Increase) | Decrease in trade receivables

(86.77)

16.13

(Increase) | Decrease in other financial assets

3.30

5.50

(Increase) | Decrease in other assets

20.38

(21.12)

Increase | (Decrease) in non-current loans

(5.18)

–

Increase | (Decrease) in trade payables

33.65

27.62

Increase | (Decrease) in other financial liabilities

(3.23)

1.81

Increase | (Decrease) in other current liabilities

(17.42)

(3.07)

Increase | (Decrease) in current provisions

2.61

(1.67)

Increase | (Decrease) in non-current provisions

2.81

1.37

(43.57)

2.05

Cash generated from operations

441.39

480.40

Less:

Income tax paid (net of refund)

77.47

105.61

Net cash inflow from operating activities

A

363.92

374.79