Atul Ltd | Annual Report 2014-15

(

`

cr)

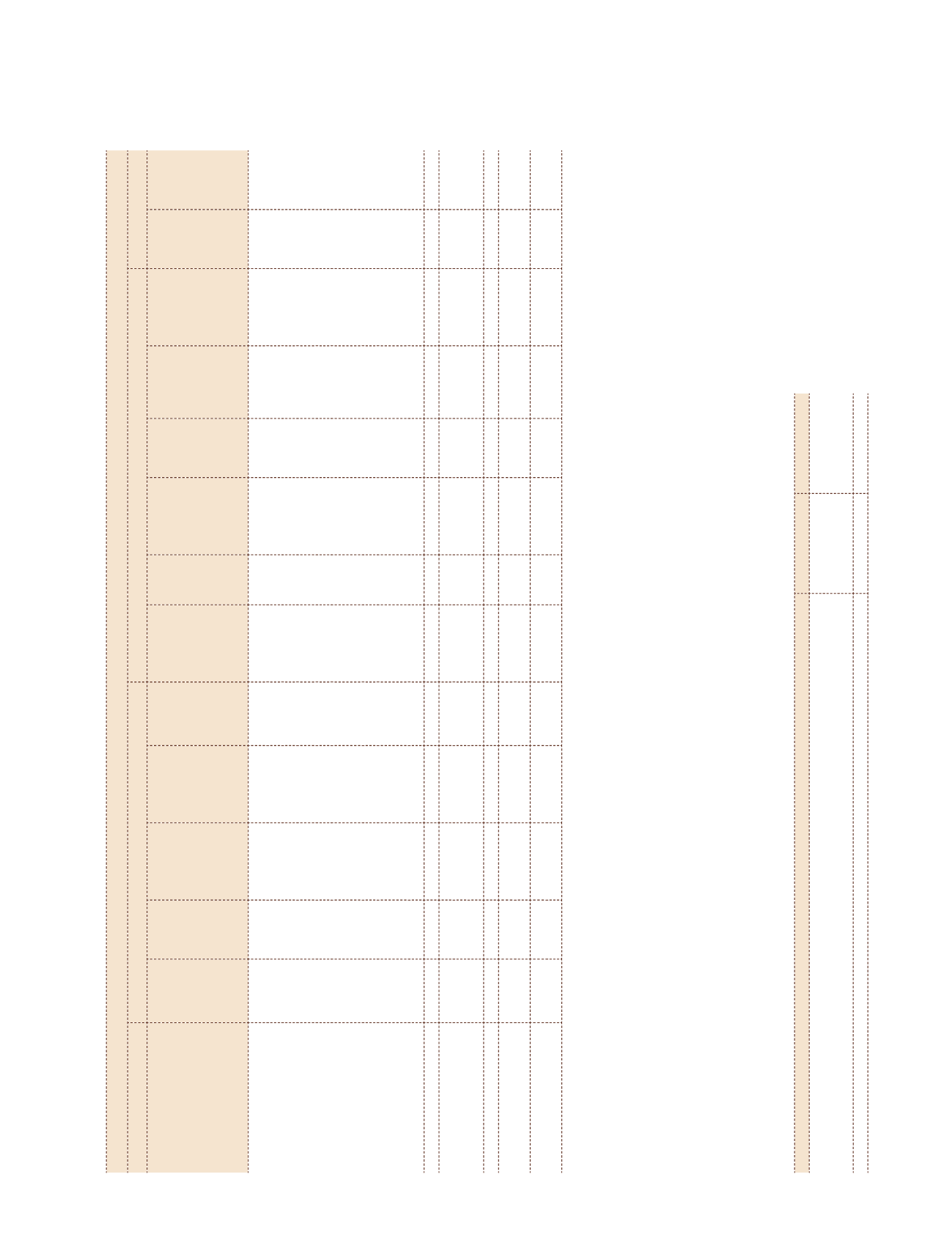

NOTE 12 FIXED ASSETS

ASSET BLOCK

GROSS BLOCK (a)

DEPRECIATION | AMORTISATION | IMPAIRMENT

NET BLOCK

As at

March 31,

2014

Additions

Other

adjustments

Deductions

and

adjustments

As at

March 31,

2015

Depreciation

upto

March 31,

2014

For the

year

Deductions

and

adjustments

(c)

As at

March 31,

2015

Impairment

fund

March 31,

2015

Depreciation

and

impairment

fund

March 31,

2015

As at

March 31,

2015

As at

March 31,

2014

Tangible assets

Land - freehold (b) and (e)

21.41

–

(7.29)

