Schedules forming part of the Account

s

2009

2008

2009

2008

2009

2008

2009

2008

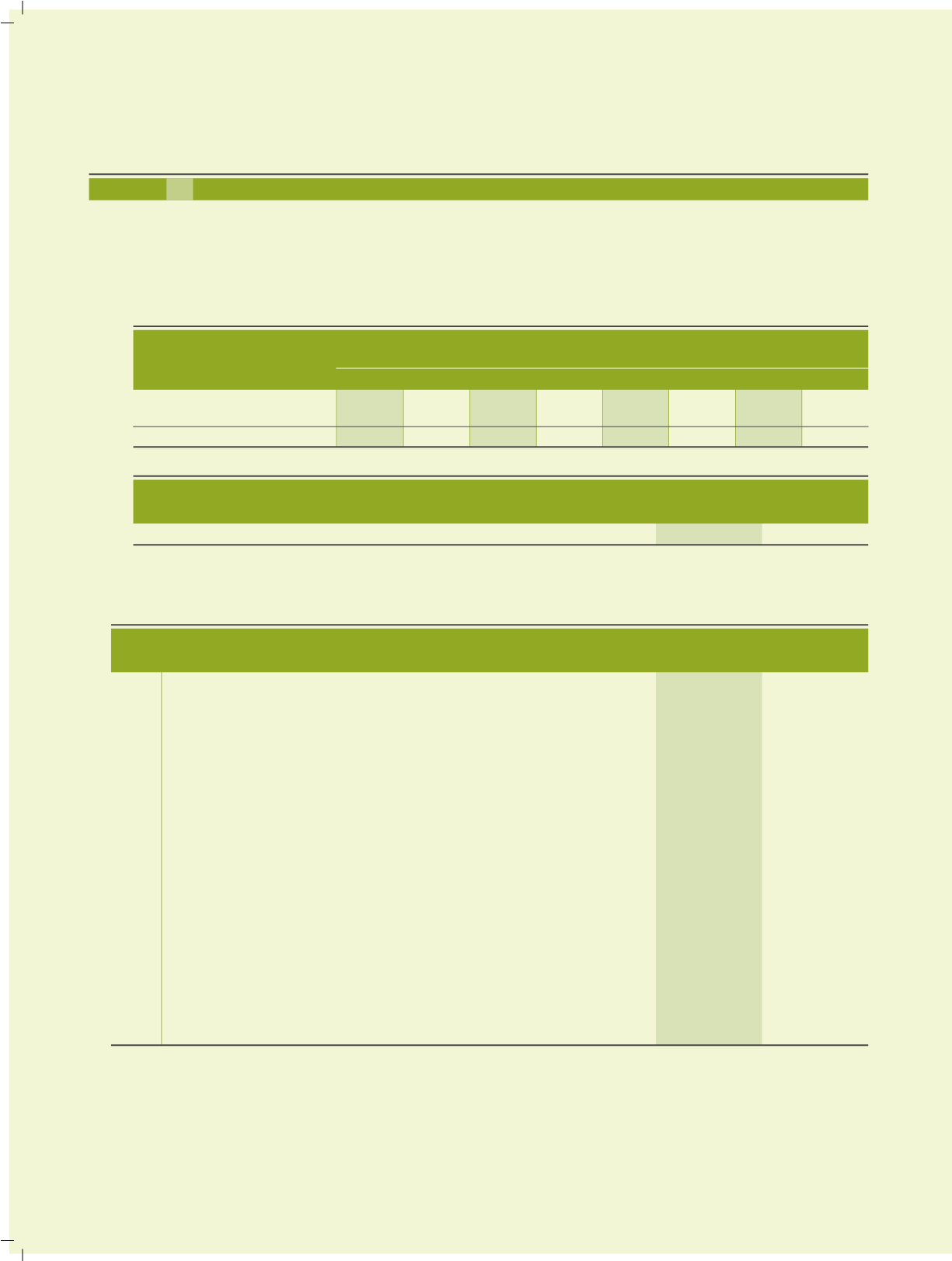

Buildings

3.80

3.80

3.80

3.80

-

-

-

-

Plant & machinery

127.50 127.50 61.52 48.34 65.98 79.16 13.18 13.18

Total

131.30 131.30 65.32 52.14 65.98 79.16 13.18 13.18

15 Lease:

(a) The Company has taken various residential and office premises under operation lease or leave and license agreements. These

are generally cancellable, having a term between 11 months and 3 years and have no specific obligation for renewal. Lease

payments are recognised in the Profit and Loss Account under rent in Schedule 15.

(b) The Company has given a building and plant & machinery on operating lease, the details of which are as under:

(Rs in lacs)

Assets

Gross block

Depreciation fund Written down

Depreciation for

value

the year

SCHEDULE 16 NOTES FORMING PART OF THE ACCOUNTS

(Contd.)

Particulars

As at

As at

March 31, 2009 March 31, 2008

Not later than one year

23.53

23.53

The future minimum lease payments to be received under the non-cancellable leases are as follows:

(Rs in lacs)

No Particulars

As at

As at

March 31, 2009 March 31, 2008

(a)

The principal amount and the interest due thereon remaining

unpaid to any supplier at the end of each accounting year;

Principal

23.35

5.84

Interest

0.79

0.33

(b)

The amount of interest paid by the buyer in terms of section 16 of the Micro,

Small and Medium Enterprise Development Act, 2006, along with the

amounts of the payment made to the suppliers beyond the

appointed day during each accounting year;

–

–

(c)

The amount of interest due and payable for the period of delay in making

payment (which have been paid but beyond the appointed day during

the year) but without adding the interest specified under the Micro,

Small and Medium Enterprise Development Act, 2006;

0.78

0.33

(d)

The amount of interest accrued and remaining unpaid

at the end of accounting year; and

0.78

0.33

(e)

The amount of further interest remaining due and payable even in the

succeeding years, until such date when the interest dues as above are

actually paid to the small enterprise, for the purpose of disallowance

as a deductible expenditure under section 23 of the Micro, Small and

Medium Enterprise Development Act, 2006;

–

–

Above disclosures have been made based on information available with the Company, for suppliers who are registered as Micro,

Small and Medium Enterprise under "The Micro, Small and Medium Enterprise Development Act, 2006" as at March 31, 2009.

17

(a) Suppliers and customers balances are subject to confirmation.

(b) Depots debtors as per depots books and Head office books are in the process of reconciliation, adjustments, if any, will be

made on completion of the reconciliation. Due to this, sundry debtors related to Depots sales are disclosed as per Head

office books of Account.

16 Micro, Small and Medium Enterprise dues:

Sundry creditors include Rs23.35 due to Micro, Small and Medium Enterprise. Following is the information, required to be

furnished as per Section 22 of the Micro, Small and Medium Enterprise Development Act, 2006.

(Rs in lacs)

76