147

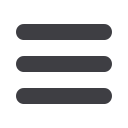

Note 27.12 Leases

a) Operating lease

The Company has taken various residential and office premises under operating lease or leave and license Agreements.

These are generally cancellable, having a term between 11 months and 3 years and have no specific obligation for

renewal. Payments are recognised in the Statement of Profit and Loss under 'Rent' in Note 26.

b) Finance lease

i)

The Company has given a building on finance lease for a term of 30 years.

Future minimum lease payments receivable under finance leases, together with the present value of the net minimum

lease payments (MLP), are as under:

(

`

cr)

Particulars

As at March 31, 2018

As at March 31, 2017

Minimum

lease

payments

receivable

Present

value

of MLP

receivable

Minimum

lease

payments

receivable

Present

value

of MLP

receivable

Not later than 1 year

–

–

0.20

0.20

Later than 1 year and not later than 5 years

0.40

0.35

0.40

0.34

Later than 5 years

2.00

0.90

2.00

0.84

Total minimum lease payments receivable

2.40

1.25

2.60

1.38

Less: unearned finance income

1.15

–

1.22

–

Present value of minimum lease payments receivable

1.25

1.25

1.38

1.38

Less: allowance for uncollectible lease payments

–

–

–

–

1.25

1.25

1.38

1.38

ii) The Company has taken on lease a parcel of land from Gujarat Industrial Development Corporation for a period of

99 years with an option to extend the lease by another 99 years on expiry of lease at a rental that is 100% higher

than the current rental. However, the Company has no specific obligation for renewal. The Company has considered

that such a lease of land transfers substantially all of the risks and rewards incidental to ownership of land, and has

thus accounted for the same as finance lease.

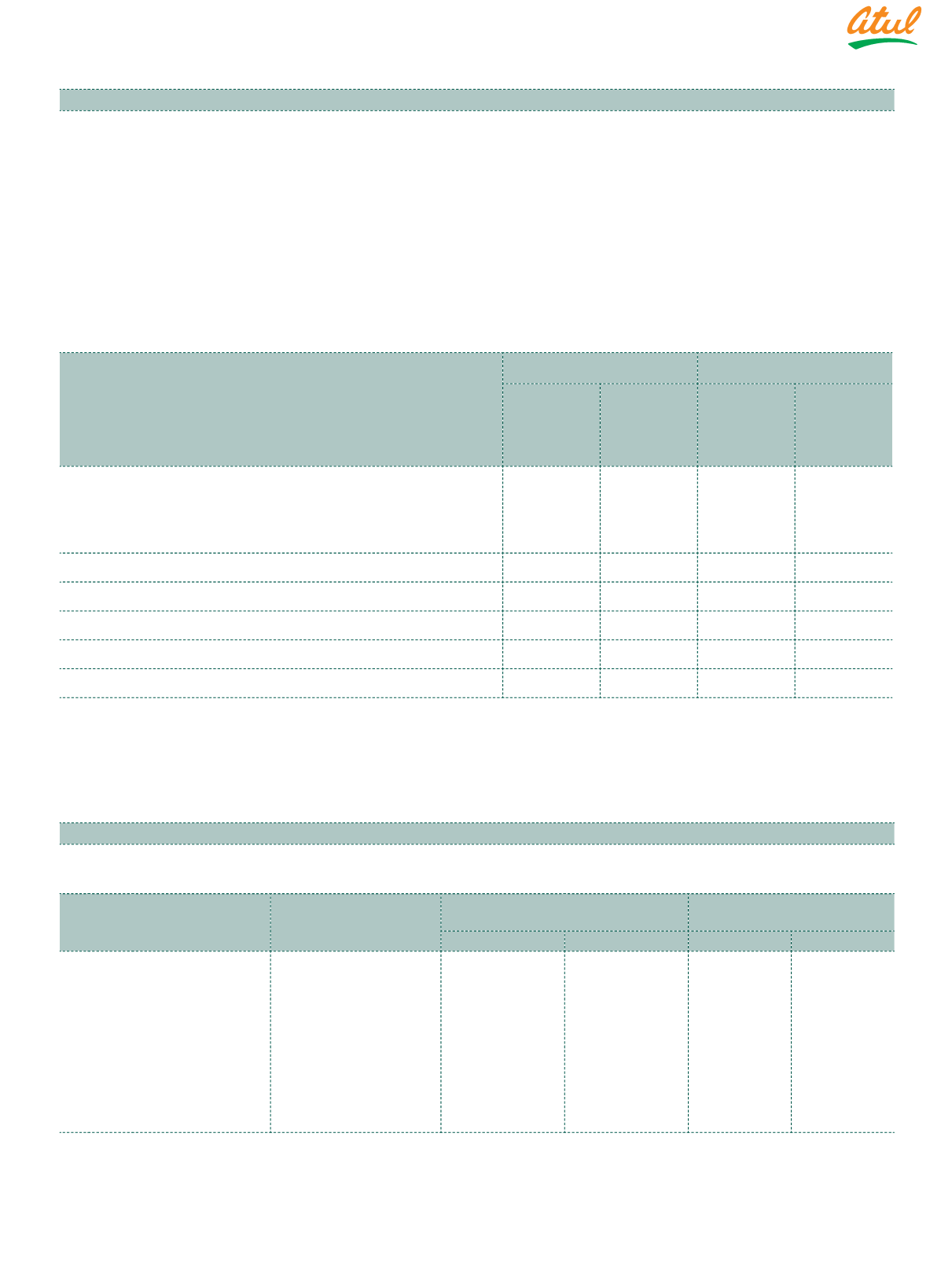

Note 27.13 Loans

Disclosures pursuant to the Regulation 34(3) read with para A of Schedule V to the SEBI (Listing obligations and disclosure

requirements) Regulations, 2015 read with Section 186 (4) of the Companies Act, 2013.

Particulars

Purpose

Amount outstanding

as at

Maximum balance

during the year

March 31, 2018 March 31, 2017

2017-18

2016-17

i)

Subsidiary

companies:

Atul Bioscience Ltd Seed funding support

as promoters

–

4.30

4.30

4.30

Amal Ltd*

Interest free loan,

pursuant to Board for

Industrial and Financial

Reconstruction order

7.07

7.89

7.89

9.37

*

At amortised cost

Notes:

a) Loans given to employees as per the policy of the Company are not considered.

b) The loanees did not hold any shares in the Share capital of the Company.

Notes

to the Financial Statements