– 14.12

–

–

–

–

–

– 14.12

21.41

Land - leasehold (b) and (e)

24.60

–

(20.04)

–

4.56

2.25

0.08

1.39

0.94

–

0.94

3.62

22.35

Buildings (b), (d) and (e)

264.25

18.37

(87.45)

4.82

190.35

72.66 10.53

11.54

71.65

–

71.65 118.70 191.59

Roads

3.31

0.10

–

–

3.41

1.35

1.27

–

2.62

–

2.62

0.79

1.96

Plant and equipment (f)

and (g)

919.09 103.68

2.14

6.52 1,018.39

583.21 57.80

3.21 637.80

21.03

658.83 359.56 314.85

Railway siding

0.08

–

–

–

0.08

0.08

–

–

0.08

–

0.08

–

–

Office equipment and

furniture

33.50

1.82

–

0.05

35.27

21.29

2.29

0.04

23.54

–

23.54

11.73

12.21

Vehicles

14.92

1.68

–

1.33

15.27

9.37

1.73

0.75

10.35

–

10.35

4.92

5.55

Total tangible assets

1,281.16 125.65

(112.64)

12.72 1,281.45

690.21 73.70

16.93 746.98

21.03

768.01 513.44 569.92

Intangible assets

Technical know-how

1.10

–

–

–

1.10

0.76

0.34

–

1.10

–

1.10

–

0.34

Computer software

12.93

0.30

–

– 13.23

12.92

0.09

– 13.01

–

13.01

0.22

0.01

Total intangible assets

14.03

0.30

–

– 14.33

13.68 0.43

– 14.11

–

14.11

0.22

0.35

Total as at

March 31, 2015

1,295.19 125.95

(112.64)

12.72 1,295.78

703.89 74.13

16.93 761.09

21.03

782.12 513.66 570.27

Total as at

March 31, 2014

1,192.64 116.81

8.53

22.79 1,295.19

665.21 61.15

22.47 703.89

21.03

724.92 570.27

Notes:

a)

At cost, except certain building premises and plant and equipment stated at fair value.

b)

The Company and one of its subsidiary companies had, in the year 1985, 2008 and 2011, revalued certain land and buildings. The residual value of which as at April 01, 2014 aggregated

`

108.97 cr. However,

with passage of time, the equitable values of the assets under the heads of land and buildings are overall much higher than their carrying values, vitiating the objective of the original exercise of revaluation.

The Company has therefore changed its Accounting Policy and decided to show all these fixed assets at historical cost only. Accordingly, the Company has reversed the aforesaid amount of Revaluation reserve,

which will result in these assets being stated at their historical cost less accumulated depreciation. The above accounting treatment does not have any impact on the Statement of Profit and Loss for the current

and subsequent years.

c)

Consequent to the enactment of the Companies Act, 2013 (Act) and its applicability for accounting periods commencing on or after April 01, 2014, the Company has re-worked depreciation with reference

to the useful lives of fixed assets prescribed by PART ‘C’ of Schedule II to the Act or the useful lives of assets as estimated by the Company, whichever is lower. Where the remaining useful life of an asset is Nil,

the carrying amount of the asset after retaining the residual value, as at April 01, 2014 has been adjusted to the General reserve. In other cases the carrying values have been depreciated over the remaining

useful lives of the assets and recognised in the Statement of Profit and Loss. As a result the charge for depreciation is lower by

`

2.28 cr for the year ended March 31, 2015.

d)

Includes premises on ownership basis

`

1.10 cr (Previous year:

`

1.10 cr) and cost of fully paid share in co-operative society

`

2,000 (Previous year:

`

2,000).

e)

Pursuant to the order passed by Honourable High Court of Gujarat, dated November 17, 2008 and April 17, 2009 in case of water charges, the Company has created first charge over its certain land and

buildings in favour of Government of Gujarat and paid security deposit

`

2 cr (Previous year:

`

2 cr)

f)

Exchange rate difference capitalised during the year

`

2.14 cr (Previous year:

`

8.53 cr).

g)

Exchange rate difference which remains unamortised in accordance with the option exercised under Para 46A of Accounting Standard-11 is

`

17.18 cr (Previous year:

`

16.62 cr).

h)

Break-up of depreciation for the year

(

`

cr)

2014-15

2013-14

Depreciation | Amortisation expenses for the year

74.13

61.15

Less: Amount withdrawn from Revaluation reserve (refer Note 3)

–

2.65

Less: Depreciation in respect of earlier year

13.86

0.24

Depreciation | Amortisation expenses as per the Consolidated Statement of Profit and Loss

60.27

58.26

Notes

to the Consolidated Financial Statements