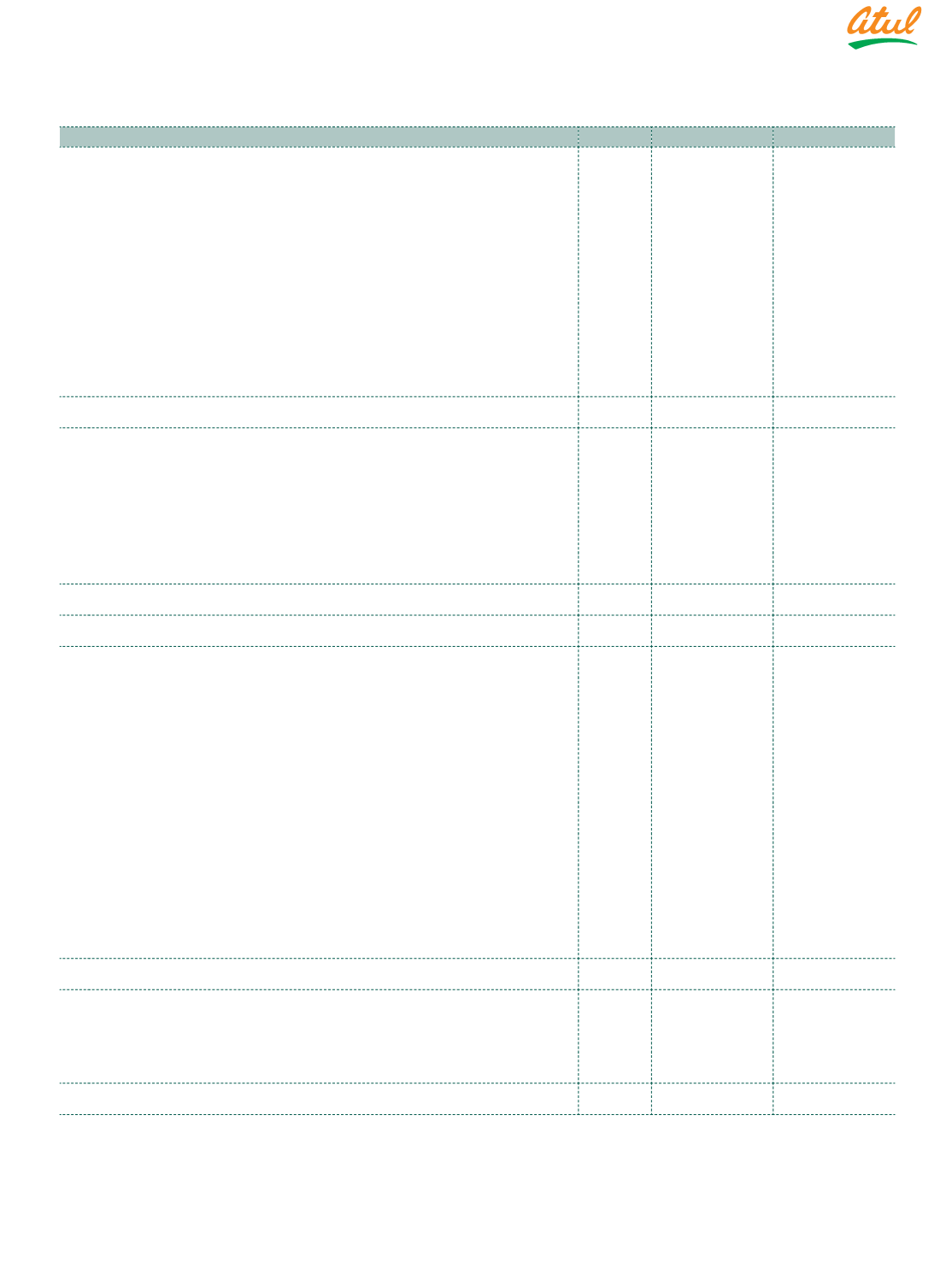

101

Statement of Cash Flows

for the year ended March 31, 2018

(

`

cr)

Particulars

Note

2017-18

2016-17

A Cash flow from operating activities

Profit before tax

397.25

400.52

Adjustments for:

Add:

Depreciation and amortisation expenses

2, 4

104.78

91.12

Finance costs

25

8.89

21.02

Loss on disposal of property, plant and equipment

26

0.12

0.20

Unrealised exchange rate difference (net)

(7.68)

0.95

106.11

113.29

503.36

513.81

Less:

Dividends received

21

21.16

22.27

Interest income from financial assets measured at amortised cost

2.29

2.87

Gain on disposal of property, plant and equipment

21

0.30

3.71

23.75

28.85

Operating profit before change in operating assets and liabilities

479.61

484.96

Adjustments for:

(Increase) | Decrease in inventories

9

(11.06)

6.28

(Increase) | Decrease in trade receivables

(202.94)

(87.91)

(Increase) | Decrease in other financial assets

(2.72)

4.10

(Increase) | Decrease in other assets

10.56

20.38

Increase | (Decrease) in trade payables

141.39

34.80

Increase | (Decrease) in other financial liabilities

10.95

(13.42)

Increase | (Decrease) in other current liabilities

(1.54)

(7.23)

Increase | (Decrease) in current provisions

0.75

0.62

Increase | (Decrease) in non-current provisions

(2.33)

2.81

(56.94)

(39.57)

Cash generated from operations

422.67

445.39

Less:

Income tax paid (net of refund)

97.53

75.42

Net cash flow from operating activities

A

325.14

369.97