iii) Foreign exchange risk

The Group has international operations

îŠē Ŀƙ ĚNJƎūƙĚē ƥū ljūƑĚĿijŠ ĚNJČĺîŠijĚ

risk arising from foreign currency

ƥƑîŠƙîČƥĿūŠƙȦ

GūƑĚĿijŠ ĚNJČĺîŠijĚ

risk arises from future commercial

ƥƑîŠƙîČƥĿūŠƙ îŠē ƑĚČūijŠĿƙĚē ǛŠîŠČĿîŕ

assets and liabilities denominated in

a currency that is not the functional

currency (

`

) of the Group. The risk

also includes highly probable foreign

ČƭƑƑĚŠČNj Čîƙĺ ǜūDžƙȦ ¹ĺĚ ūċŏĚČƥĿDŽĚ ūlj

ƥĺĚ Čîƙĺ ǜūDžƙ ĺĚēijĚƙ Ŀƙ ƥū ŞĿŠĿŞĿƙĚ

the volatility of the

`

Čîƙĺ ǜūDžƙ ūlj

highly probable forecast transactions.

¹ĺĚ HƑūƭƎ ĺîƙ ĚNJƎūƙƭƑĚ îƑĿƙĿŠij

ūƭƥ ūlj ĚNJƎūƑƥȡ ĿŞƎūƑƥȡ ŕūîŠƙ îŠē

other transactions other than

functional risk. The Group hedges its

ljūƑĚĿijŠ ĚNJČĺîŠijĚ ƑĿƙŒ ƭƙĿŠij ljūƑĚĿijŠ

ĚNJČĺîŠijĚ ljūƑDžîƑē ČūŠƥƑîČƥƙ îŠē

currency options after considering

the natural hedge. The same is within

the guidelines laid down by Risk

Management Policy of the Group.

ƙ îŠ ĚƙƥĿŞîƥĿūŠ ūlj ƥĺĚ îƎƎƑūNJĿŞîƥĚ

ĿŞƎîČƥ ūlj ƥĺĚ ljūƑĚĿijŠ ĚNJČĺîŠijĚ ƑîƥĚ ƑĿƙŒȡ

with respect to Financial Statements,

the Group has calculated the impact as

follows:

For derivative and non-derivative

ǛŠîŠČĿîŕ ĿŠƙƥƑƭŞĚŠƥƙȡ î Ǩɼ ĿŠČƑĚîƙĚ

in the spot price as on the reporting

date would have led to an increase

in additional

`

2.91 cr gain in other

comprehensive income (2017-18: gain

of

`

2.78 cr). A 2% decrease would have

led to an increase in additional

`

ǨȦǨǪ

cr loss in other comprehensive income

(2017-18: Gain of

`

2.30 cr).

