159

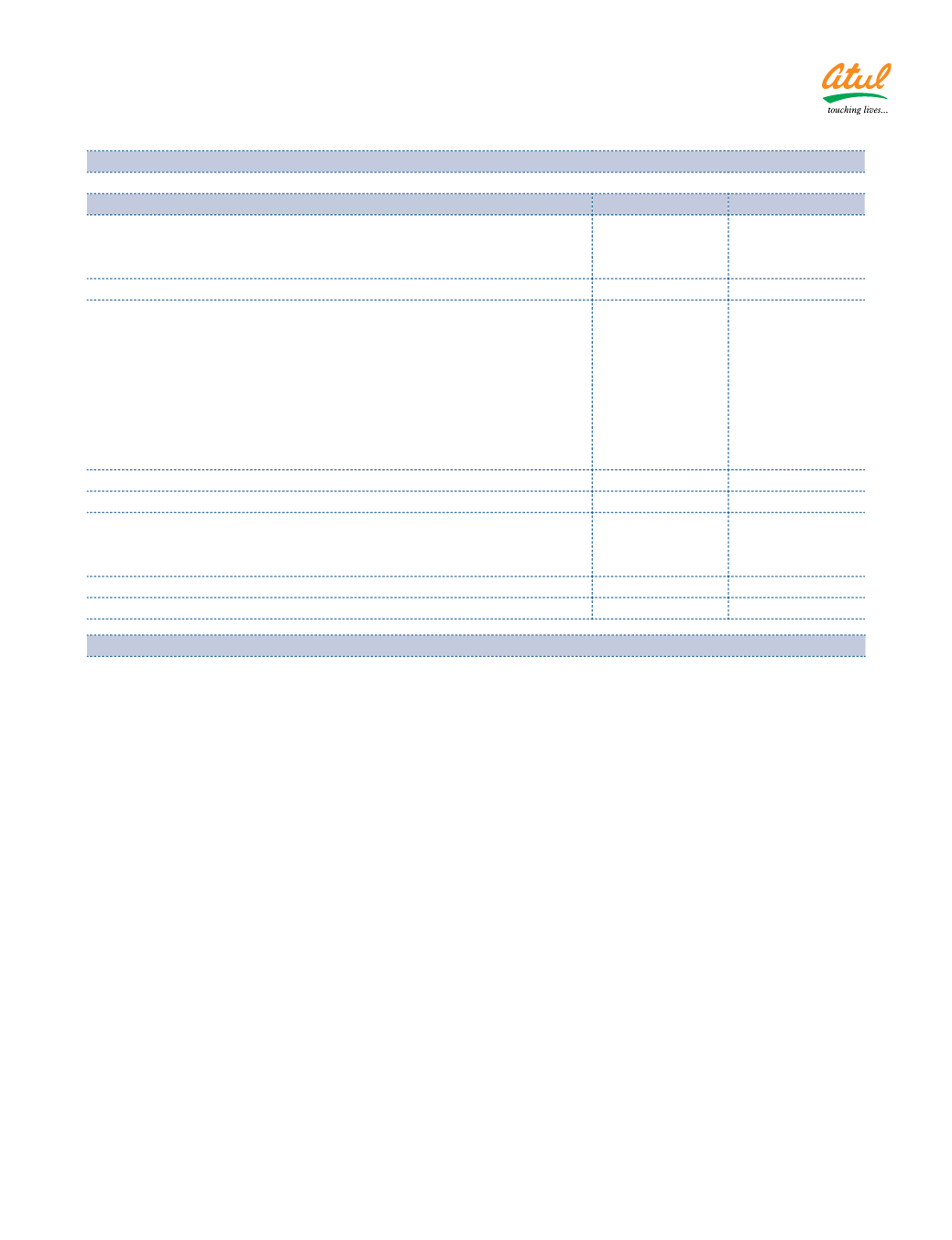

Note 28.9 Interest in joint venture company

(continued)

Statement of Profit and Loss

for the year ended March 31, 2016

(

`

cr)

Particulars

2015-16

2014-15

Revenue

Revenue from operations

30.74

22.03

Other income

0.44

0.75

31.18

22.78

Expenses

Cost of materials consumed

17.71

12.89

Purchase of stock-in-trade

1.43

1.60

Changes in inventories of finished goods, work-in-progress and

stock-in-trade

(0.41)

0.08

Finance costs

0.01

0.01

Depreciation and amortisation expenses

0.06

0.40

Other expenses

5.42

3.74

24.22

18.72

Profit before tax

6.96

4.06

Tax expense

Current tax

2.37

1.40

Deferred tax

0.04

(0.08)

2.41

1.32

Net profit | (loss)

4.55

2.74

Note 28.10 Amalgamation of Amal Ltd

The Board of Directors (Board) approved the Scheme of Amalgamation of Amal Ltd with the Company (Scheme)

on December 05, 2014. The Board has approved a share swap ratio of 1 Equity share of the face value of

`

10

each fully paid up of Atul Ltd for every 50 Equity shares of the face value of

`

10 each fully paid up of Amal Ltd.

In terms of the Scheme, the appointed date is April 01, 2014. The Scheme of Amalgamation has been awaiting

approval from Board for Industrial and Financial Reconstruction. Pending all other statutory approvals, no effect

to the above Scheme has been given in the Financial Statements. The impact of the Scheme on the Financial

Statement is not expected to be material.

Notes

to the Consolidated Financial Statements