Atul Ltd | Annual Report 2015-16

(

`

cr)

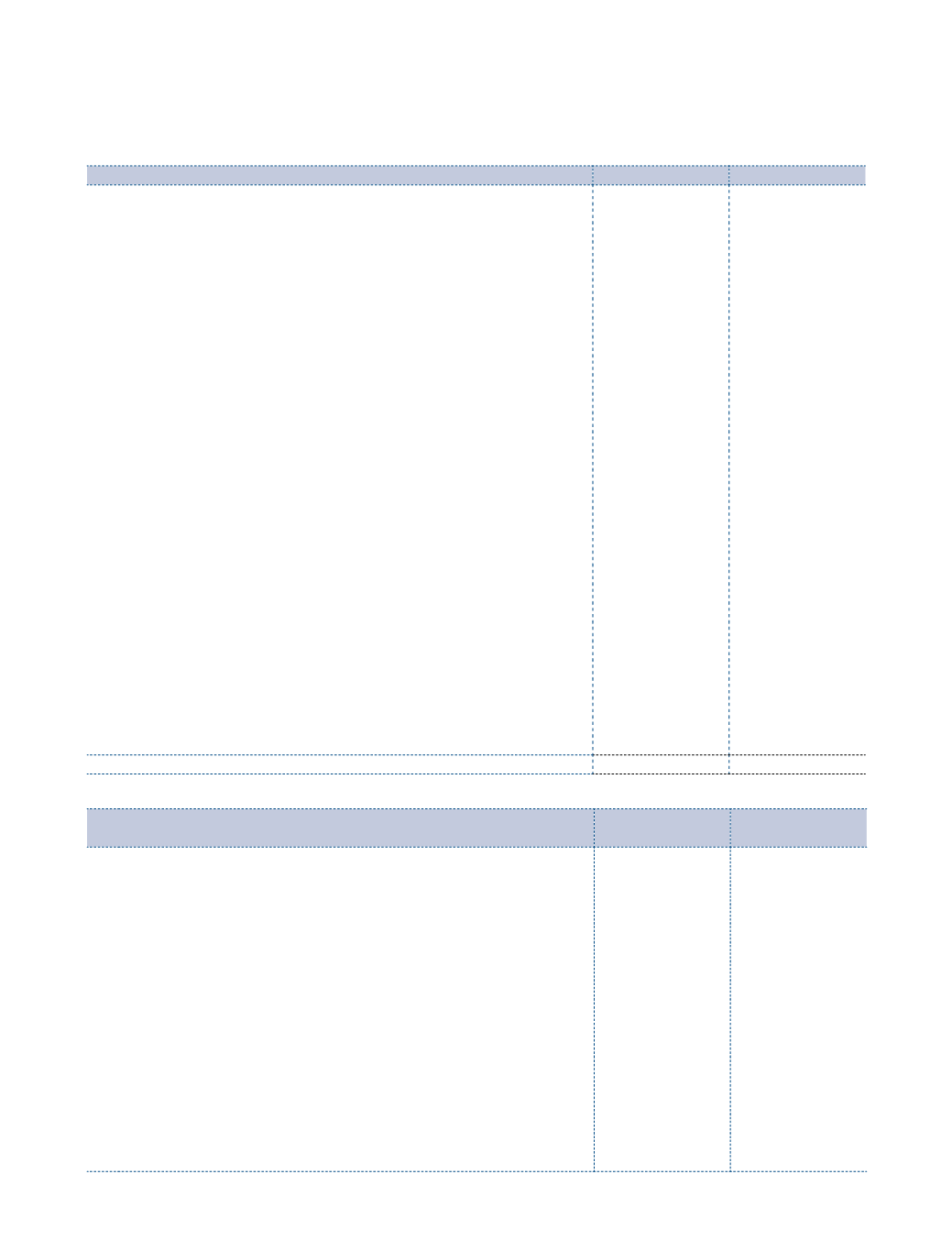

Note 27 Other expenses

2015-16

2014-15

Consumption of stores and spares

38.99

39.78

Power, fuel and water

267.09

298.21

Conversion and plant operation charges

30.76

28.48

Building repairs

19.71

17.37

Plant and equipment repairs

59.31

58.04

Sundry repairs

7.33

6.86

Rent

2.80

2.29

Rates and taxes

1.45

1.54

Insurance

7.00

5.58

Freight, cartage and octroi

61.99

70.81

Discount and commission

18.17

19.22

Travelling and conveyance

15.98

14.16

Payments to the Statutory Auditors

a) Audit fees

0.80

0.79

b) Other matters

0.20

0.11

c) Out of pocket expenses

0.01

0.02

Payments to the Cost Auditors

a) Audit fees

0.02

0.02

b) Out of pocket expenses (Current year:

`

21,315 and Previous

year:

`

11,859)

Directors' fees and travelling

1.38

1.45

Directors' commission (other than the Executive Directors)

0.92

0.66

Manpower services

33.43

26.58

Goodwill on consolidation written off

1.89

–

Bad debts and irrecoverable balances written off

1.55

1.78

Exchange difference on translation of foreign subsidiary companies

(7.86)

(9.91)

Provision for doubtful debts

1.48

0.98

Loss on assets sold, discarded or demolished

1.11

0.87

Corporate Social Responsibility

5.45

3.95

Miscellaneous expenses

57.37

56.76

628.33

646.40

(

`

cr)

Note 28.1 Contingent liabilities

As at

March 31, 2016

As at

March 31, 2015

i) Claims against the Company not acknowledged as debts in

respects of:

a) Excise

7.70

7.25

b) Income tax

7.93

8.33

c) Sales tax

0.67

0.67

d) Customs

0.18

0.18

e) Water charges

89.65

79.84

f) Others

14.42

14.93

g) In respect of a customer claim amounting to

`

32.35 cr, the

Company, based on a legal opinion, believes that the claim will

not sustain.

Note: Future cash outflows in respect of (a) to (g) above are

determinable on receipt of judgements | decisions pending with

various forums | authorities.

ii) Guarantees given by the Company:

Corporate guarantee to a bank on behalf of a subsidiary company for

facilities availed by it.

–

9.25

Notes

to the Consolidated Financial Statements