Atul Ltd | Annual Report 2017-18

Note 29.8 Financial Risk Management

(continued)

iii) Foreign exchange risk

The Group has international

operations and is exposed to

foreign exchange risk arising from

foreign

currency

transactions.

Foreign exchange risk arises from

future commercial transactions

and recognised financial assets

and liabilities are denominated in a

currency that is not the functional

currency (

`

) of the Group. The risk

also includes highly probable foreign

currency cash flows. The objective

of the cash flows hedges is to

minimise the volatility of the

`

cash

flows of highly probable forecast

transactions.

The Group has exposure arising

out of export, import, loans and

other transactions other than

functional risk. The Group hedges its

foreign exchange risk using foreign

exchange forward contracts and

currency options after considering

the natural hedge. The same is

within the guidelines laid down by

the Risk Management Policy of the

Group.

As an estimation of the approximate

impact of the foreign exchange rate

risk, with respect to the Financial

Statements, the Group has calculated

the impact as follows:

For derivative and non-derivative

financial instruments, a 2% increase

in the spot price as on the reporting

date may have led to an increase in

additional

`

2.78 cr gain in Other

Comprehensive Income (2016-17:

gain of

`

2.05 cr). A 2% decrease

may have led to an increase in

additional

`

2.30 cr loss in Other

Comprehensive Income (2016-17:

Gain of

`

0.65 cr).

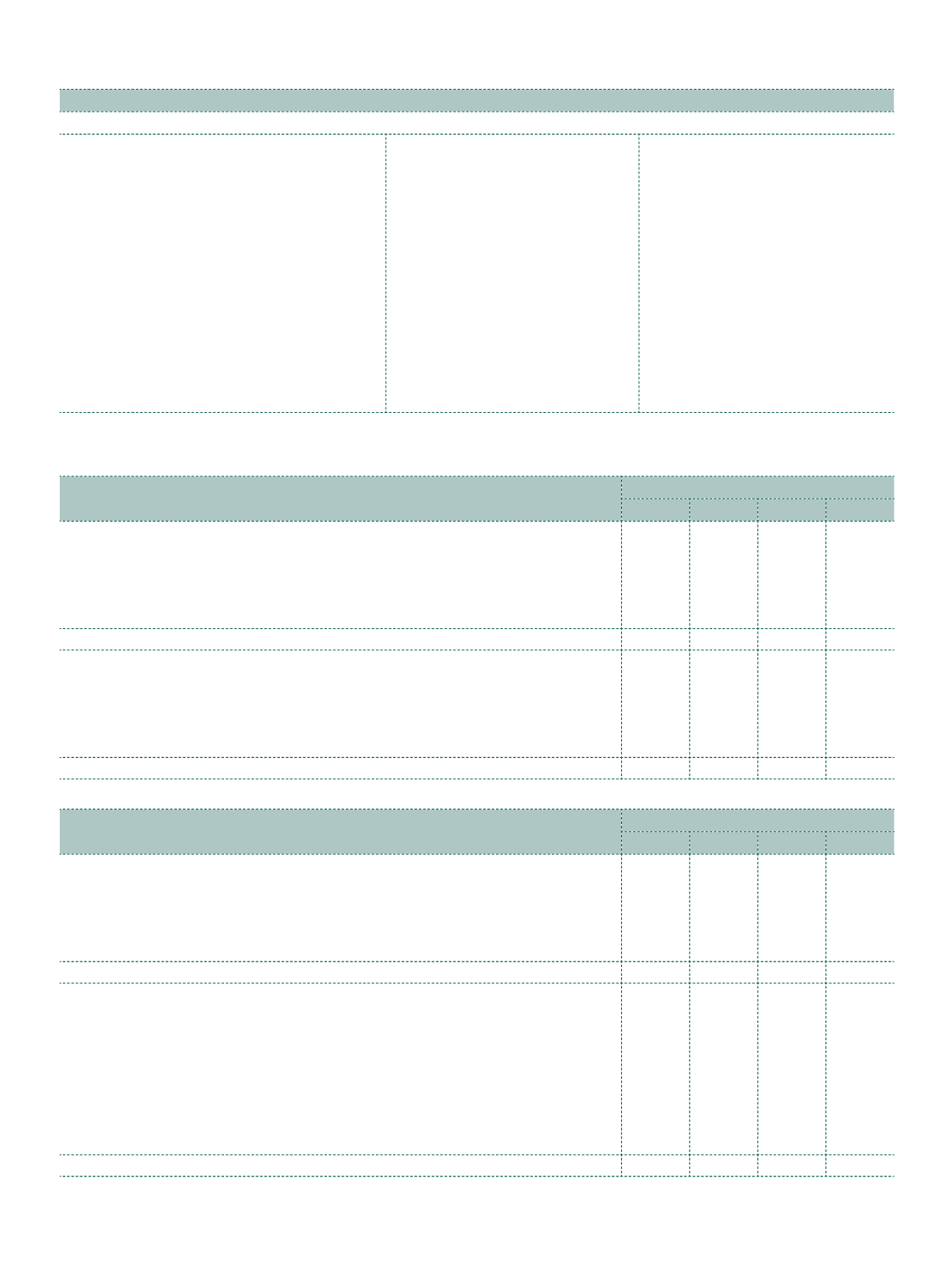

Foreign currency risk exposure:

The exposure to foreign currency risk of the Group at the end of the reporting period expressed are as follows:

Particulars

As at March 31, 2018

US$ mn

`

cr

€ mn

`

cr

Financial assets

Trade receivables

37.07 241.10

1.21

9.78

Less:

Hedged through derivatives

1

Foreign exchange forward contracts

0.92

6.01

–

–

Net exposure to foreign currency risk (assets)

36.15 235.09

1.21

9.78

Financial liabilities

Trade payables

16.39 106.55

0.06

0.48

Less:

Hedged through derivatives

1

Currency range options

3.72 24.22

–

–

Net exposure to foreign currency risk (liabilities)

12.67 82.33

0.06

0.48

1

Includes hedges for highly probable transactions up to next 12 months

Particulars

As at March 31, 2017

US$ mn

`

cr

€ mn

`

cr

Financial assets

Trade receivables

27.00 175.07

0.85

5.89

Less:

Hedged through derivatives

1

Currency range options

7.65

49.60

–

–

Net exposure to foreign currency risk (assets)

19.35 125.47

0.85

5.89

Financial liabilities

Borrowings

10.67 69.15

–

–

Trade payables

7.87 51.06

0.22

1.50

Capital creditors

0.03

0.16

–

–

Less:

Hedged through derivatives

1

Foreign exchange forward contracts

9.00 58.35

–

–

Currency swaps

1.67 10.80

–

–

Net exposure to foreign currency risk (liabilities)

7.90 51.22

0.22

1.50

1

Includes hedges for highly probable transactions up to the next 12 months

Notes

to the Consolidated Financial Statements