60 /

Atul Ltd

|

Annual Report 2009-10

and 58AA or any other relevant provisions of the

Act and the Companies (Acceptance of Deposits)

Rules, 1975 with regard to the deposits accepted

from the public. According to the information and

explanations given to us, no order has been passed

by the Company Law Board or National Company

Law Tribunal or Reserve Bank of India or any Court or

any other Tribunal on the Company in respect of the

aforesaid deposits.

vii. In our opinion, the Company has an internal audit

system commensurate with its size and nature of its

business.

viii. We have broadly reviewed the books of account

maintained by the Company in respect of products

where, pursuant to the Rules made by the Central

Government of India, the maintenance of cost

records has been prescribed under clause (d) of sub-

section (1) of Section 209 of the Act, and are of the

opinion that prima facie, the prescribed accounts

and records have been made and maintained. We

have, however, not made a detailed examination of

the records with a view to determine whether they

are accurate or complete.

ix. (a) According to the information and explanations

given to us and the records of the Company

examined by us, in our opinion, the Company is

regular in depositing the undisputed statutory

dues including provident fund, investor

education and protection fund, employees’

state insurance, income-tax, sales-tax, wealth

tax, service tax, customs duty, excise duty, cess

and other material statutory dues as applicable

with the appropriate authorities.

(b) According to the information and explanations

given to us and the records of the Company

examined by us, the particulars of dues of

income-tax, sales-tax, customs duty, excise duty

and cess as at March 31, 2010 which have not

been deposited on account of a dispute are

as follows:

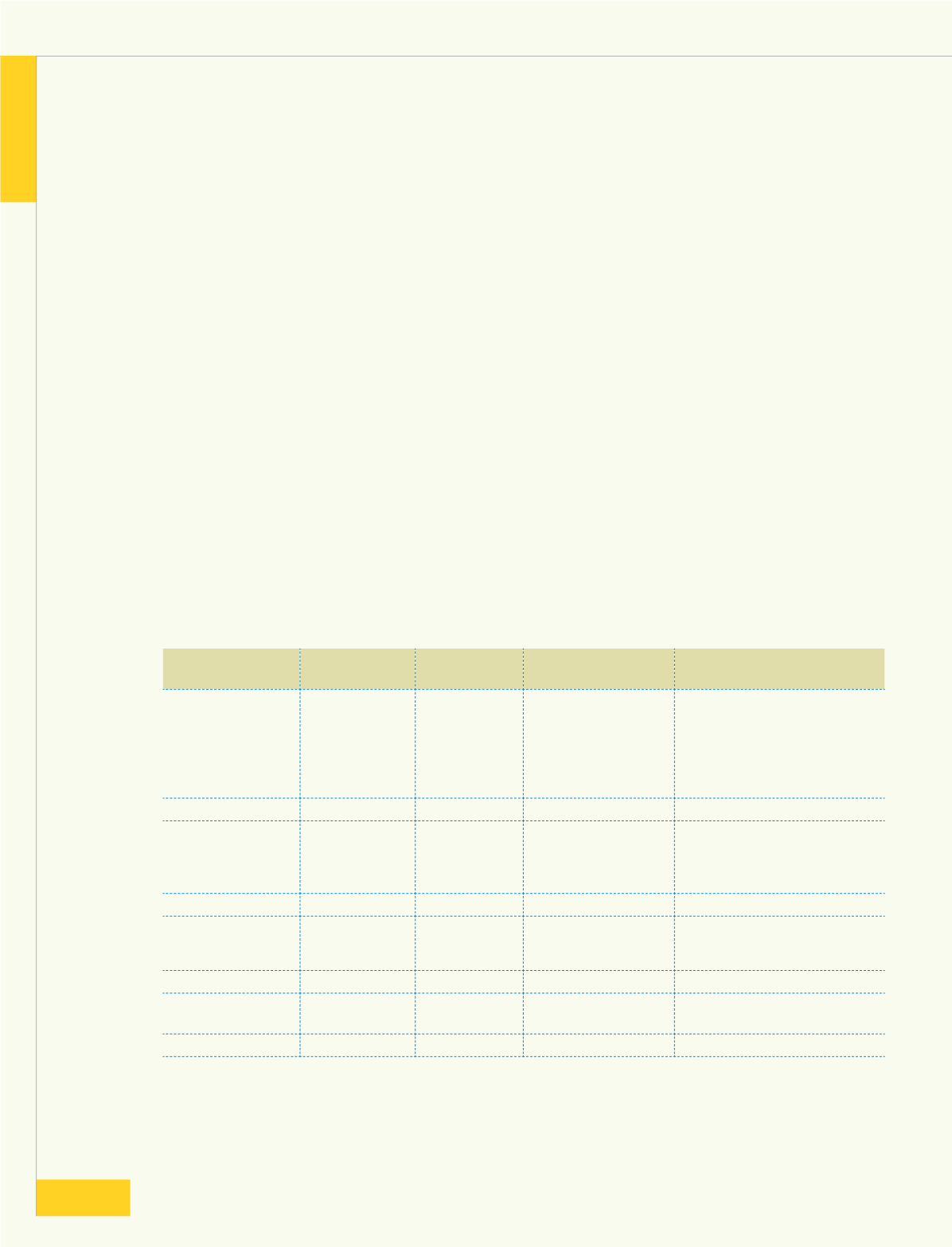

Name of the statute Nature of dues Amount

(Rs crores) (a)

Period to which the

amount relates

Forum where the dispute is

pending (b)

The Central Excise

Act, 1944

Central excise

6.46

0.51

5.19

0.01

5.09

1995-96 to 2006-07

1995-96 to 2006-07

1986-98 to 2003-04

1991-94

1992-93 to 2009-10

{Joint Commissioner,

Commissioner (Appeals),

Customs, Excise and Service Tax

Appellate Tribunal,

Gujarat High Court,

Assistant Commissioner}

Total

17.26

The Customs Act,

1962

Customs duty

0.59

1.76

13.65

1994 to 1998

1993 to 1998

1996-97 to 2007-08

{Commissioner (Appeals),

Customs, Excise and Service Tax

Appellate Tribunal,

Assistant Commissioner}

Total

16.00

The Income Tax Act,

1961

Income tax

2.36

1.84

2003-04

2004-05

{Gujarat High Court,

Commissioner of Income tax

(Appeals) }

Total

4.20

Gujarat Sales Tax

Act, 1969

Sales tax

1.02 2004-05

Joint Commissioner of Commer-

cial Tax (Appeals)

Total

1.02

(a) Net of amounts deposited.

(b) Necessary stay received from respective authorities.

Annexure

to the Report of the Auditors

61