Atul Ltd | Annual Report 2012-13

Notes

to financial statements

(

`

cr)

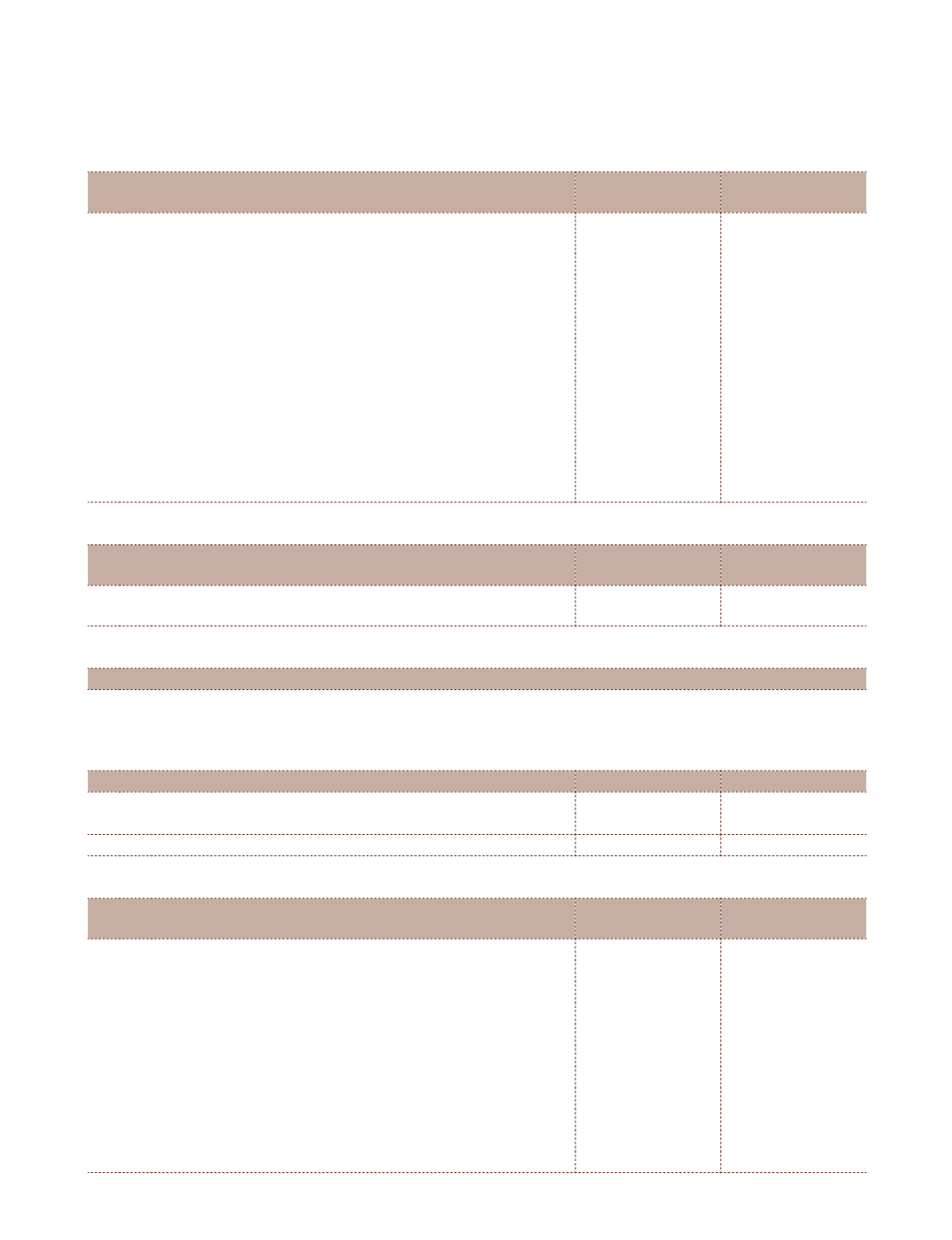

NOTE 27.1 CONTINGENT LIABILITIES

As at

March 31, 2013

As at

March 31, 2012

(i) Claims against the Company not acknowledged as debts

in respects of:

(a) Excise

5.84

6.25

(b) Income tax

35.03

27.70

(c) Sales tax

-

0.74

(d) Customs

2.78

2.78

(e) Water charges

71.92

68.63

(f) Others

13.54

13.26

1RWH )XWXUH FDVK RXWÁRZV LQ UHVSHFW RI D WR I DERYH DUH

determinable on receipt of judgements | decisions pending with

various forums | authorities.

(ii) Guarantees given by the Company :

(a) Corporate guarantee to a bank on behalf of subsidiary

company for facilities availed by them

8.23

1.11

(

`

cr)

NOTE 27.2 COMMITMENTS

As at

March 31, 2013

As at

March 31, 2012

Estimated amount of contracts remaining to be executed on capital

accounts and not provided for (net of advances)

20.56

13.97

NOTE 27.3 RESEARCH AND DEVELOPMENT

Details of expenditure incurred on in-house Research and Development (R&D) facilities approved by Department of

6FLHQWLÀF DQG ,QGXVWULDO 5HVHDUFK 0LQLVWU\ RI 6FLHQFH DQG 7HFKQRORJ\ *RYHUQPHQW RI ,QGLD XQGHU 6HFWLRQ $%

of Income Tax Act, 1961.

(

`

cr)

Particulars

2012-13

2011-12

Capital expenditure

3.80

0.40

Recurring expenditure

12.88

10.48

16.68

10.88

(

`

cr)

NOTE 27.4 CIF VALUEOF IMPORT, EXPENDITURE, REMITTANCES

AND EARNINGS IN FOREIGN CURRENCY

2012-13

2011-12

(a) CIF value of imports:

Raw materials

313.91

309.54

7UDGLQJ ÀQLVKHG JRRGV

10.98

11.03

Capital goods

4.45

5.47

(b) Expenditure in foreign currency:

Commission

4.72

4.24

Other matters

16.67

8.58

(c) Other remittances:

Loan repayments

153.83

210.68

(d) Earnings in foreign currency:

FOB value of exports

952.40

777.55