121

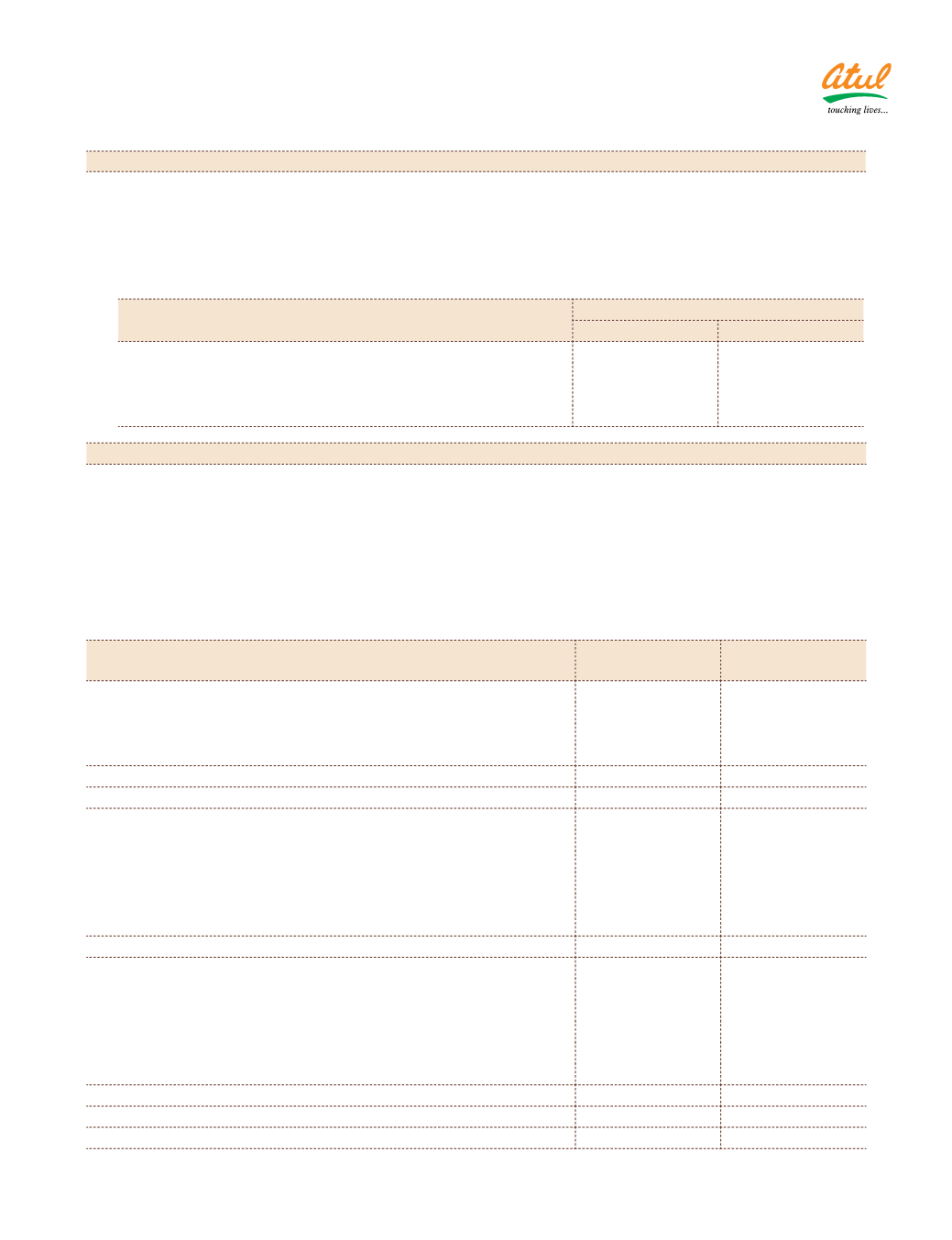

NOTE 28.11 EMPLOYEE BENEFITS

(continued)

d)

The estimates of future salary increases, considered in actuarial valuation, take account of inflation, seniority,

promotion and other relevant factors, such as supply and demand in the employment market. Mortality rates

are obtained from the relevant data.

Unfunded Schemes

(

`

cr)

Particulars

Compensated absences

March 31, 2015 March 31, 2014

1 Present value of unfunded obligations

–

21.24

2 Expense recognised in the Statement of Profit and Loss

3.23

3.23

3 Discount rate (per annum)

7.80%

9.29%

4 Salary escalation rate (per annum)

7.00%

7.00%

NOTE 28.12 INTEREST IN JOINT VENTURE COMPANY

The Company acquired 50% interest in Rudolf Kiri Chemicals Pvt Ltd, now called Rudolf Atul Chemicals Ltd (RACL),

a joint venture company in India between IB Industriechemie Beteiligungs GmbH, Germany and Atul Ltd on

August 18, 2011. RACL is engaged in the business of manufacturing and marketing textile chemicals. As per the

contractual arrangement between the Shareholders of RACL, both the companies have significant participating

rights such that they jointly control the operations of the joint venture company. The aggregate amount of assets,

liabilities, income and expenses related to the share of the Company in RACL as at and for the year ended March

31, 2015 as per the audited Financial Statements are given below:

Balance Sheet

as at March 31, 2015

(

`

cr)

Particulars

As at

March 31, 2015

As at

March 31, 2014

Current liabilities

Trade payables

3.41

2.44

Other current liabilities

0.43

0.38

Short-term provisions

0.73

0.52

4.57

3.34

Total (A)

4.57

3.34

Non-current assets

Tangible assets, net

0.27

0.25

Intangible assets, net

0.01

0.36

Capital work-in-progress

0.11

–

Deferred tax assets (net) (Previous year:

`

3,654)

0.08

Long-term loans and advances

1.41

1.42

1.88

2.03

Current assets

Inventories

2.79

2.05

Trade receivables

5.35

3.95

Cash and cash equivalents

3.77

2.51

Short-term loans and advances

0.14

0.12

Other current assets

0.61

0.59

12.66

9.22

Total (B)

14.54

11.25

Net worth (B-A)

9.97

7.91

Notes

to the Financial Statements