Atul Ltd | Annual Report 2014-15

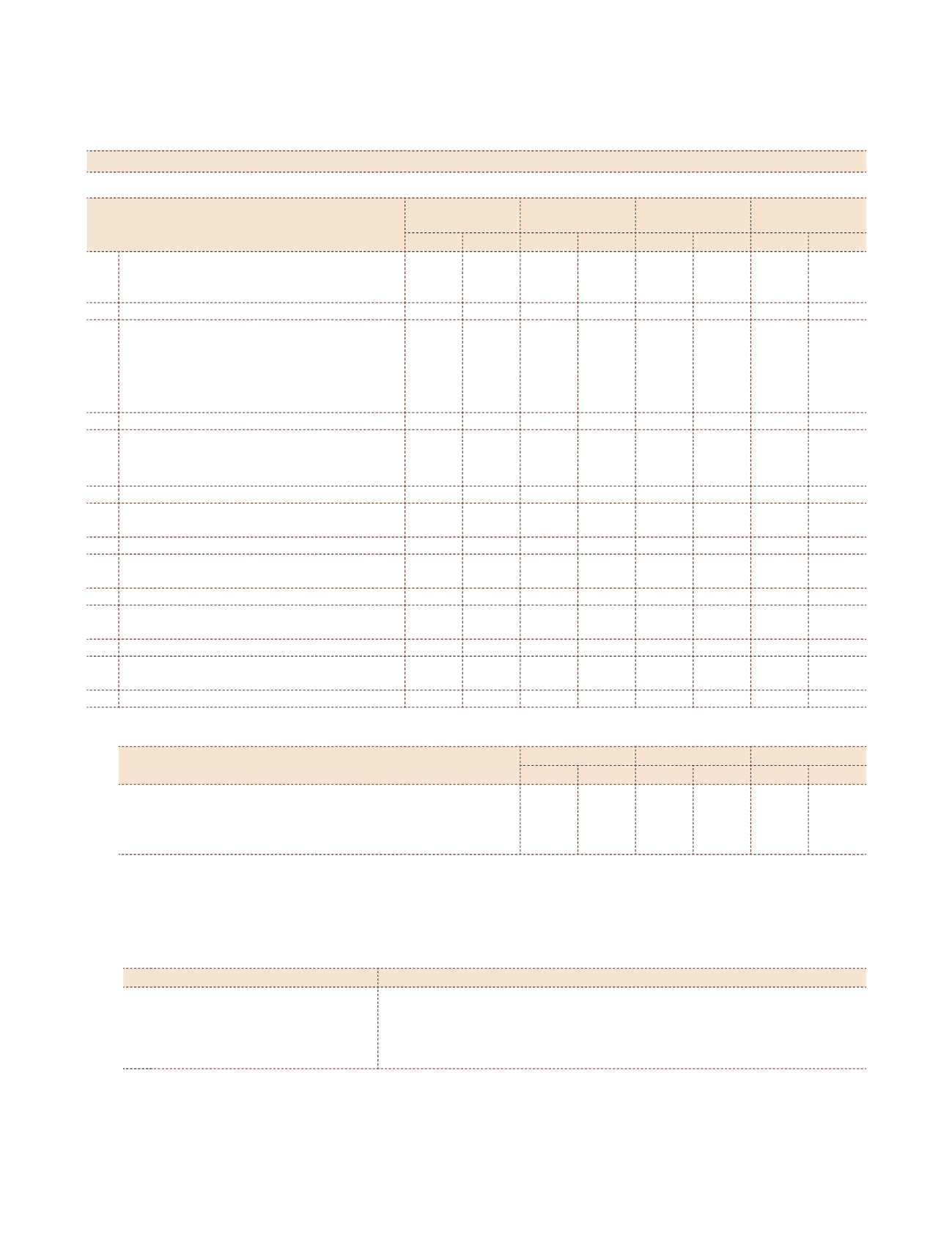

NOTE 28.5 SEGMENT INFORMATION

a) Primary segment - business

(

`

cr)

Particulars

Life Science

Chemicals

Performance and

Other Chemicals

Others

Total

2014-15 2013-14 2014-15 2013-14 2014-15 2013-14 2014-15 2013-14

1 Segment revenue

Gross sales

754.06 810.95 2,197.14 1,869.66

4.77

2.10 2,955.97 2,682.71

Less: Inter segment revenue

–

– 173.95 127.82

–

– 173.95 127.82

Net revenue from operations

754.06 810.95 2,023.19 1,741.84

4.77

2.10 2,782.02 2,554.89

2 Segment results

Profit before finance cost and tax

123.86 153.57 254.99 184.34

(1.14)

(1.22) 377.71 336.69

Less: Finance costs

25.69

33.44

Less: Other unallocable expenditure

(net of unallocable income)

26.44

(5.05)

Profit before tax

325.58 308.30

3 Other information

Segment assets

423.21 455.67 1,024.29 928.21 51.14

49.80 1,498.64 1,433.68

Unallocated common assets

324.43 384.11

Total assets

1,823.07 1,817.79

Segment liabilities

89.78 147.48 276.80 280.50

5.46

6.22 372.04 434.20

Unallocated common liabilities

107.53

61.97

Total liabilities

479.57 496.17

Capital expenditure

40.42

30.57 138.37

73.55

1.94

12.35 180.73 116.47

Unallocated capital expenditure

17.63

1.52

Total capital expenditure *

198.36 117.99

Depreciation

17.31

18.16

39.14

37.00

2.08

0.99

58.53

56.15

Unallocated depreciation

1.74

2.11

Total depreciation

60.27

58.26

Significant non-cash expenses

–

–

–

–

–

–

–

–

Significant unallocated non-cash expenses

–

–

Total significant non-cash expenses

–

–

b) Secondary segment - geographical

(

`

cr)

Particulars

In India

Outside India

Total

2014-15 2013-14 2014-15 2013-14 2014-15 2013-14

Segment revenue

1,493.39 1,377.74 1,288.63 1,177.15 2,782.02 2,554.89

Carrying cost of assets by location of assets

1,661.35 1,618.28 161.72 199.51 1,823.07 1,817.79

Additions to assets and intangible assets*

195.41 114.96

2.95

3.03 198.36 117.99

Other disclosures:

1. The Company has disclosed business segment as the primary segment which have been identified in line with

the Accounting Standard-17 ‘Segment Reporting’ taking into account the organisation structure as well as

the differing risks and returns.

2. Composition of business segment:

Name of segment

Comprises

a) Life Science Chemicals

APIs, API intermediates, Fungicides, Herbicides, etc

b) Performance and Other Chemicals

Adhesion promoters, Bulk chemicals, Epoxy resins and hardeners, Intermediates, Perfumery,

Textile dyes, etc

c) Others

Mainly agribiotech

3. The Segment revenue, results, assets and liabilities include respective amounts identifiable to each segment

and amounts allocated on a reasonable basis.

4. The Company accounts for inter segments sales and transfers at market price.

* Including capital work-in-progress and capital advances

Notes

to the Consolidated Financial Statements