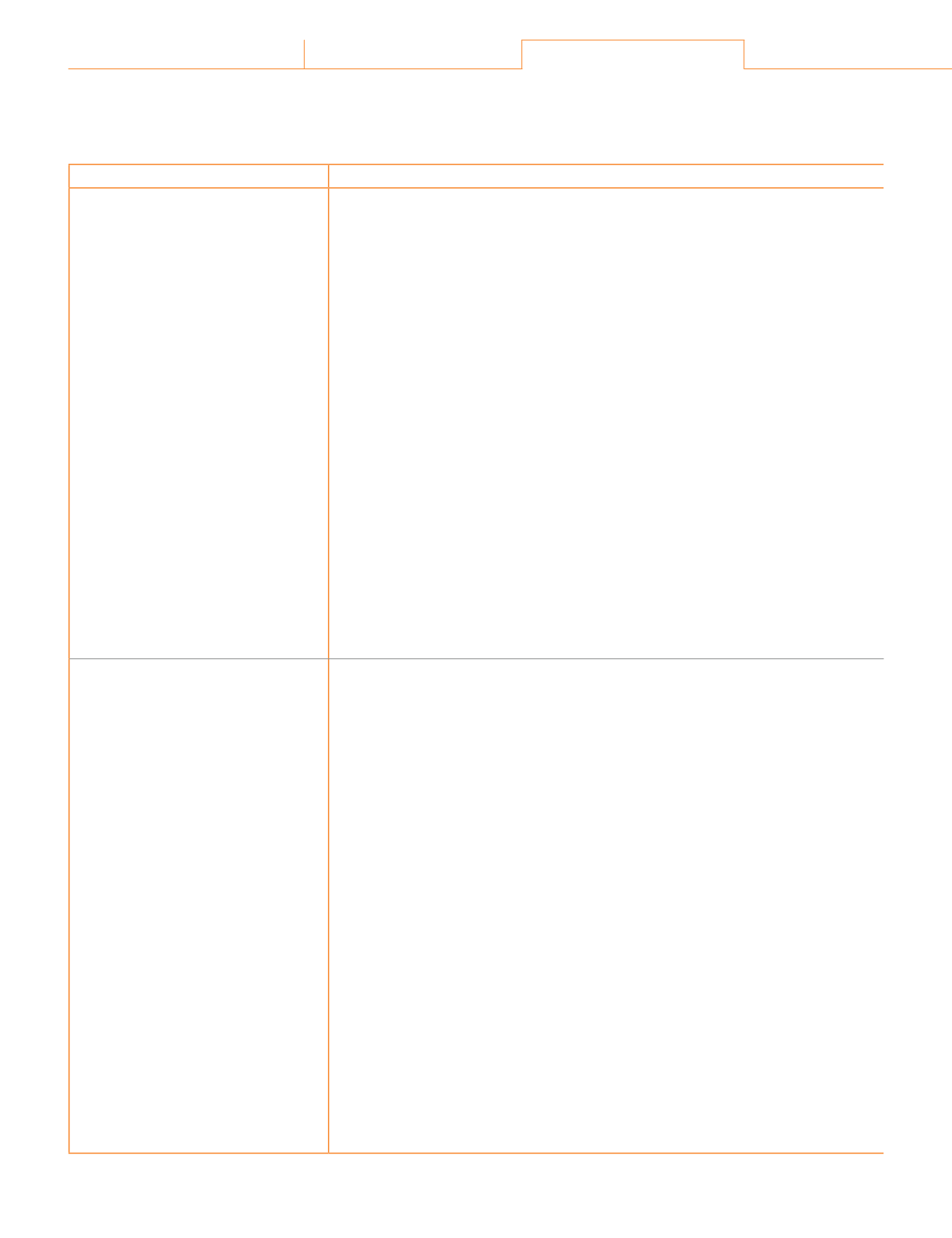

Key audit matters

Auditor's responses

Contingent liabilities and provisions

The Company has received certain

claims from the government

authorities and customers, which

are disputed. These involve a high

degree of judgement to determine

the possible outcomes, and estimates

relating to the timing and the amount

ūlj ūƭƥǜūDžƙ ūlj ƑĚƙūƭƑČĚƙ ĚŞċūēNjĿŠij

ĚČūŠūŞĿČ ċĚŠĚǛƥƙȦ

The audit procedures included but were not limited to:

- Obtaining a detailed understanding processes and controls of the Management

with respect to claims or disputes.

- Evaluation of the design of the controls relating to compilation of the claims;

assessment of probability of outcome, estimates of the timing and the amount

ūlj ƥĺĚ ūƭƥǜūDžƙȡ îŠē îƎƎƑūƎƑĿîƥĚ ƑĚƎūƑƥĿŠij ċNj ƥĺĚ qîŠîijĚŞĚŠƥ îŠē ƥĚƙƥĿŠij

implementation and operating effectiveness of the key controls.

