(

`

cr)

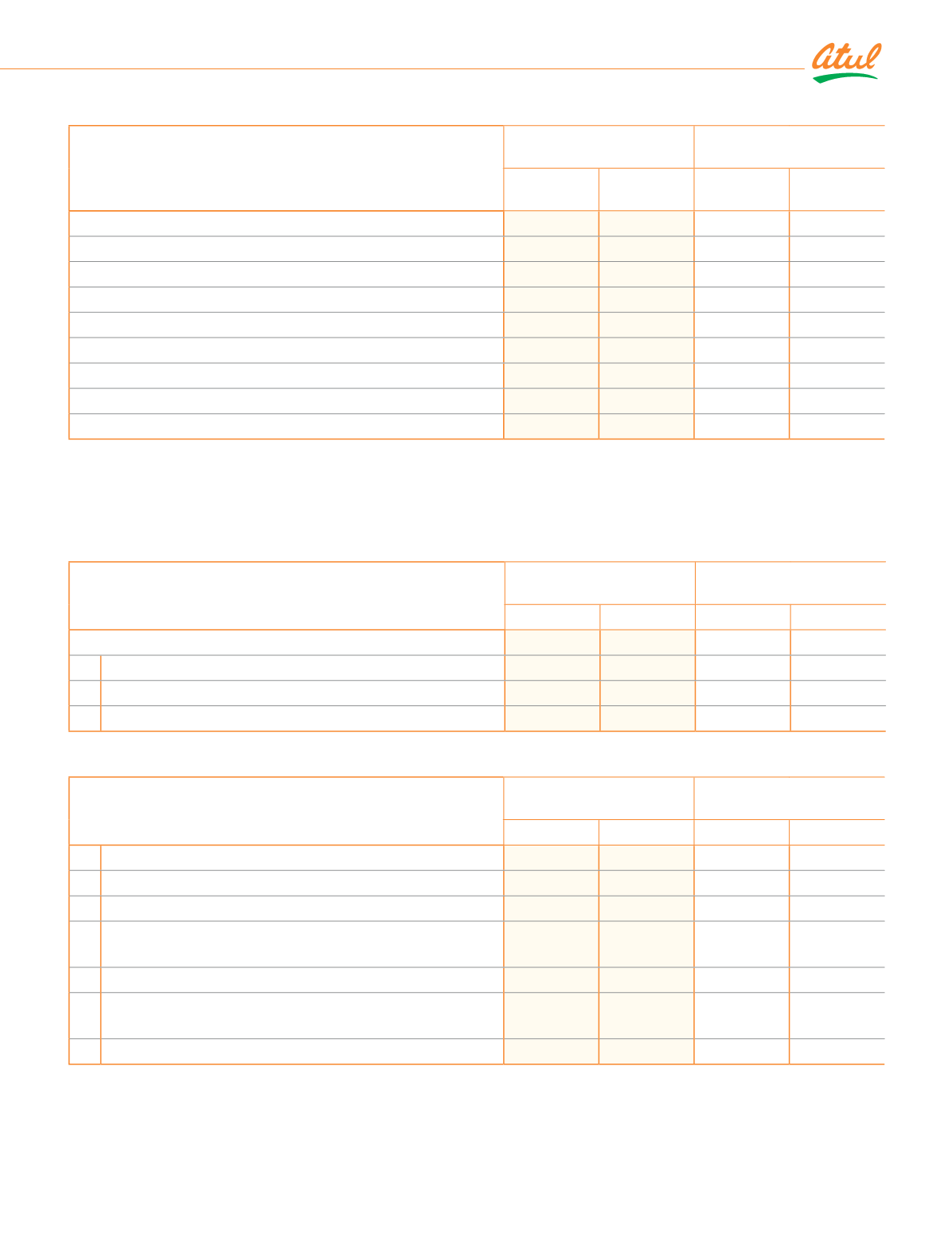

Note 5.3 Current investment

As at

March 31, 2019

As at

March 31, 2018

Number of

units

Number of

units

Investment in mutual funds measured at FVPL

Unquoted

Investment in mutual funds

ǯȡǨǪȡǩǩȡǧǧǯ

ǧǯǭȦǬǪ

-

-

197.64

-

926.32

594.81

Aggregate amount of quoted investments

1

ǫǪǩȦǪǮ

ǪǬǯȦǬǯ

Aggregate market value of quoted investments

529.71

ǪǫǬȦǬǯ

Aggregate amount of unquoted investments

ǩǮǨȦǮǪ

125.12

Aggregate amount of impairment in value of investments

-

-

¹Book value includes equity component of

`

18.12 cr (March 31, 2018:

`

18.12 cr) recognised on 0% preference shares and

loans given to Amal Ltd carried at amortised cost |

2

Conversion option exercised and allotment of resultant shares in process |

3

Received in terms of demerger scheme |

Ǫ

Shares with differential voting rights (DVR) carrying value of

`

8,520 (March 31,

2018:

`

12,700) |

5

ÀŠēĚƑ ŕĿƐƭĿēîƥĿūŠ

(

`

cr)

Note 6 Loans

As at

March 31, 2019

As at

March 31, 2018

Current

Non-current

Current

Non-current

gūîŠƙ ƥū ƙƭċƙĿēĿîƑNj ČūŞƎîŠĿĚƙ ȳƑĚljĚƑ sūƥĚ ǨǮȦǪ îŠē ǨǮȦǧǩȴ

i)

Considered good - secured

ǪȦǫǮ

-

1.70

5.03

ii) Considered good - unsecured

ǦȦǩǪ

-

ǦȦǩǪ

-

4.92

-

2.04

5.03

(

`

cr)

sūƥĚ ǭ ~ƥĺĚƑ ǛŠîŠČĿîŕ îƙƙĚƥƙ

As at

March 31, 2019

As at

March 31, 2018

Current

Non-current

Current

Non-current

a) Security deposits for utilities and premises

0.87

0.89

0.37

0.73

b)

'ĚƑĿDŽîƥĿDŽĚ ǛŠîŠČĿîŕ îƙƙĚƥƙ ēĚƙĿijŠîƥĚē îƙ ĺĚēijĚƙ ȳŠĚƥȴ

1.22

-

0.05

-

c) Finance lease receivable

-

1.33

-

1.25

d)

îŕîŠČĚ DžĿƥĺ ċƙ ĿŠ ǛNJĚē ēĚƎūƙĿƥƙȡ DžĿƥĺ ŞîƥƭƑĿƥNj ċĚNjūŠē

12 months

-

-

-

0.50

e) Dividends receivable

0.18

-

17.38

-

f)

Other receivables (including discount receivable, insurance

receivable, etc)

15.18

-

ǧǪȦǧǪ

-

17.45

2.22

31.94

2.48

137

Standalone

|

Notes to the Financial Statements