97

Notes

to financial statements

(

`

cr)

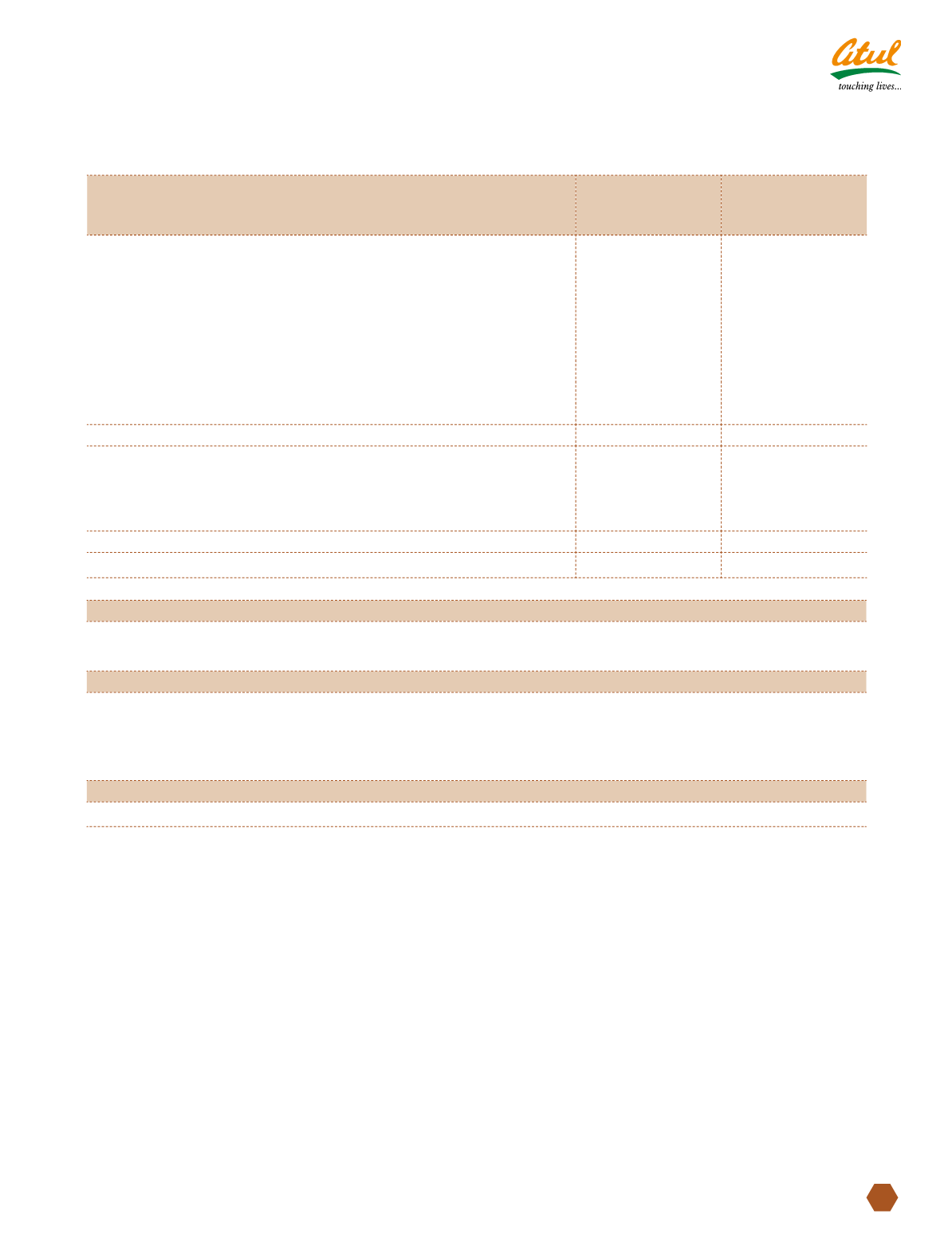

Particulars

For the period

August 18, 2011

to March 31, 2012

As at

March 31, 2011

Expenses

Cost of materials consumed

1.67

-

Purchase of stock-in-trade

-

-

Changes in inventories of finished goods, work-in-progress and

stock-in-trade

0.04

-

Employee benefit expenses

0.17

-

Finance costs

0.04

-

Depreciation and amortisation expenses

0.09

-

Other expenses

0.91

-

2.92

-

Profit Before Tax

(0.10)

-

Tax expense

Current tax

0.02

Deferred tax

0.02

0.04

-

Net loss for the period

(0.14)

-

As per our attached report of even date

For and on behalf of the Board of Directors

For Dalal & Shah

Firm Registration No. 102020W

Sunil S Lalbhai

Chartered Accountants

Chairman & Managing Director

G S Patel

S S Baijal

B S Mehta

H S Shah

S Venkatesh

S M Datta

Partner

R A Shah

Samveg A Lalbhai

Membership No. F-037942

T R Gopi Kannan

V S Rangan

Managing Director

Mumbai

President, Finance &

B N Mohanan

Mumbai

May 15, 2012

Company Secretary

Directors

May 15, 2012

NOTE 27.14 NON-CURRENT INVESTMENTS

In the opinion of the Management, the diminution in the value of any of the investment as shown in Note 12, held

by the Company is temporary in nature and accordingly, no provision is considered necessary by the Management.

NOTE 27.15 REGROUPED | RECAST | RECLASSIFIED

The financial statements for the year ended March 31, 2011 were prepared as per the applicable, pre-revised

Schedule VI to the Companies Act, 1956. Consequent to the notification of Revised Schedule VI under the Companies

Act, 1956, the financial statements for the year ended March 31, 2012 are prepared as per Revised Schedule VI.

Accordingly, previous year figures have also been restated to conform to classification as per current year.

NOTE 27.16 ROUNDING OFF

Figures less than

`

50,000 has been shown at actual in bracket.