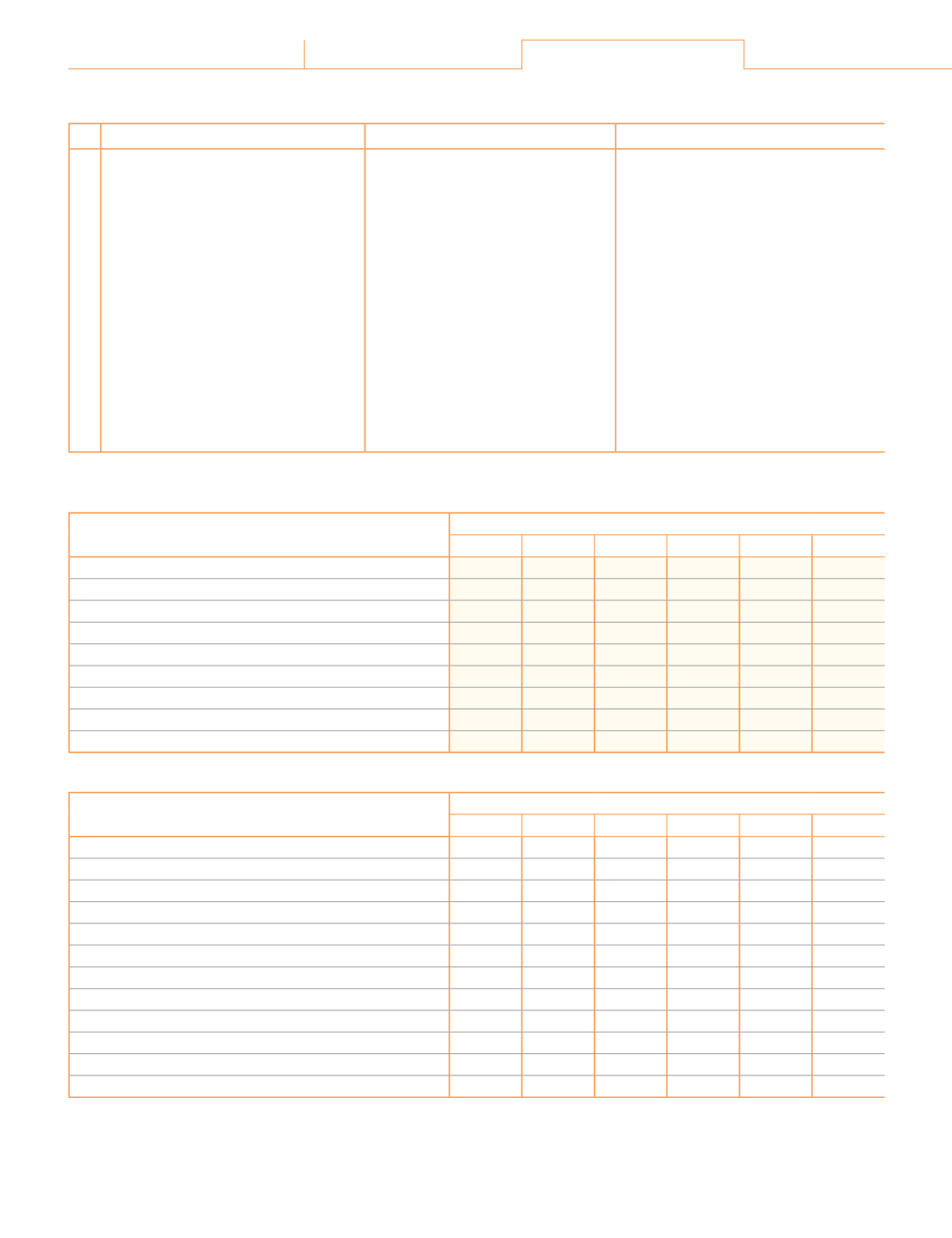

GūƑĚĿijŠ ČƭƑƑĚŠČNj ƑĿƙŒ ĚNJƎūƙƭƑĚȠ

¹ĺĚ ĚNJƎūƙƭƑĚ ƥū ljūƑĚĿijŠ ČƭƑƑĚŠČNj ƑĿƙŒ ūlj ƥĺĚ HƑūƭƎ îƥ ƥĺĚ ĚŠē ūlj ƥĺĚ ƑĚƎūƑƥĿŠij ƎĚƑĿūē ĚNJƎƑĚƙƙĚē îƑĚ îƙ ljūŕŕūDžƙȠ

Particulars

As at March 31, 2019

US$ mn

`

cr

€ mn

`

cr

£ mn

`

cr

Financial assets

Trade receivables

38.62

267.15

2.03

15.76

0.33

2.96

Less:

Hedged through derivatives

1

Currency range options

ǧǨȦǪǫ

86.12

0.13

1.01

-

-

Net exposure to foreign currency risk (assets)

26.17 181.03

1.90

14.75

0.33

2.96

Financial liabilities

Trade payables

13.53

92.58

0.08

0.59

-

ǦȦǦǪ

Net exposure to foreign currency risk (liabilities)

13.53

92.58

0.08

0.59

-

0.04

1

TŠČŕƭēĚƙ ĺĚēijĚƙ ljūƑ ĺĿijĺŕNj ƎƑūċîċŕĚ ƥƑîŠƙîČƥĿūŠƙ ƭƎ ƥū ŠĚNJƥ ǧǨ ŞūŠƥĺƙ

Particulars

As at March 31, 2018

US$ mn

`

cr

€ mn

`

cr

£ mn

`

cr

Financial assets

Trade receivables

37.07

ǨǪǧȦǧǦ

1.21

9.78

0.03

0.27

Less:

Hedged through derivatives

1

Currency range options

0.92

6.01

-

-

-

-

Net exposure to foreign currency risk (assets)

36.15 235.09

1.21

9.78

0.03

0.27

Financial liabilities

Trade payables

16.39

106.55

0.06

ǦȦǪǮ

0.03

ǦȦǨǪ

Less:

Hedged through derivatives

1

Currency range option

3.72

ǨǪȦǨǨ

-

-

-

-

Net exposure to foreign currency risk (liabilities)

12.67

82.33

0.06

0.48

0.03

0.24

1

TŠČŕƭēĚƙ ĺĚēijĚƙ ljūƑ ĺĿijĺŕNj ƎƑūċîċŕĚ ƥƑîŠƙîČƥĿūŠƙ ƭƎ ƥū ŠĚNJƥ ǧǨ ŞūŠƥĺƙ

Note 29.8 Financial risk management (continued)

ǨǩǪ

Atul Ltd | Annual Report 2018-19

Corporate Overview 01-22

Statutory Reports 23-105

Financial Statements 107-250