The goodwill of

`

23.75 cr pertains to the control acquisition of Amal Ltd. The recoverable amount of the cash generating unit

has been determined based on the higher of fair value less costs of disposal and its value in use. The fair value less costs of

disposal has been determined based on closing quoted share price of Amal Ltd on an active market as on March 31, 2019.

During the year a subsidiary company acquired Active Pharma ingredients business of Polydrug Laboratories Pvt Ltd the

ĚNJČĚƙƙ ūlj ČūŠƙĿēĚƑîƥĿūŠ ƎîĿē ūDŽĚƑ ƥĺĚ ŠĚƥ îƙƙĚƥƙ îČƐƭĿƑĚē Džîƙ

`

8.56 cr and recognised as goodwill.

The Group has carried out impairment assessment as at March 31, 2019 for its all intangible assets. The Management believes

ƥĺîƥ îŠNj ƑĚîƙūŠîċŕNj ƎūƙƙĿċŕĚ ČĺîŠijĚ ĿŠ ƥĺĚ ŒĚNj îƙƙƭŞƎƥĿūŠƙ ŞîNj Šūƥ ČîƭƙĚ ƥĺĚ ČîƑƑNjĿŠij îŞūƭŠƥ ƥū ĚNJČĚĚē ƥĺĚ ƑĚČūDŽĚƑîċŕĚ

amount of the cash generating units. Accordingly, there was no impairment recorded during the year.

Note 5 Biological assets

a) Biological assets of the Group consists:

Ŀȴ

TŞŞîƥƭƑĚ ƥĿƙƙƭĚ ČƭŕƥƭƑĚ ƑîĿƙĚē ēîƥĚ ƎîŕŞƙ ƥĺîƥ îƑĚ ČŕîƙƙĿǛĚē îƙ ŠūŠȹČƭƑƑĚŠƥ ċĿūŕūijĿČîŕ îƙƙĚƥƙȦ ¹ĺĚ HƑūƭƎ ĺîƙ î

ƎƑūēƭČƥĿūŠ ČNjČŕĚ ūlj îċūƭƥ ljūƭƑȹǛDŽĚ NjĚîƑƙ

ĿĿȴ qîƥƭƑĚ ƥĿƙƙƭĚ ČƭŕƥƭƑĚ ƑîĿƙĚē ēîƥĚ ƎîŕŞƙ ƥĺîƥ îƑĚ ČŕîƙƙĿǛĚē îƙ ČƭƑƑĚŠƥ ċĿūŕūijĿČîŕ îƙƙĚƥƙȦ

