Atul Ltd | Annual Report 2017-18

No. Particulars

Reason for

change

Shareholding as at

April 01, 2017

Cumulative shareholding

during 2017-18

Number of

shares

% of total

shares of the

Company

Number of

shares

% of total

shares of the

Company

13. B R Arora

At the beginning of the year

100

–

100

–

Increase | Decrease during the year

At the end of the year

100

–

100

–

14. L P Patni

At the beginning of the year

–

–

–

–

Increase | Decrease during the year

At the end of the year

–

–

–

–

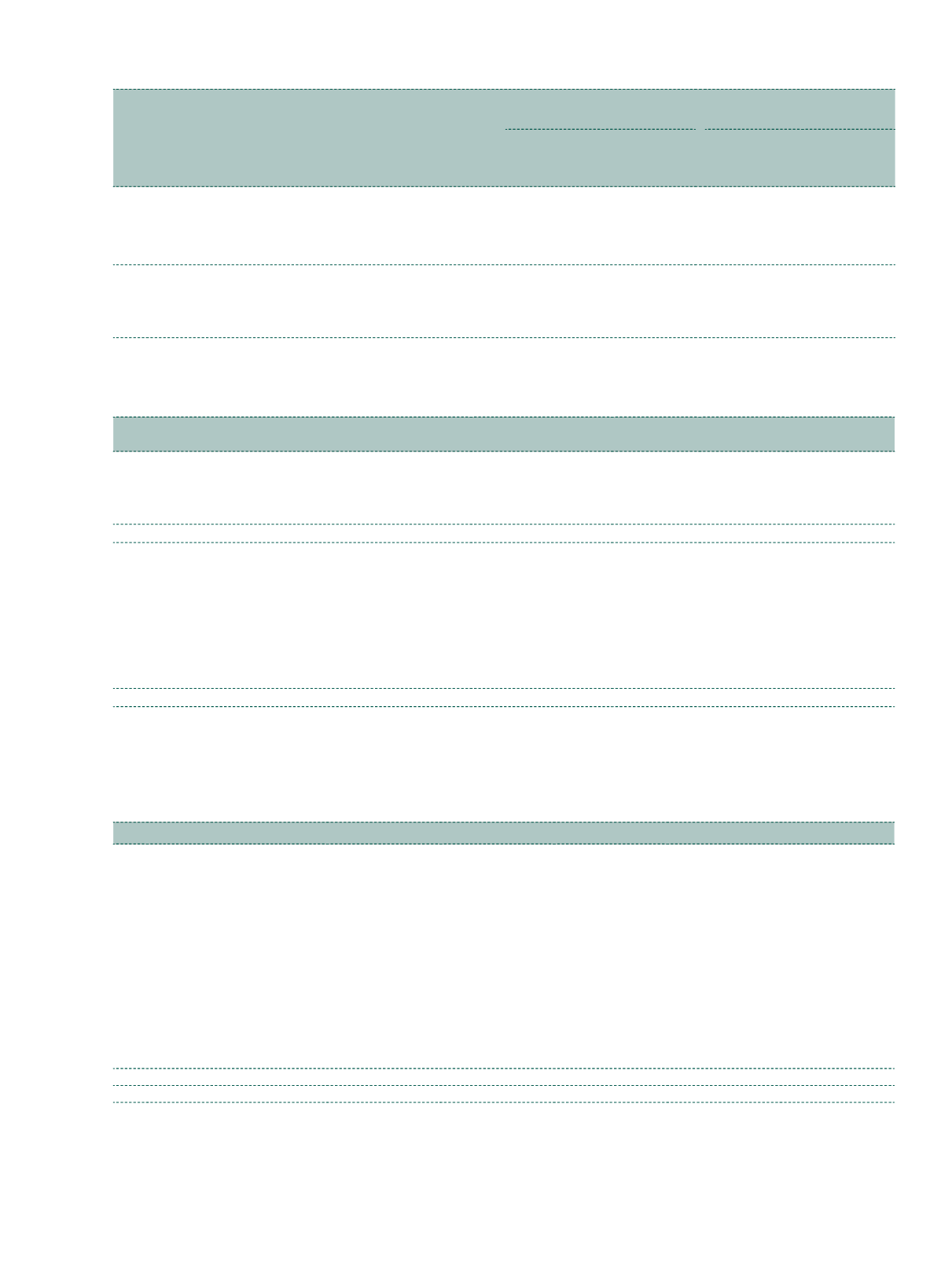

4.5 Indebtedness

Indebtedness of the Company including interest outstanding | accrued, but not due for payment

(

`

cr)

Particulars

Secured loans

excluding deposits

Unsecured

loans

Deposits

Total

indebtedness

Indebtedness at the beginning of the financial year

i)

Principal amount

29.39

125.83

–

155.22

ii)

Interest due, but not paid

–

–

–

–

iii)

Interest accrued, but not due

0.18

–

–

0.18

Total i) + ii) + iii)

29.57

125.83

–

155.40

Change in indebtedness during the financial year

Addition

–

–

–

–

Reduction

29.57

125.82

–

155.39

Net change

29.57

125.82

–

155.39

Indebtedness at the end of the financial year

i)

Principal amount

0.01

–

–

0.01

ii)

Interest due, but not paid

–

–

–

–

iii)

Interest accrued, but not due

–

–

–

–

Total i) + ii) + iii)

0.01

–

–

0.01

Note: As on March 31, 2018, two deposits of

`

0.005 cr from each of the Directors, Mr B S Mehta and Mr R A Shah were lying with

the Company.

4.6 Remuneration of the Directors and the Key Managerial Personnel

4.6.1 Remuneration to the Managing Director, the Whole-time Directors and | or the Manager

(

`

)

No. Particulars

S S Lalbhai

1

S A Lalbhai

B N Mohanan T R Gopi Kannan

2

Total amount

01.

Gross salary

Salary as per provisions

under Section 17(1) of the

Income Tax Act, 1961

3

2,86,27,689

89,69,192

87,35,451

1,25,74,333

5,89,06,665

Value of perquisites

under Section 17(2) of the

Income Tax Act, 1961

79,244

5,65,885

7,35,474

39,600

14,20,203

Profits in lieu of salary

under Section 17(3) of the

Income Tax Act, 1961

–

–

–

–

–

02.

Stock option

–

–

–

–

–

03.

Sweat Equity

–

–

–

–

–

04.

Commission

4,17,10,000

4

1,30,64,250

5

–

–

5,47,74,250

05.

Variable pay

–

–

16,73,000

12,93,000

29,66,000

06.

Others

–

–

–

–

–

07.

Total (A)

7,04,16,933

2,25,99,327

1,11,43,925

1,39,06,933

11,80,67,118

08.

Overall ceiling as per the Act

41,71,00,000

1

CMD (CEO)

2

WtD (CFO)

3

Excluding commission and variable pay

4

1% of profit (

`

4,17,10,000) or 60 months basic salary (

`

7,16,85,000), whichever is lower.

5

0.50% of profit (

`

2,08,55,000) or 30 months basic salary (

`

1,30,64,250), whichever is lower.