Atul Ltd | Annual Report 2010-11

Schedules

forming part of Balance Sheet as at March 31, 2011

(

`

crores)

(

`

crores)

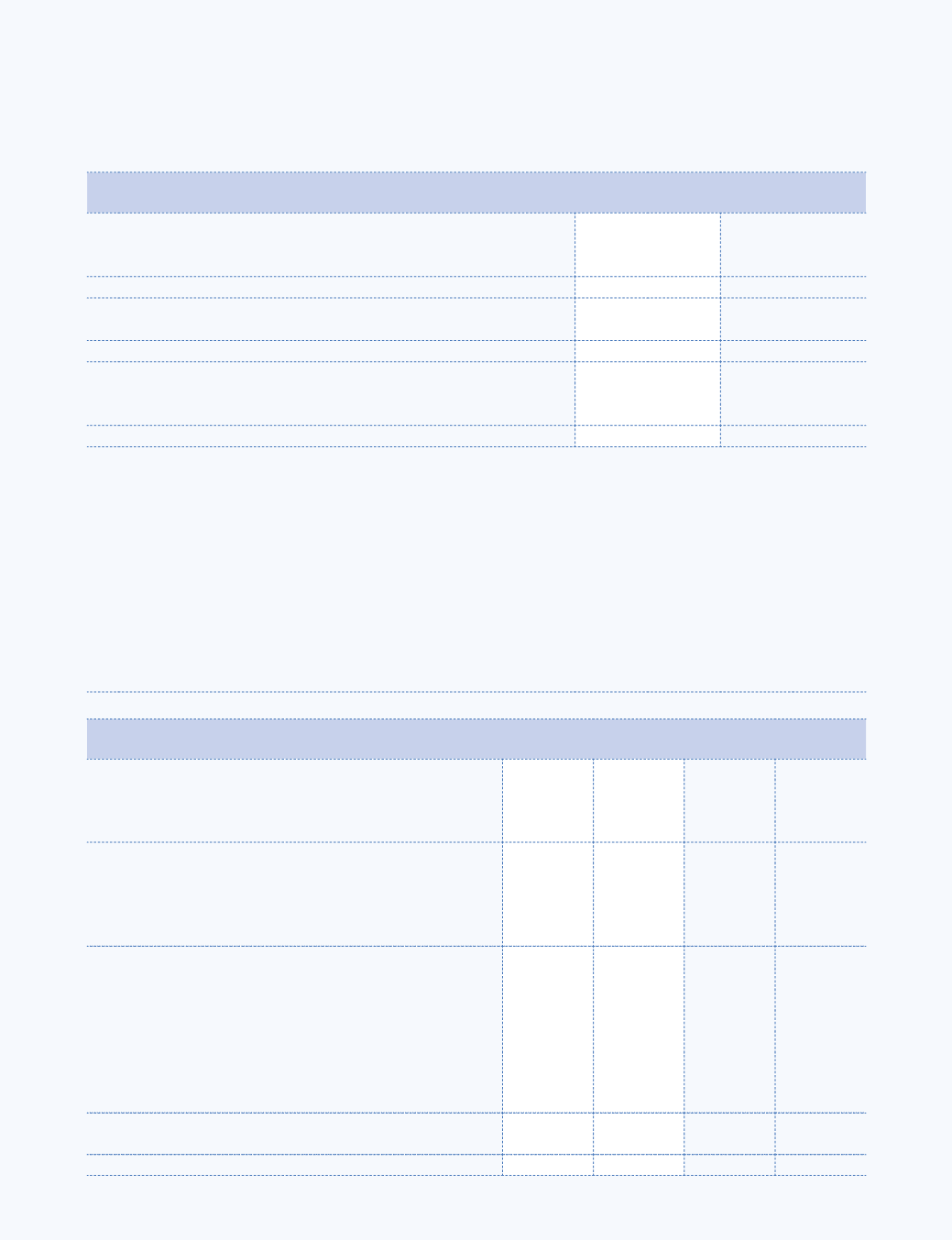

SCHEDULE 1 SHARE CAPITAL

As at

March 31, 2011

As at

March 31, 2010

Authorised

80,00,000 Cumulative Redeemable Preference Shares of

`

100 each

80.00

80.00

8,00,00,000 Equity Shares of

`

10 each

80.00

80.00

160.00

160.00

Issued

2,96,91,780 Equity Shares of

`

10 each

29.69

29.69

29.69

29.69

Subscribed

2,96,61,733 Equity Shares of

`

10 each, fully paid

29.66

29.66

Add: Forfeited shares (amount paid-up)

0.02

0.02

29.68

29.68

Notes:

1. 19,64,650 Equity Shares are issued as fully paid-up Bonus shares by way of capitalisation of reserves.

2. 3,58,600 Equity Shares of

`

10 each issued on account of reduction and consolidation of 35,86,000 Equity

Shares of

`

10 each as confirmed by the Honourable High Court of Gujarat vide its order dated August 20, 1988.

3. 75,00,000 Equity Shares are issued to the Shareholders of erstwhile The Atul Products Ltd, pursuant to

Amalgamation Scheme sanctioned by the Honourable High Court of Gujarat as per its order dated August

20, 1988.

4. 38,09,310 Equity Shares are issued as fully paid-up shares on conversion of 12.5% Fully Convertible Secured

debentures of

`

120 each per debenture in the year 1992-93.

5. 1,10,29,173 Equity Shares are issued as fully paid-up on conversion of 14% Fully Convertible Secured

debentures of

`

180 each per Debenture in the year 1994-95.

6. 50,00,000 Equity Shares issued on preferential basis to Promoters in the year 1993-94.

SCHEDULE 2 RESERVES AND SURPLUS

As at

March 31, 2011

As at

March 31, 2010

Securities premium account

34.66

34.66

Central and state subsidy reserve

As per last account

–

0.98

Less: Transferred to general reserve

–

0.98

–

–

Capital reserve

6.68

6.68

Revaluation reserve

As per last account

110.64

112.70

Less: Transferred to Profit and Loss Account

2.06

2.06

108.58

110.64

Hedging reserve [see Note 16 (c)]

(5.09)

(15.03)

General reserve

As per last account

53.27

46.61

Add: Transferred from central and state subsidy reserve

–

0.98

Add: Transferred from unclaimed amount of fractional

coupons of bonus shares

0.11

–

Add: Set aside this year

5.68

5.68

59.06

53.27

Surplus as per annexed Account

333.52

264.71

537.41

454.93