(

`

crores)

Schedules

forming part of the Consolidated accounts

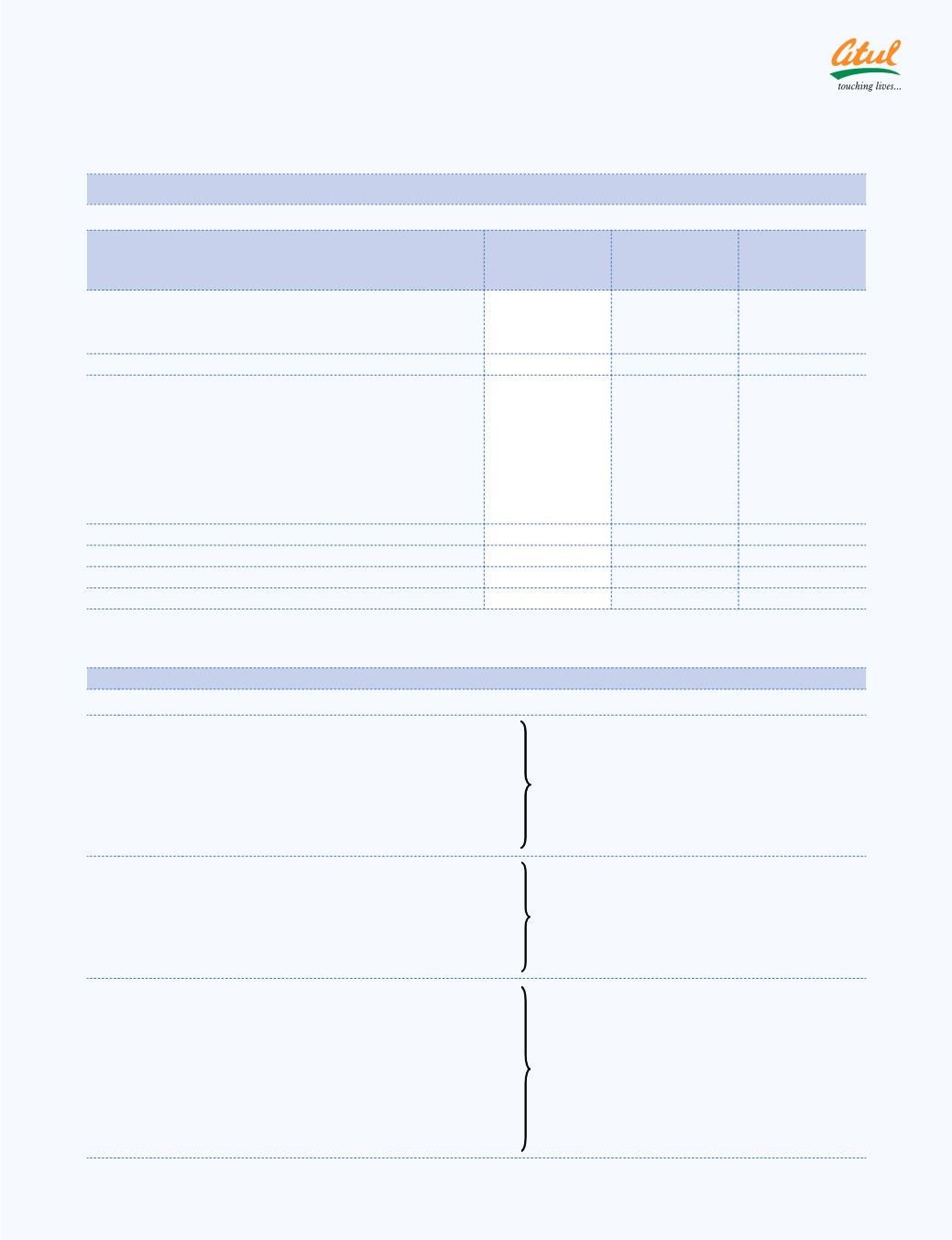

5 Deferred tax adjustments recognised in the financial statements

Particulars

Balance

As at

March 31, 2011

Charge | credit

during the year

Balance

As at

March 31, 2010

Deferred tax liabilities:

on account of timing difference in

(a) Depreciation | impairment loss

28.87

(0.18)

29.05

28.87

(0.18)

29.05

Deferred tax assets:

on account of timing difference in

(a) Provision for leave encashment

4.69

0.33

4.36

(b) 43 B expenses allowable

-

(0.42)

0.42

(c) Provision for doubtful debts

0.14

0.14

-

(d) Provision for doubtful advances

0.06

-

0.06

(e) Payment under VRS

0.92

(0.71)

1.63

5.81

(0.66)

6.47

23.06

0.48

22.58

(f) Deferred tax assets of subsidiary companies

(0.02)

(0.01)

(0.01)

Net deferred tax liabilities | (assets)

23.04

0.47

22.57

SCHEDULE 16 NOTES FORMING PART OF THE CONSOLIDATED ACCOUNTS

(contd)

6 Related party information

(a) Name of the related party and nature of relationship

No Name of the related party

Description of relationship

Party where control exists

1

2

3

4

5

6

7

Amal Ltd

Atul Bioscience Ltd

Gujarat Synthwood Ltd

AtRo Ltd

Atul Infotech Private Ltd

Anchor Adhesives Private Ltd

M. Dohmen S.A.

Associate companies

8

9

10

11

12

13

Atul Bio Space Private Ltd

Atul Clean Energy Private Ltd

Biyaban Agri Ltd

Raja Dates Ltd

Aasthan Dates Ltd

Atul Seeds Ltd

Enterprises over which control exercised by key

management personnel

14

15

16

17

18

19

20

21

22

LAPOX Polymers Private Ltd

Atul (Retail) Brands Private Ltd

Atul Ayurveda Ltd

Atul Crop Care Ltd

Atul Entertainment Ltd

Atul Hospitality Ltd

Atul Medical Care Ltd

Jayati Infrastructure Ltd

Osia Dairy Ltd

Enterprises over which significant influence

exercised

112 | 113