91

Notes

to financial statements

NOTE 27.9 DERIVATIVES

The use of Derivative instruments is governed by the policies of the Company approved by the Board of Directors,

ZKLFK SURYLGH ZULWWHQ SULQFLSOHV RQ WKH XVH RI VXFK ÀQDQFLDO GHULYDWLYHV FRQVLVWHQW ZLWK ULVN PDQDJHPHQW VWUDWHJ\

of the Company.

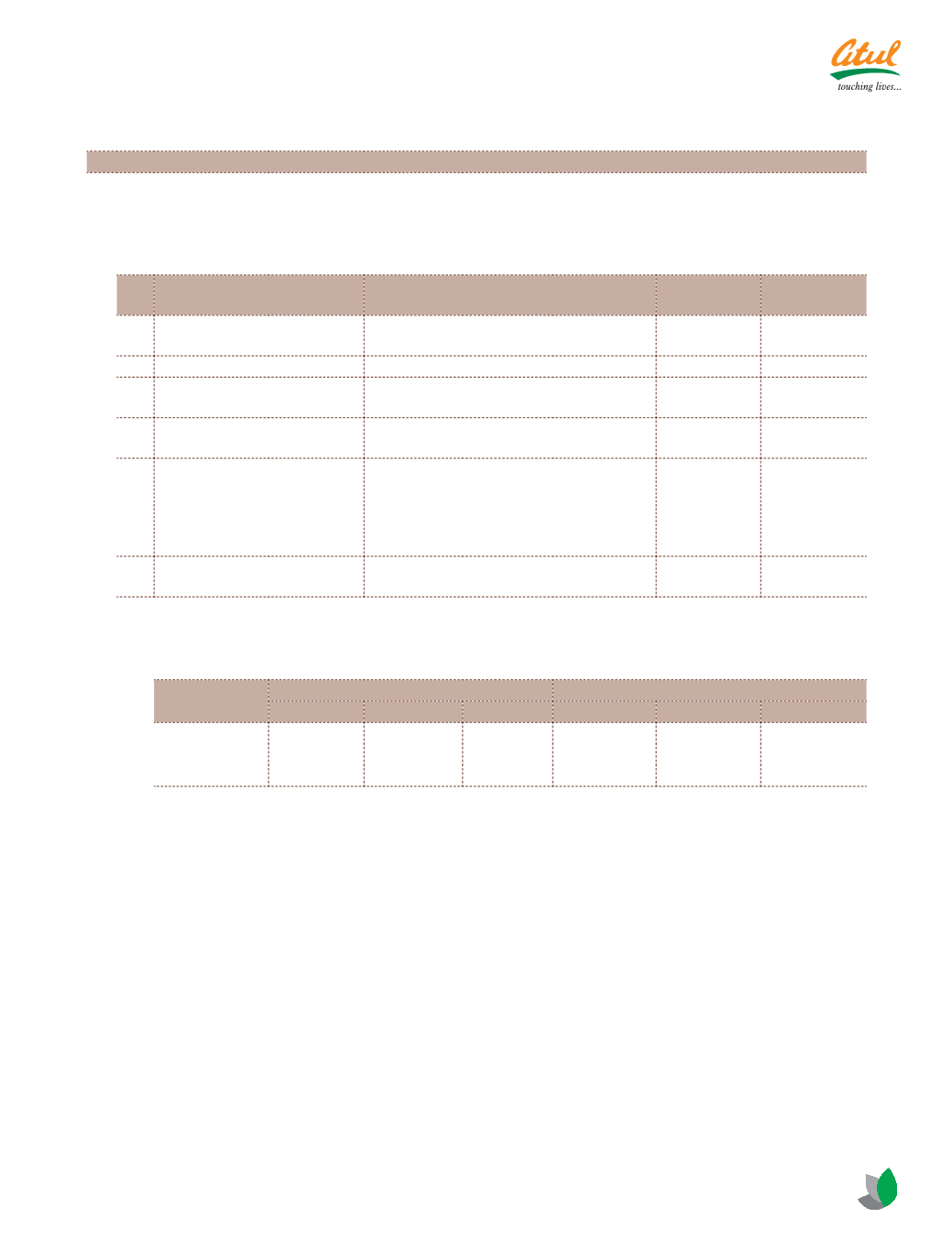

(a) Derivatives outstanding as at Balance Sheet date

*Fc in cr

Sr

No

Particulars

Purpose

As at March

31, 2013

As at March

31, 2012

1 Forward Contracts to Sell US$ +HGJH RI ÀUP FRPPLWPHQW DQG KLJKO\

probable foreign currency sales

0.12

0.07

2 Forward Contracts to Buy US$ Hedge of foreign currency loans

0.17

0.11

3 Currency Options contracts

-Range options to Sell US$

+HGJH RI ÀUP FRPPLWPHQW DQG KLJKO\

probable foreign currency sales

0.23

1.62

4 Currency Options contracts

-Vanilla option to Sell US$

+HGJH RI ÀUP FRPPLWPHQW DQG KLJKO\

probable foreign currency sales

0.22

0.55

5 Interest Rate Swaps US$ Hedge against exposure to variable

LQWHUHVW RXWÁRZ RQ IRUHLJQ FXUUHQF\

ORDQV 6ZDS WR SD\ À[HG LQWHUHVW DQG

receive a variable interest based on LIBOR

on the notional amount

0.61

0.75

6 Currency swaps US$

+HGJH DJDLQVW ÁXFWXDWLRQV LQ FKDQJHV LQ

exchange rate and interest rate

1.00

-

(b) The year end foreign currency exposures that have not been hedged by a derivative instrument or

otherwise are given below.

*Fc in cr

Particulars

As at March 31, 2013

As at March 31, 2012

US$

€

Other FCs

US$

€

Other FCs

Debtors

3.11

0.27

0.92

1.21

0.39

-

Creditors

0.56

0.03

0.36

0.57

0.01

-

Loans Taken

1.61

-

-

2.78

-

-

(c)

Financial Derivatives Hedging Transactions:

Pursuant to the announcement issued by The Institute of Chartered Accountants of India dated March

29, 2008 in respect of derivatives, the Company has applied the Hedge Accounting Principles set out

in the Accounting Standard-30 ‘Financial Instruments : Recognition and Measurement’. Accordingly,

Derivatives are Mark-to-Market and the gain aggregating

`

0.74 cr (Previous year loss

`

0.78 cr) arising

FRQVHTXHQWO\ RQ FRQWUDFWV WKDW ZHUH GHVLJQDWHG DQG HIIHFWLYH DV KHGJHV RI IXWXUH FDVK ÁRZV KDV EHHQ

recognized directly in the Hedging Reserve Account. Actual gain or loss on exercise of these Derivatives or

DQ\ SDUW WKHUHRI LV UHFRJQLVHG LQ WKH 6WDWHPHQW RI 3URÀW DQG /RVV +HGJH DFFRXQWLQJ ZLOO EH GLVFRQWLQXHG

LI WKH KHGJLQJ LQVWUXPHQW LV VROG WHUPLQDWHG RU QR ORQJHU TXDOLÀHV IRU KHGJH DFFRXQWLQJ

*Fc = Foreign currency