1.2

Technology absorption

1.2.1 Research and Development

Ŀȴ

¬ƎĚČĿǛČ îƑĚîƙ ĿŠ DžĺĿČĺ ¤ĚƙĚîƑČĺ îŠē 'ĚDŽĚŕūƎŞĚŠƥ ȳ¤ʁ'ȴ Džîƙ ČîƑƑĿĚē ūƭƥ ċNj ƥĺĚ ūŞƎîŠNjȠ

¹ĺĚ ūŞƎîŠNj ljūČƭƙĚē Ŀƥƙ ¤ʁ' ĚljljūƑƥƙ ūŠ ƎƑūČĚƙƙ ĿŞƎƑūDŽĚŞĚŠƥ ūlj Ŀƥƙ ĚNJĿƙƥĿŠij ƎƑūēƭČƥƙȡ ƑĚČūDŽĚƑNj ūlj ƎƑūēƭČƥƙ ljƑūŞ

pollutants and process development of new products and formulations. The R&D departments also helped in

troubleshooting in manufacturing departments.

ĿĿȴ

ĚŠĚǛƥƙ ēĚƑĿDŽĚē ljƑūŞ ¤ʁ'Ƞ

The Company increased yield of 15 products, decreased consumption of raw materials of 14 products, decreased

consumption charge of 10 solvents, recovered 12 products from pollutants and introduced 23 new products and

formulations.

iii) Future plan:

The Company is investing further in people and equipment so as to strengthen its R&D and thereby enhance its

capability.

