Atul Ltd | Annual Report 2017-18

(

`

cr)

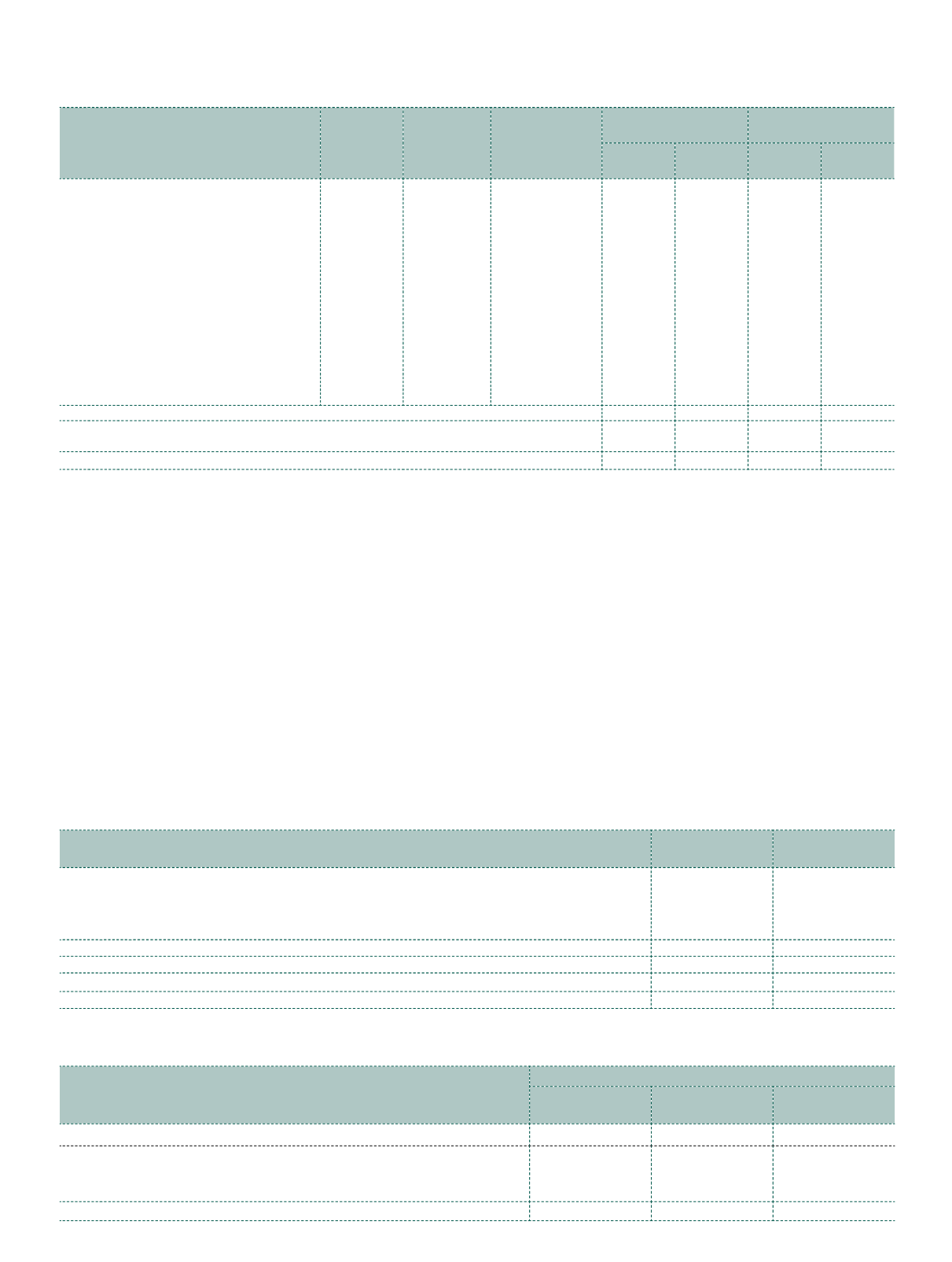

Note 15 Borrowings

Maturity Terms of

repayment

Effective

interest

rate p.a.

As at

March 31, 2018

As at

March 31, 2017

Current

Non-

current

Current

Non-

current

a) Secured

i)

Rupee term loan from a foreign

financial institution (refer Note a)

January,

2018

15 equal

half yearly

installments

6.99% – 7.46%

–

–

–

10.42

ii) Foreign currency term loans from

banks (refer Note b and c)

September,

2017

12 equal

quarterly

installments

3 months LIBOR

+ 2.90%

–

–

–

10.81

iii) Working capital loans from

banks (refer Note d)

1-6 months Repayable

on demand

2.43% – 10.40%

–

–

8.17

–

b) Unsecured

i)

Loan from banks including

foreign banks

1-6 months 1-6 months 1.10%

–

–

51.87

–

ii) Commercial papers

1-3 months 1-3 months 6.50%

–

–

73.95

–

iii) Deposit from the Directors

1-12 months 1-12 months 6.50%

1

0.01

–

0.01

–

0.01

–

134.00

21.23

Amount of current maturities of long-term debt disclosed under the head 'Other

financial liabilities' (refer Note 16)

–

–

– (21.23)

0.01

– 134.00

–

1

9.00% p.a. during the previous year

.

a) Rupee term loan from a foreign financial institution was secured by first

pari passu

charge by way of hypothecation of

all movable property, plant and equipment and mortgage of immovable properties of the Company, present and future,

excluding specific assets with first

pari passu

charge with other lenders and second charge on entire current assets of the

Company, both present and future.

b) Foreign currency term loan from a foreign bank was secured by first

pari passu

charge by way of hypothecation of all

movable property, plant and equipment and mortgage of immovable properties of the Company, present and future,

excluding specific assets with first

pari passu

charge and second charge on entire current assets of the Company, both

present and future.

c) Foreign currency term loan from a bank was secured by first

pari passu

charge on the entire movable and immovable

property, plant and equipment of the Company, both present and future.

d) Security details:

Working capital loans repayable on demand from banks is secured by hypothecation of tangible current assets, namely,

inventories and book debts of the Company as a whole and also secured by second and subservient charge on immovable

and movable assets of the Company to the extent of individual bank limit as mentioned in joint consortium documents.

This also extends to guarantees and letters of credit given by the bankers aggregating to

`

88.30 cr (March 31, 2017:

`

83.24 cr).

e) The carrying amount of assets hypothecated | mortgaged as security for current and non-current borrowings is:

(

`

cr)

Particulars

As at

March 31, 2018

As at

March 31, 2017

First charge for current and second charge for non-current borrowings

i)

Inventories

378.95

367.89

ii) Trade receivables

717.68

507.06

iii) Current assets other than inventories and trade receivables

181.79

153.83

1,278.42

1,028.78

First charge for non-current and second charge for current borrowings

Property, plant and equipment excluding leasehold land

900.21

908.98

Total assets as security

2,178.63

1,937.76

f)

Net debt reconciliation:

(

`

cr)

Particulars

Liabilities from financing activities

Current

borrowings

Non-current

borrowings

Total

Net debt as at March 31, 2017

155.23

–

155.23

Repayments

(155.22)

–

(155.22)

Interest expense

6.38

–

6.38

Interest paid

(6.38)

–

(6.38)

Net debt as at March 31, 2018

0.01

–

0.01

Notes

to the Financial Statements