Atul Ltd | Annual Report 2017-18

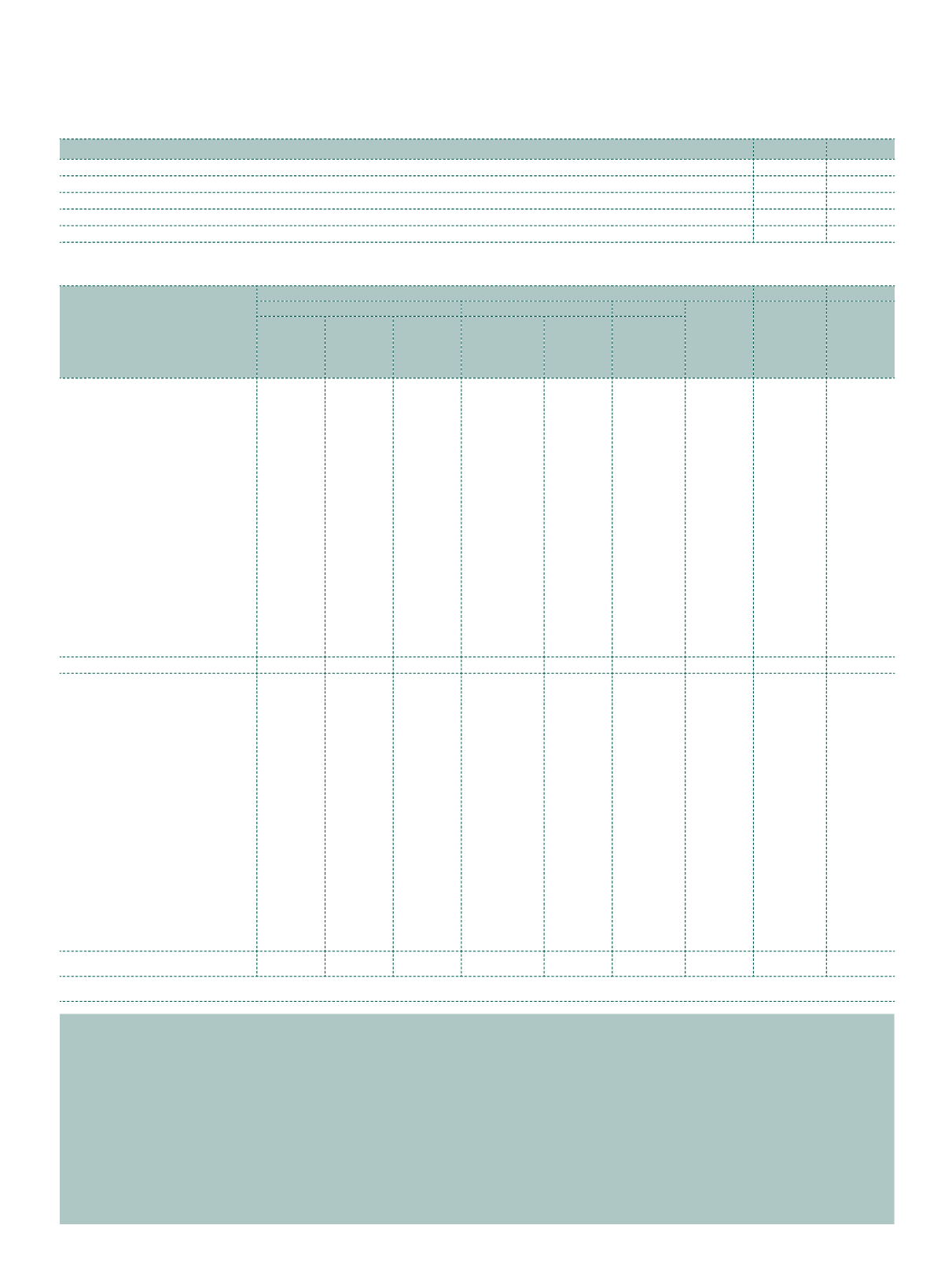

Consolidated Statement of changes in equity

for the year ended March 31, 2018

A Equity share capital

(

`

cr)

Particulars

Note Amount

As at March 31, 2016

29.68

Changes in Equity share capital during the year

–

As at March 31, 2017

29.68

Changes in Equity share capital during the year

–

As at March 31, 2018

15

29.68

B Other equity

(

`

cr)

Particulars

Attributable to owners of the Company

Reserves and surplus

Other reserves

Total

other

equity

Non-

controlling

interest

Total

Securities

premium

reserve

General

reserve

Retained

earnings

FVOCI

equity

instruments

Cash flow

hedging

reserve

Foreign

currency

translation

reserve

As at March 31, 2016

34.66

97.36 1,156.81 287.52

(0.59)

9.35 1,585.11

2.45 1,587.56

Profit for the year

–

– 322.97

–

–

– 322.97

0.38 323.35

Other Comprehensive Income

–

–

1.58

77.36

(0.48)

4.45

82.91

0.01

82.92

Total comprehensive

income for the year

–

– 324.55

77.36

(0.48)

4.45 405.88

0.39 406.27

Transfer to retained

earnings on disposal of

FVOCI equity instruments

–

–

0.75

(0.75)

–

–

–

–

–

Hedging gain | (loss)

reclassified to Statement of

Profit and Loss

–

–

–

–

0.59

–

0.59

0.59

Transactions with

owners in their capacity

as owners:

Dividend paid (including

dividend distribution tax)

–

–

(37.02)

–

–

–

(37.02)

– (37.02)

Transactions with

non-controlling interests

–

–

(18.30)

–

–

–

(18.30)

12.41

(5.89)

As at March 31, 2017

34.66

97.36 1,426.79

364.13

(0.48)

13.80 1,936.26

15.25 1,951.51

Profit for the year

–

– 276.48

–

–

– 276.48

4.76 281.24

Other Comprehensive Income

–

–

1.76

37.28

0.03

5.06

44.13

–

44.13

Total comprehensive

income for the year

–

– 278.24

37.28

0.03

5.06 320.61

4.76 325.37

Transfer to retained

earnings on disposal of

FVOCI equity instruments

–

–

1.59

(1.59)

–

–

–

–

–

Hedging gain | (loss)

reclassified to Statement of

Profit and Loss

–

–

–

–

0.48

–

0.48

–

0.48

Transactions with

owners in their capacity

as owners:

Dividend paid (including

dividend distribution tax)

–

–

(38.51)

–

–

–

(38.51)

–

(38.51)

Non-controlling interest on

acquisition of subsidiary

companies

–

–

(4.60)

–

–

–

(4.60)

–

(4.60)

As at March 31, 2018

34.66

97.36 1,663.51

399.82

0.03

18.86 2,214.24

20.01 2,234.25

The accompanying Notes 1-29 form an integral part of the Consolidated Financial Statements

In terms of our report attached

For Deloitte Haskins & Sells LLP

Chartered Accountants

R A Shah

S S Baijal

B S Mehta

H S Shah

S M Datta

V S Rangan

M M Chitale

S A Panse

B R Arora

Directors

For and on behalf of the Board of Directors

S S Lalbhai

Chairman and Managing Director

S A Lalbhai

Managing Director

Mumbai

April 27, 2018

Samir R. Shah

Partner

Mumbai

April 27, 2018

T R Gopi Kannan

Whole-time Director and CFO

L P Patni

Company Secretary

B N Mohanan

Whole-time Director

and President - U&S