Corporate Identity Serving Diverse Industries Purpose and Values Overview by the Chairman Operational Highlights Financial Analysis Research and Technology

Safety, HealthandEnvironment Serving the Society Directors’ Report Management Discussion andAnalysis Report on Corporate Governance

Financial Statements

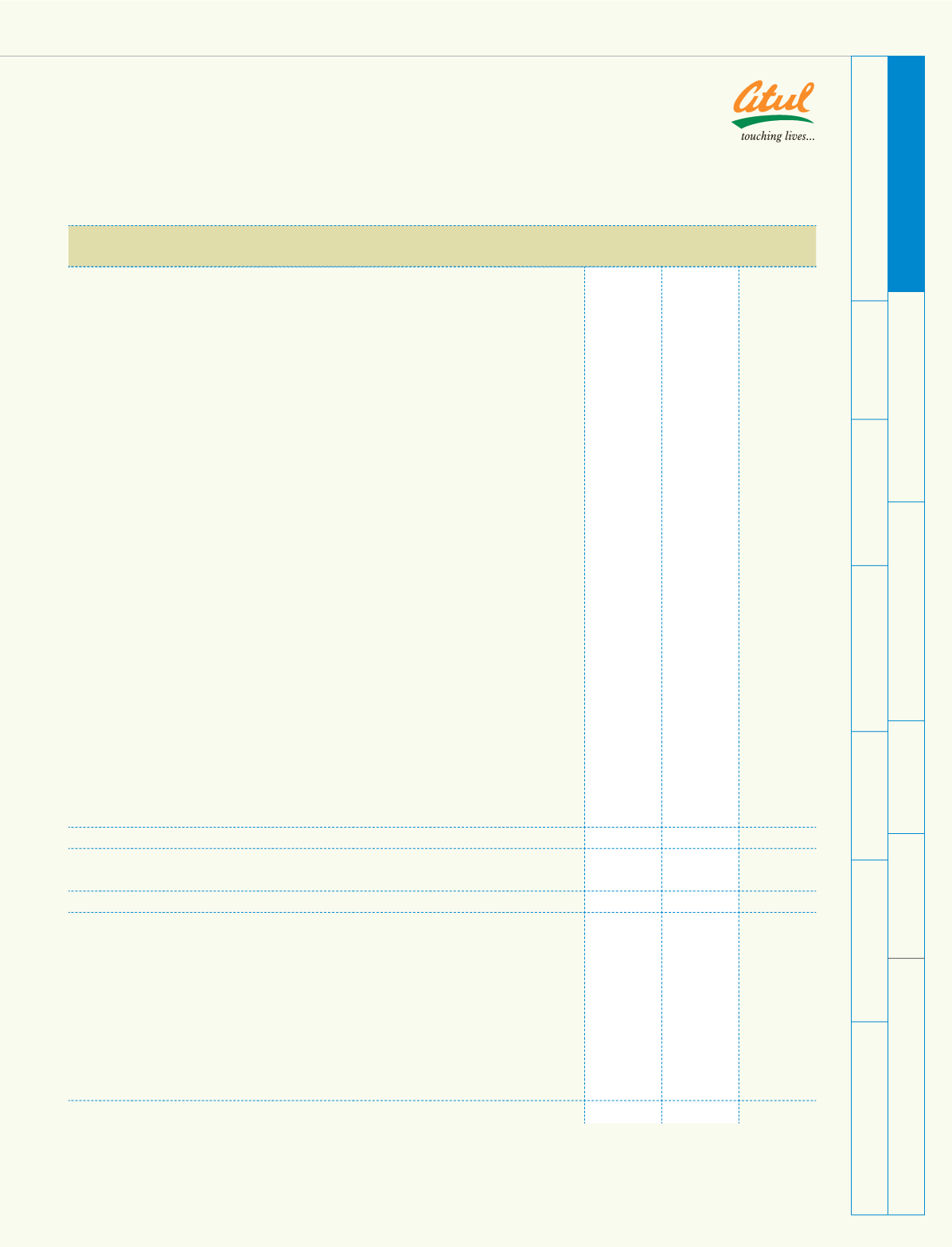

5 C I F value of imports, remittances, expenditure and earnings in

foreign currency

(a) C I F value of imports:

Raw materials

154.25 190.09

Finished goods - for trading

4.05

8.76

Capital goods

0.80

9.67

(b) Expenditure in foreign currency:

Commission

3.80

4.11

Other matters

7.94

5.15

(c) Remittances:

Loan repayments

28.24

5.88

(d) Earnings in foreign currency:

F O B value of exports

491.25 560.83

6 Managerial Remuneration

(a) Calculation of Directors, Managing and Executive Directors’ commission:

Computation of Net Profit as per Section 349 of the Companies

Act, 1956

Profit as per Profit and Loss Account

56.81 37.87

Add: Managing Directors’ remuneration (including perquisites)

2.41

1.53

Executive I Wholetime Directors’ remuneration (including perquisites)

0.56

0.96

Directors’ commission

0.27

0.12

Depreciation

37.30

31.72

Provision for taxation

22.94

7.82

Provision for diminution in value of investments

0.11

-

Payment under VRS scheme

1.82

0.94

65.41 43.09

122.22 80.96

Less: Depreciation under section 350

37.30 31.72

Net Profit as per Section 349 of the Companies Act, 1956

84.92 49.24

(i) Commission to Chairman and Managing Director:

1% of the profit computed above Rs 0.85 crore

Maximum upto Rs 0.93 crore

0.85

0.37

Commission to Managing Director:

0.50% of the profit computed above Rs 0.42 crore

Maximum upto Rs 0.40 crore

0.40

0.25

1.25

0.62

Schedule

forming part of the accounts

(Rs crores)

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

2009-10

2008-09