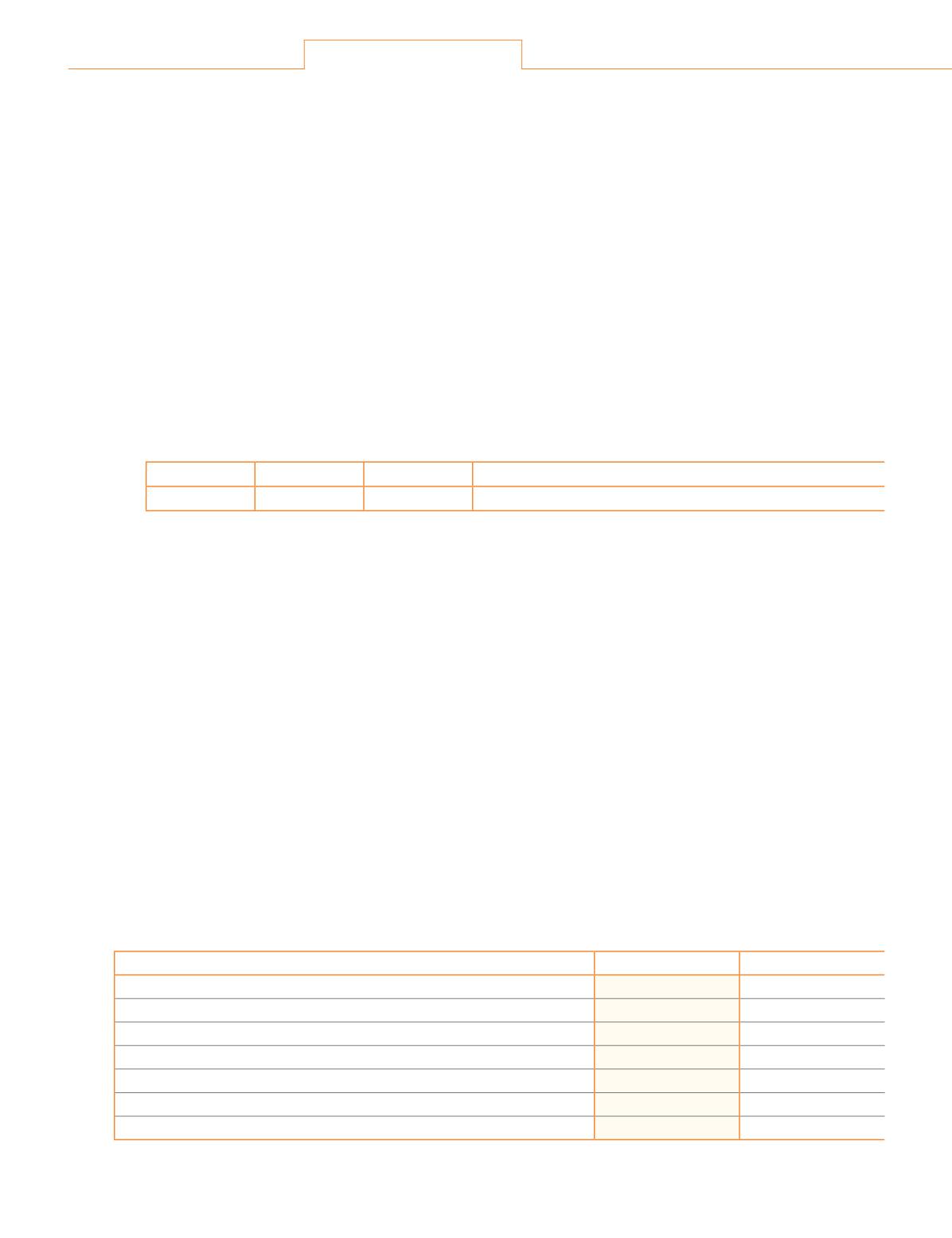

ĿDŽȴ ¤ʁ' ĚNJƎĚŠēĿƥƭƑĚȠ

(

`

cr)

Capital

Recurring

Total

Total R&D expenditure as a percentage of total sales

5.22

22.94

28.16

0.73%

1.2.2 Technology absorption, adaptation and innovation

i)

Efforts in brief, made towards technology absorption, adaptation and innovation:

¹ĺĚ ūŞƎîŠNj ƭƎijƑîēĚē ŞîŠNj ūlj Ŀƥƙ ƎƑūČĚƙƙĚƙ îŠē ūƎĚƑîƥĿūŠƙ ċNj ĿŞċĿċĿŠij ŠĚDž ƥĚČĺŠūŕūijNjȡ ƭƙĿŠij ŞūƑĚ ĚljǛČĿĚŠƥ

equipment and incorporating automation.

ĿĿȴ

ĚŠĚǛƥƙ ēĚƑĿDŽĚē îƙ î ƑĚƙƭŕƥ ūlj ƥĺĚ îċūDŽĚ ĚljljūƑƥƙȡ ljūƑ ĚNJîŞƎŕĚȡ ƎƑūēƭČƥ ĿŞƎƑūDŽĚŞĚŠƥȡ Čūƙƥ ƑĚēƭČƥĿūŠȡ ƎƑūēƭČƥ

development and import substitution:

The above efforts have resulted in improvement in quality, increase in yields, increase in throughput and decrease

in manpower.

ĿĿĿȴ ¹ĚČĺŠūŕūijNjȡ Ŀlj îŠNjȡ ĿŞƎūƑƥĚē ēƭƑĿŠij ƥĺĚ ŕîƙƥ ǩ NjĚîƑƙ ƑĚČŒūŠĚē ljƑūŞ ƥĺĚ ċĚijĿŠŠĿŠij ūlj ƥĺĚ ǛŠîŠČĿîŕ NjĚîƑȠ

The Company did not import any technology.

1.3

Foreign exchange earnings and outgo

ǧȦǩȦǧ /NJƎūƑƥ ƙîŕĚƙȠ îČƥĿDŽĿƥĿĚƙȡ ēĚDŽĚŕūƎŞĚŠƥ ĿŠĿƥĿîƥĿDŽĚƙ îŠē ljƭƥƭƑĚ ƎŕîŠƙ

The Company sold its products in 92 countries, directly and through its subsidiary companies in the USA, the UK, the

UAE, China and Brazil. Sales outside India* increased by 27% from

`

1,478 cr to

`

1,874 cr mainly due to higher prices as

compared to the previous year. The Company is taking further steps to strengthen its international marketing network.

*Free On Board (FOB) value

ǧȦǩȦǨ ¹ūƥîŕ ljūƑĚĿijŠ ĚNJČĺîŠijĚ ĚîƑŠĿŠijƙ îŠē ūƭƥijū

(

`

cr

)

Particulars

2018-19

2017-18

Earnings

/NJƎūƑƥƙ ȶ G~ DŽîŕƭĚ

1,874.27

1,477.69

Dividends, etc

0.19

6.25

Outgo

Loan repayment

-

69.16

Payment for raw materials, books and periodicals, dividend, etc

764.78

602.50

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250

30

Atul Ltd | Annual Report 2018-19