- Performing following procedures on samples selected:

ȟ ÀŠēĚƑƙƥîŠēĿŠij ƥĺĚŞîƥƥĚƑƙ ċNj ƑĚîēĿŠij ƥĺĚ ČūƑƑĚƙƎūŠēĚŠČĚƙ ʈ ČūŞŞƭŠĿČîƥĿūŠƙȡ

minutes of the Audit Committee and | or the Board meetings and discussions

with the appropriate Management personnel.

ȟ ¡ĚƑljūƑŞĿŠij ČūƑƑūċūƑîƥĿDŽĚ ĿŠƐƭĿƑĿĚƙ DžĿƥĺ îƎƎƑūƎƑĿîƥĚ ŕĚDŽĚŕ ūlj ƥĺĚ qîŠîijĚŞĚŠƥ

personnel including status update, expectation of outcomes with the basis,

and the future course of action contemplated by the Company, and perusing

legal opinions, if any, obtained by the Management.

ȟ ~ċƥîĿŠĿŠij ēĿƑĚČƥ ČūŠǛƑŞîƥĿūŠ ljƑūŞ ƥĺĚ ŕĚijîŕ îƥƥūƑŠĚNjƙ ūlj ƥĺĚ ūŞƎîŠNj îŠē

considering their opinions | probability assessment of the outcomes.

ȟ /DŽîŕƭîƥĿŠij ƥĺĚ ĚDŽĿēĚŠČĚƙ ƙƭƎƎūƑƥĿŠij ƥĺĚ ŏƭēijĚŞĚŠƥ ūlj ƥĺĚ qîŠîijĚŞĚŠƥ îċūƭƥ

possible outcomes and the reasonableness of the estimates. We involved our

internal experts for technical guidance and evaluation of the assessments of

the Management, as appropriate.

- Evaluating appropriateness of adequate disclosures in accordance with the

applicable accounting standards.

Adoption of Ind AS 115, Revenue

from contracts with customers (new

revenue accounting standard)

The Company sells products to the

customers under different types of

contractual terms. The application

of the new revenue accounting

standard involved assessing if distinct

performance obligations exist under

each type of the contracts, and

ensuring appropriate and adequate

disclosures in the Standalone

Financial Statements.

The audit procedures included but were not limited to:

- Assessment of the processes of the Company for adoption of the new Accounting

Standards.

- Selecting a sample from each type of the contracts with the customers, and

ƥĚƙƥĿŠij ƥĺĚ ūƎĚƑîƥĿŠij ĚljljĚČƥĿDŽĚŠĚƙƙ ūlj ƥĺĚ ĿŠƥĚƑŠîŕ ČūŠƥƑūŕȡ ƑĚŕîƥĿŠij ƥū ĿēĚŠƥĿǛČîƥĿūŠ

of the distinct performance obligations and determination of transaction price.

Carrying out a combination of procedures involving enquiry and observation, re-

performance and inspection of evidence in respect of operation of these controls.

- Testing the relevant controls including access and change management

controls of information technology systems, which are relevant for appropriate

measurement and presentation of revenue and related account balances.

- Performing following procedures on the samples selected:

ȟ ¤ĚîēĿŠijȡ îŠîŕNjƙĿŠij îŠē ĿēĚŠƥĿljNjĿŠij ƥĺĚ ēĿƙƥĿŠČƥ ƎĚƑljūƑŞîŠČĚ ūċŕĿijîƥĿūŠƙ ĿŠ

these contracts.

ȟ ūŞƎîƑĿŠij ƥĺĚƙĚ ƎĚƑljūƑŞîŠČĚ ūċŕĿijîƥĿūŠƙ DžĿƥĺ ƥĺîƥ ĿēĚŠƥĿǛĚē îŠē ƑĚČūƑēĚē

by the Company.

ȟ ūŠƙĿēĚƑĿŠij ƥĺĚ ƥĚƑŞƙ ūlj ƥĺĚ ČūŠƥƑîČƥƙ ƥū ēĚƥĚƑŞĿŠĚ ƥĺĚ ƥƑîŠƙîČƥĿūŠ ƎƑĿČĚ îŠē

Ŀƥƙ îŕŕūČîƥĿūŠ ƥū ƥĺĚ ĿēĚŠƥĿǛĚē ƎĚƑljūƑŞîŠČĚ ūċŕĿijîƥĿūŠƙȦ

ȟ ¹ĚƙƥĿŠij ƙîŞƎŕĚ ūlj ƑĚDŽĚŠƭĚƙ DžĿƥĺ ƥĺĚ ƎĚƑljūƑŞîŠČĚ ūċŕĿijîƥĿūŠƙ ƙƎĚČĿǛĚē ĿŠ ƥĺĚ

underlying contracts.

ȟ ¡ĚƑljūƑŞĿŠij îŠîŕNjƥĿČîŕ ƎƑūČĚēƭƑĚƙ ljūƑ ƑĚîƙūŠîċŕĚŠĚƙƙ ūlj ƑĚDŽĚŠƭĚƙ ēĿƙČŕūƙĚē

by segments.

- Evaluating the appropriateness of adequate disclosures in accordance with the

standards.

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250

108

Atul Ltd | Annual Report 2018-19