Atul Ltd | Annual Report 2012-13

Notes

to Consolidated financial statements

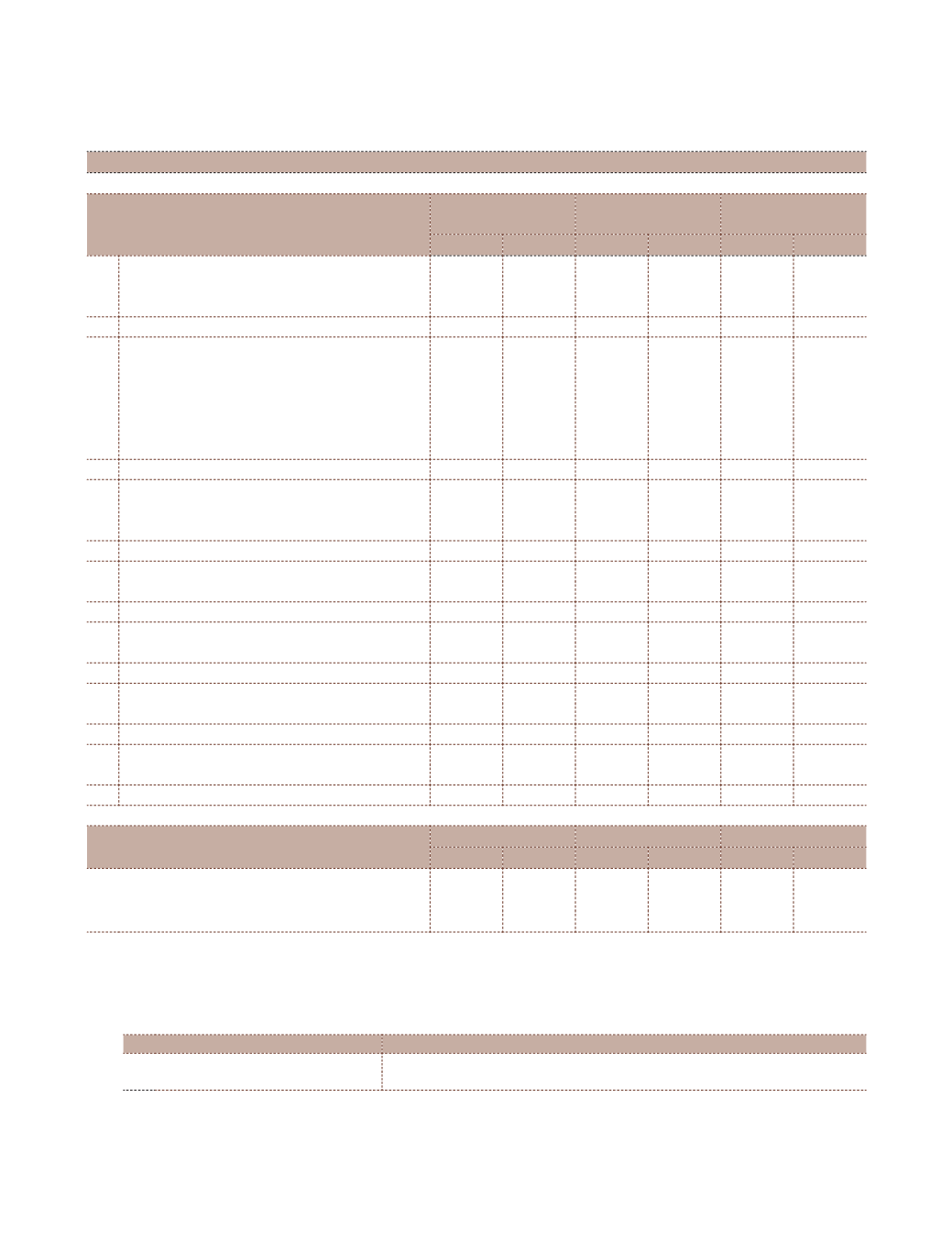

NOTE 27.6 SEGMENT INFORMATION

(a) Primary Segment - Business

(

`

cr)

Particulars

Life Science

Chemicals

Performance &

Other Chemicals

Total

2012-13 2011-12 2012-13 2011-12 2012-13 2011-12

1 Segment revenues

Gross sales

772.22 644.64 1,556.69 1,373.09 2,328.91 2,017.73

Less: Inter segment revenues

-

- 156.83 132.46 156.83 132.46

Net revenues from operations

772.22 644.64 1,399.86 1,240.63 2,172.08 1,885.27

2 Segment results

3URÀW EHIRUH ÀQDQFH FRVW DQG WD[

136.34 102.47

83.32

84.76 219.66 187.23

$GG 5HYHUVDO RI SUHYLRXV \HDU ÀQDQFH FRVWV

5.38

-

Less: Finance costs

34.88

43.31

Less: Other unallocable expenditure

3.79

13.85

(net of unallocable income)

3URÀW EHIRUH WD[

186.37 130.07

3 Other information

Segment assets

400.35 345.42 829.69 783.47 1,230.04 1,128.89

Unallocated common assets

333.74 329.79

Total assets

1,563.78 1,458.68

Segment liabilities

101.28

89.60 257.05 253.14 358.33 342.74

Unallocated common liabilities

75.35

65.04

Total liabilities

433.68 407.78

Capital expenditure

30.80

36.62

81.81

95.28 112.61 131.90

Unallocated capital expenditure

4.74

6.58

Total capital expenditure*

117.35 138.48

Depreciation

14.94

10.29

31.99

29.28

46.93

39.57

Unallocated depreciation

4.47

4.45

Total depreciation

51.40

44.02

6LJQLÀFDQW QRQ FDVK H[SHQVHV

-

-

-

-

-

-

6LJQLÀFDQW XQDOORFDWHG QRQ FDVK H[SHQVHV

-

-

7RWDO VLJQLÀFDQW QRQ FDVK H[SHQVHV

-

-

(b) Secondary Segment - Geographical

(

`

cr)

Particulars

In India

Outside India

Total

2012-13 2011-12 2012-13 2011-12 2012-13 2011-12

Segment revenues

1,149.31 1,064.49 1,022.77 820.78 2,172.08 1,885.27

Carrying cost of assets by location of assets 1,355.62 1,285.64 208.16 173.04 1,563.78 1,458.68

Additions to assets and intangible assets* 115.67 136.09

1.68

2.39 117.35 138.48

Other disclosures:

7KH 6HJPHQWV KDYH EHHQ LGHQWLÀHG LQ OLQH ZLWK WKH $FFRXQWLQJ 6WDQGDUG ¶6HJPHQW 5HSRUWLQJ· WDNLQJ LQWR

account the organisation structure as well as the differing risks and returns.

2 The Company has disclosed business segment as the primary segment.

3 Composition of business segment:

Name of the Segment

Comprises

(a) Life Science Chemicals

API Intermediates, Fungicides, Herbicides, Insecticides,

p

-AA,

p-

AAI, etc

(b) Performance & Other Chemicals Epoxy Resins, Hardeners,

p

-Cresol, Sulphones, Textile dyes, etc

7KH 6HJPHQW UHYHQXH UHVXOWV DVVHWV DQG OLDELOLWLHV LQFOXGH UHVSHFWLYH DPRXQWV LGHQWLÀDEOH WR HDFK VHJPHQW

and amounts allocated on a reasonable basis.

5 The company accounts for inter segments sales and transfers at market price.

* Including capital work-in-progress and capital advances.