Atul Ltd | Annual Report 2013-14

(

`

cr)

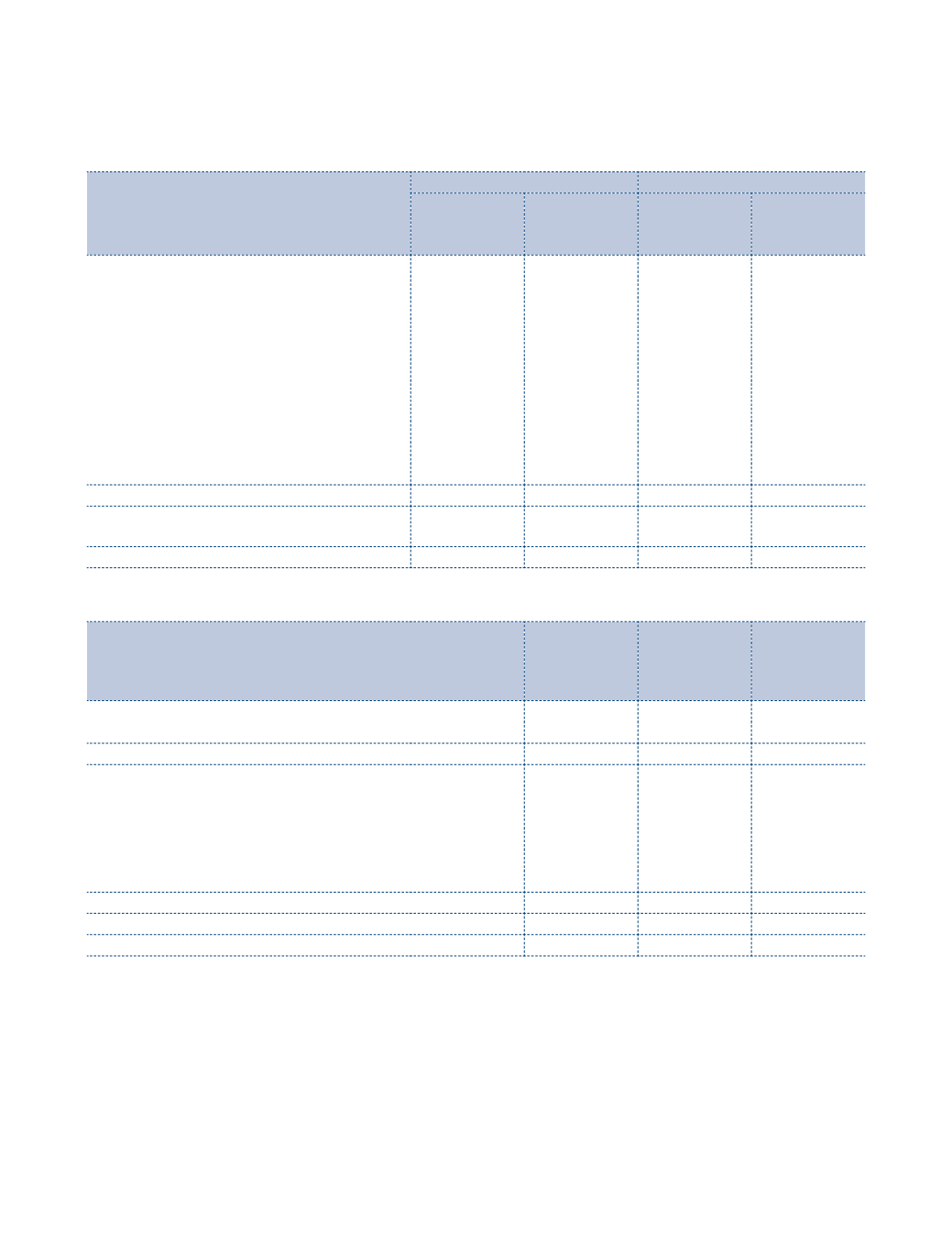

NOTE 5 DEFERRED TAX LIABILITIES (NET)

As at

Charge |

(credit)

during the

year

As at

March 31,

2014

March 31,

2013

Deferred tax liabilities:

on account of timing difference in depreciation

43.85

8.68

35.17

43.85

8.68

35.17

Deferred tax assets:

on account of timing difference in

(a) Provision for leave encashment

7.22

0.41

6.81

(b) Provision for doubtful debts

1.14

0.19

0.95

(c) Provision for doubtful advances

0.06

–

0.06

(d) Voluntary retirement scheme

0.04

(0.15)

0.19

8.46

0.45

8.01

Deferred tax liabilities | (assets) of subsidiary companies

1.70

1.58

0.12

Net deferred tax liabilities | (assets)

37.09

9.81

27.28

(

`

cr)

NOTE 4 LONG-TERM BORROWINGS

Non-current

Current maturities

As at

As at

As at

As at

March 31,

2014

March 31,

2013

March 31,

2014

March 31,

2013

Term loans

Secured:

(i) Rupee term loans from banks

5.00

8.84

1.50

–

(ii) Rupee term loans from a foreign

financial institution

31.25

41.66

10.42

10.42

(iii) Foreign currency term loans from banks

60.60

70.77

17.59

6.80

(iv) Foreign currency term loans from a

foreign financial institution

22.54

43.06

25.04

22.66

Unsecured:

(v) Rupee term loans from bank

0.10

0.02

0.16

0.34

(vi) Rupee term loan

–

0.01

–

–

119.49

164.36

54.71

40.22

Amount disclosed under the head ‘Other

Current Liabilities’ (see Note 9)

(54.71)

(40.22)

119.49

164.36

–

–

Notes

to the Consolidated Financial Statements