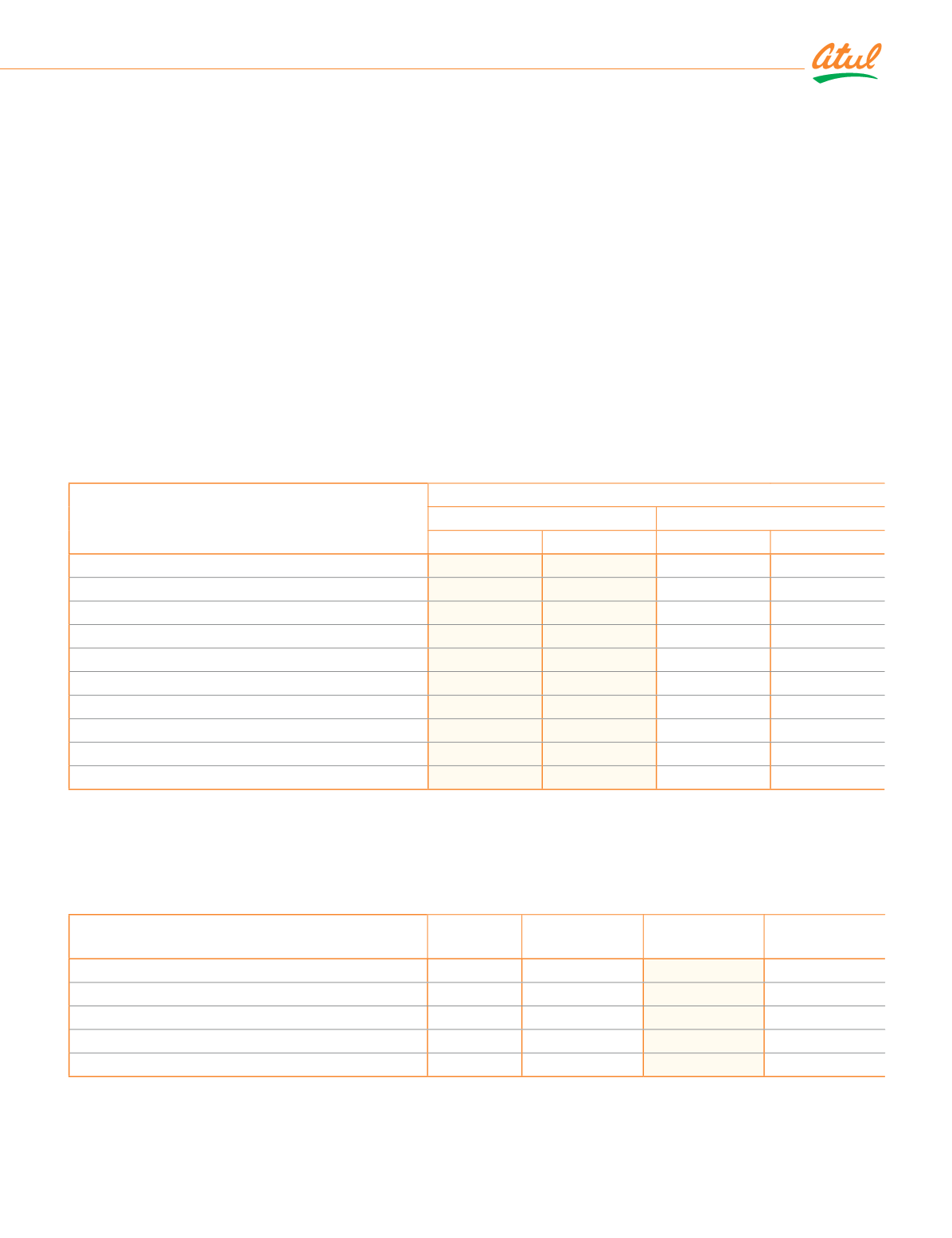

b) Reconciliation of changes to the carrying value of biological assets between the beginning and the end of the current year

are as follows:

(

`

cr)

Particulars

Tissue culture raised date palms

March 31, 2019

March 31, 2018

Mature

Immature

Mature

Immature

Opening balance

11.20

11.50

11.77

9.32

Increase due to production

0.17

11.70

0.18

9.86

Change due to biological transformation

10.05

(10.05)

7.68

(7.68)

Decrease due to sale

ȳǧǩȦǪǨȴ

-

ȳǯȦǦǪȴ

-

Decrease due to write-off

(0.13)

-

(0.05)

-

Change in fair value due to price changes

1.16

-

0.66

-

Closing balance

9.03

13.15

11.20

11.50

Current assets

9.03

-

11.20

-

Non-current assets*

-

13.15

-

11.50

Biological assets shown in Balance Sheet

9.03

13.15

11.20

11.50

ȜsūŠȹČƭƑƑĚŠƥ ċĿūŕūijĿČîŕ îƙƙĚƥ Ŀƙ ĚNJƎĚČƥĚē ƥū ƥîŒĚ ŞūƑĚ ƥĺîŠ ǧǨ ŞūŠƥĺƙ ljƑūŞ ƑĚƎūƑƥĿŠij ēîƥĚ ƥū ċĚČūŞĚ ƑĚîēNj ljūƑ ēĿƙƎîƥČĺȦ

ƙ îƥ qîƑČĺ ǩǧȡ ǨǦǧǯ ƥĺĚ HƑūƭƎ ĺîē ǧǪȡǩǮǦ ŞîƥƭƑĚ ƎŕîŠƥƙ ȳqîƑČĺ ǩǧȡ ǨǦǧǮȠ ǭȡǯǩǪȴ îŠē ǩȡǪǨȡǭǧǬ ĿŞŞîƥƭƑĚ ƎŕîŠƥƙ ȳqîƑČĺ ǩǧȡ

ǨǦǧǮȠ ǪȡǧǪȡǪǩǬȴȦ

During current year the Group has sold 1,52,898 plants (March 31, 2018: 1,6

ǭȡǩǪǩȴȦ

(

`

cr)

Note 6.1 Investments accounted for using the

equity method

Place of

business

% of ownership

interest

As at

March 31, 2019

As at

March 31, 2018

Investment in equity instruments (fully paid-up)

ÀŠƐƭūƥĚē ĿŠDŽĚƙƥŞĚŠƥ ĿŠ ŏūĿŠƥ DŽĚŠƥƭƑĚ ČūŞƎîŠNjȠ

Rudolf Atul Chemicals Ltd

India

50

10.72

10.00

ēēȠ HƑūƭƎ ƙĺîƑĚ ūlj ƎƑūǛƥ ljūƑ ƥĺĚ NjĚîƑ

5.02

0.72

Total equity accounted investments

15.74

10.72

Consolidated

|

Notes to the Financial Statements

203