Atul Ltd | Annual Report 2010-11

Schedules

forming part of the accounts

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(contd)

16 The use of derivative instruments is governed by the policies of the Company approved by the Board of

Directors, which provide written principles on the use of such financial derivatives consistent with the

Company’s risk management strategy.

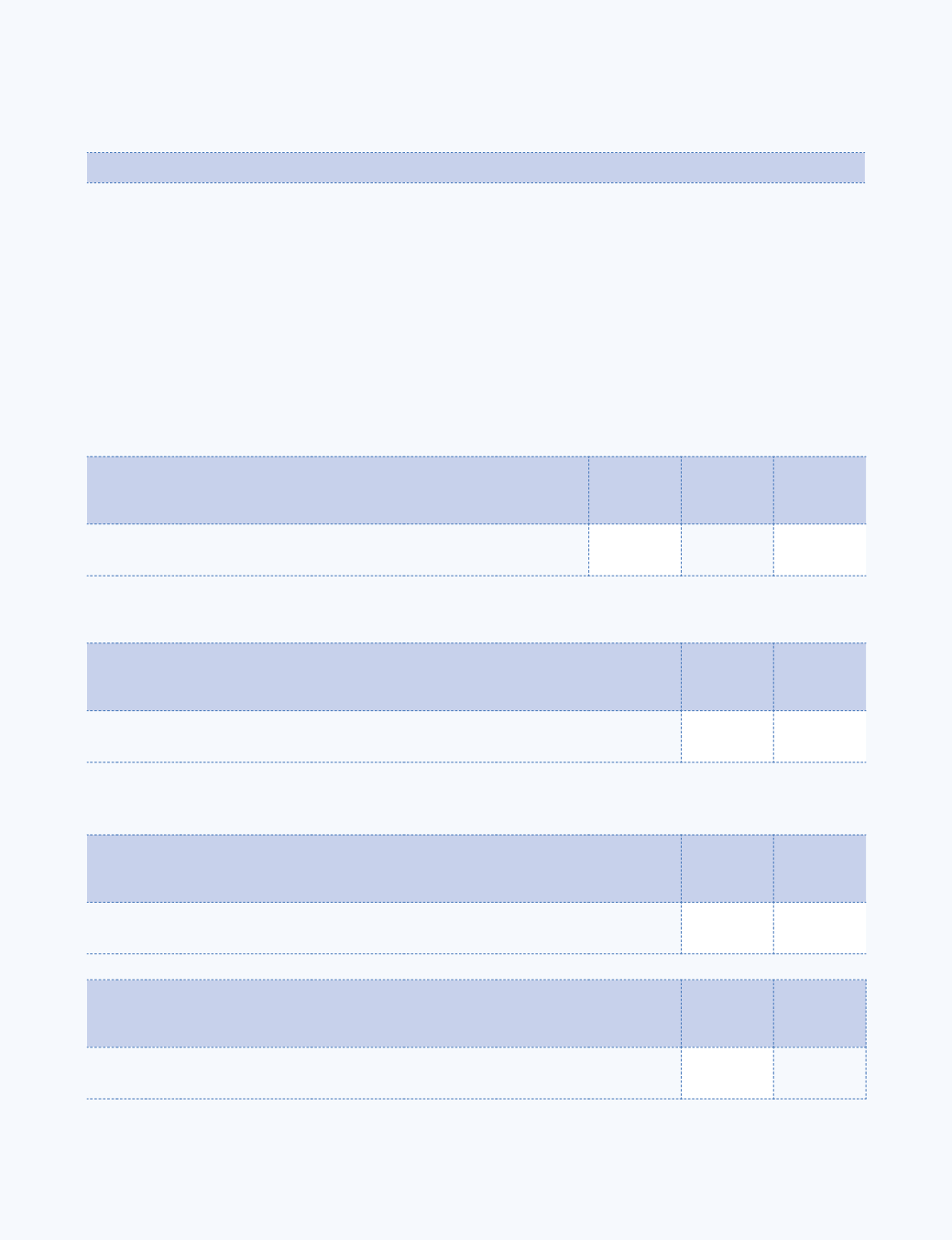

(a) The Company has entered into the following derivatives:

(1) The Company uses foreign currency forward contracts to hedge its risks associated with foreign

currency fluctuations relating to certain firm commitments and highly probable forecast transactions.

The following are the outstanding forward exchange contracts entered into by the Company:

As at

No. of

contracts

Type

US$

equivalent

(crores)

March 31, 2010

3

Buy

0.04

March 31, 2011

-

-

-

(2) The Company has outstanding currency option contracts (hedging instruments) which are bought

by the Company, in addition to forward contracts, to hedge a part of its highly probable forecasted

export transactions.

As at

No. of

contracts

US$

equivalent

(crores)

March 31, 2010

8

3.35

March 31, 2011

7

1.60

(3) The Company also uses derivative contracts other than forward contracts to hedge the interest rate

and currency risk on its capital account.

(i) Interest Rate Swaps to hedge against fluctuations in interest rate changes :

As at

No of

contracts

US$

equivalent

(crores)

March 31, 2010

3

0.28

March 31, 2011

7

1.60

(ii) Currency Swap to hedge against fluctuations in changes in exchange rate and interest Rate

As at

No. of

contracts

US$

equivalent

(crores)

March 31, 2010

2

0.20

March 31, 2011

1

0.06

(b) The year end foreign currency exposures that have not been hedged by a derivative instrument or

otherwise are given below:

15 Provision for contingency represents provision made for irrecoverable loans and advances created by way of

utilisation of capital redemption reserve account totally and security premium account partly in terms of order

dated February 01, 2005 passed by the Honourable High Court of Gujarat. In line with the said order and

settlement arrived with financers this amount has been utilised to write off amount paid on behalf of Gujarat

Synthwood Ltd.