79

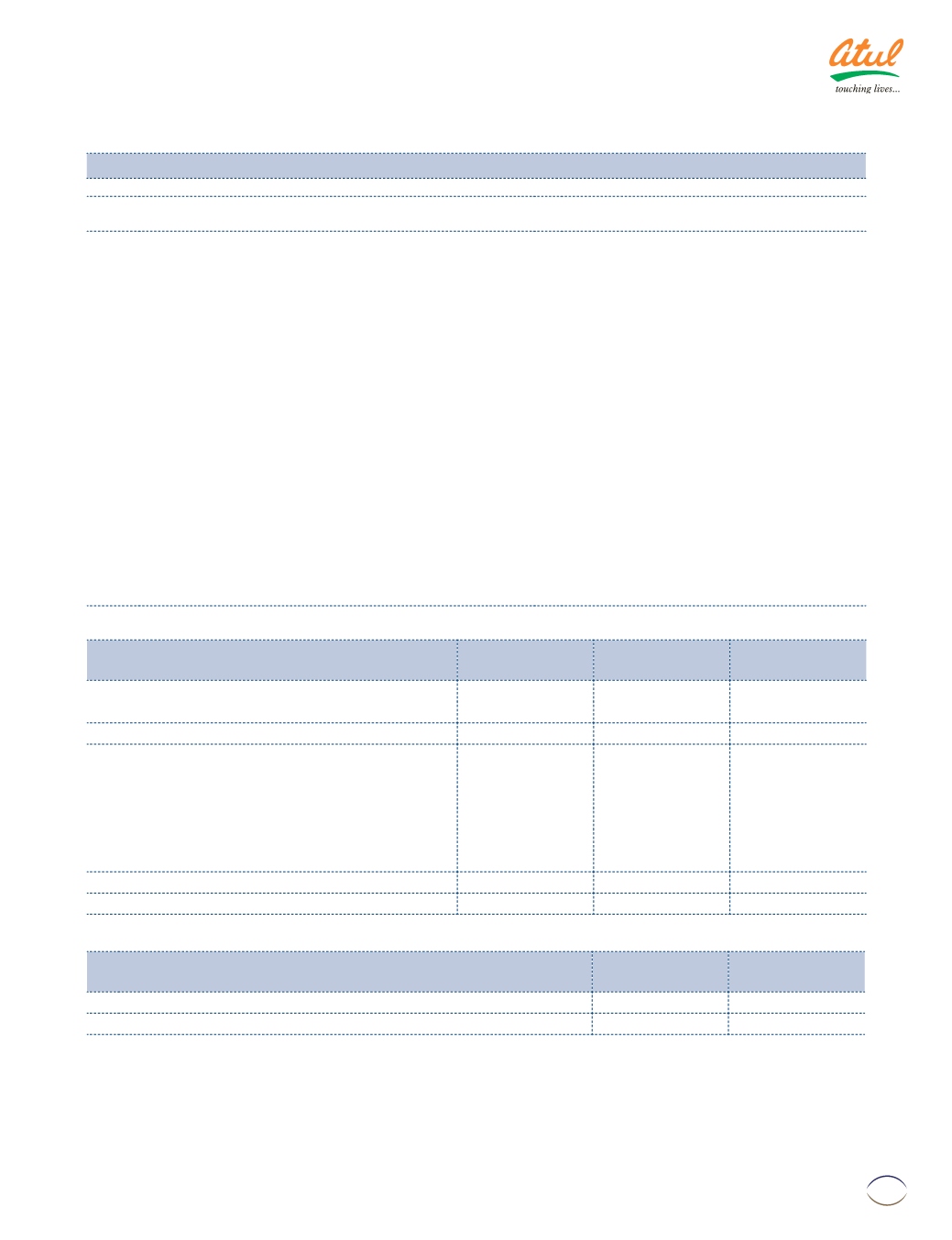

NOTE 4 LONG-TERM BORROWINGS

(contd)

Sr No

Type of loan | Nature of security

Terms of repayment

(iii)

Foreign currency loan from a foreign financial

institution amounting to

`

47.58 cr (Previous year:

`

65.72 cr) is secured by first

pari passu

charge by way of

hypothecation of all movable fixed assets and mortgage

of immovable properties of the Company, present and

future, excluding specific assets with exclusive charge and

second charge on entire current assets of the Company,

present and future.

Tranche1:7halfyearlyinstallmentsbeginning

from January 15, 2013 along with interest

@ 6 Month LIBOR + 225 bps p.a. (balance

installments payable-3 of

`

2.50 cr each).

Tranche 2:7 half yearly installments

beginning from July 15, 2013 along with

interest @ 6 Month LIBOR + 225 bps p.a.

(balance installments payable-4 of

`

10.02

cr each).

(iv)

a) Unsecured rupee term loan from a bank amounting

to

`

0.05 cr (Previous year:

`

0.11 cr).

20 equal quarterly installments beginning

from November 30, 2011 along with

interest @ Base rate +1.5% p.a. (balance

installments payable-9 for

`

0.01 cr each).

b) Unsecured rupee term loan from a bank amounting

to

`

0.21 cr (Previous year:

`

0.25 cr).

Quarterly installments beginning from

December 1, 2012 along with interest @

Base rate +1.5% p.a. (balance installments

payable-6 of

`

0.04 cr each).

(

`

cr)

NOTE 5 DEFERRED TAX LIABILITIES (NET)

As at

March 31, 2014

Charge | (credit)

during the year

As at

March 31, 2013

Deferred tax liabilities:

on account of timing difference in depreciation

43.85

8.68

35.17

43.85

8.68

35.17

Deferred tax assets:

on account of timing difference in

(a) Provision for leave encashment

7.22

0.41

6.81

(b) Provision for doubtful debts

1.14

0.19

0.95

(c) Provision for doubtful advances

0.06

–

0.06

(d) Voluntary retirement scheme

0.04

(0.15)

0.19

8.46

0.45

8.01

Net deferred tax liabilities | (assets)

35.39

8.23

27.16

(

`

cr)

NOTE 6 LONG-TERM PROVISIONS

As at

March 31, 2014

As at

March 31, 2013

Provision for leave entitlement

5.19

5.04

5.19

5.04

Notes

to the Financial Statements