Atul Ltd | Annual Report 2014-15

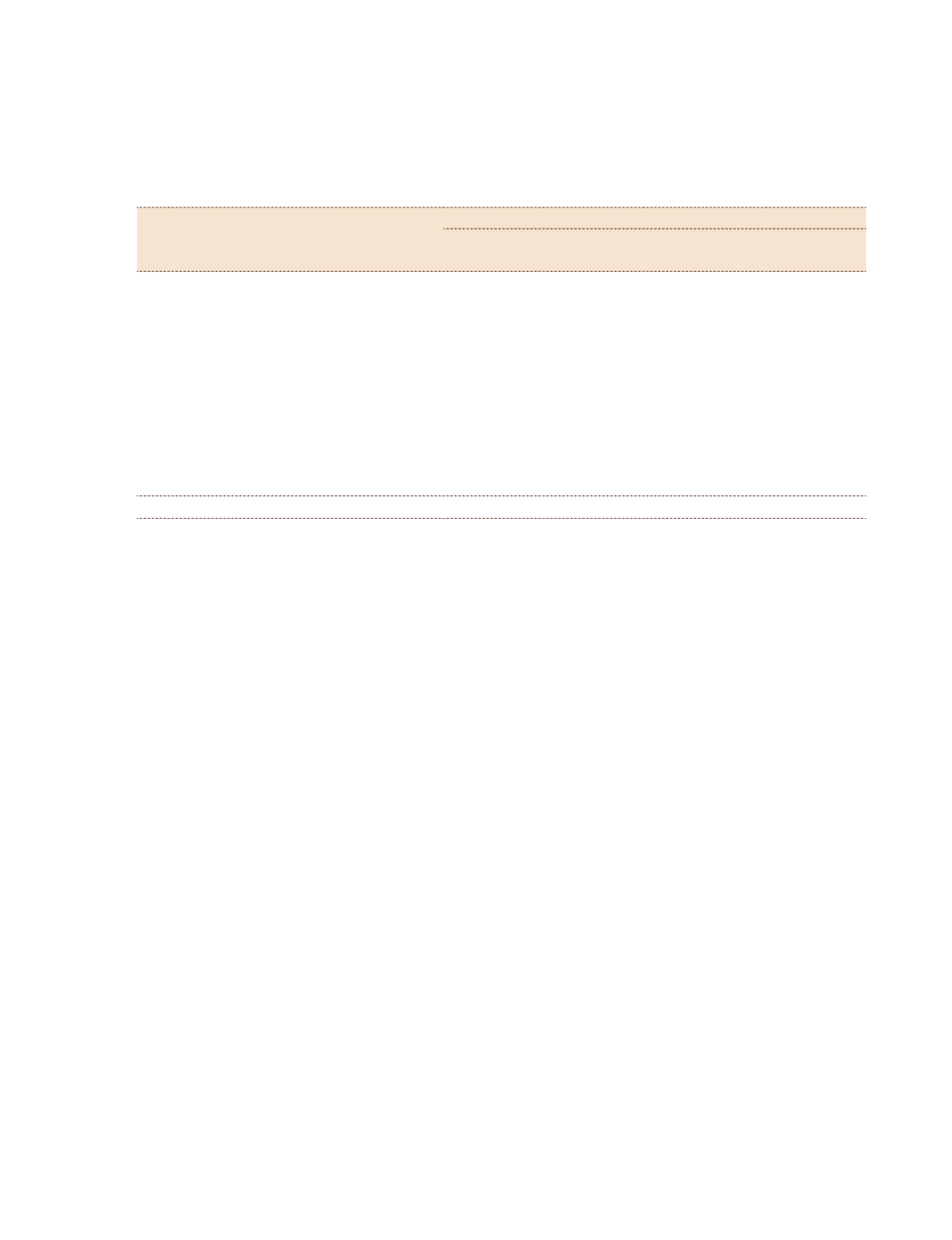

4.6.3 Remuneration to the Key Managerial Personnel other than the Managing Director | the Manager | the Whole-time

Director

(

`

)

No. Particulars

Key Managerial Personnel

CEO

CS

CFO

Total

S S Lalbhai

L P Patni

1

T R Gopi Kannan

2

1 Gross salary

Salary as per provisions contained under

Section 17(1) of the Income-tax Act, 1961

NA 17,23,751

85,61,477

1,02,85,228

Value of perquisites under Section 17(2)

of the Income-tax Act, 1961

NA

2,41,171

17,820

2,58,991

Profits in lieu of salary under Section 17(3)

of the Income-tax Act, 1961

NA

–

–

–

2 Stock option

NA

–

–

–

3 Sweat Equity

NA

–

–

–

4 Commission

NA

–

–

–

5 Others

NA

–

–

–

Total

NA 19,64,922

85,79,297

1,05,44,219

NA: Not Applicable

1

Effective October 17, 2014 to March 31, 2015 |

2

Effective April 01, 2014 to October 16, 2014 (CFO and CS)

4.7 Penalties | Punishment | Compounding of offences

There were no penalties | punishment | compounding of offences for the year ending March 31, 2015.

5.

Secretarial Audit Report

Form number – 3

Secretarial Audit Report

For the financial year ended on March 31, 2015

{Pursuant to Section 204 (1) of the Companies Act, 2013 and Rule number 9 of

The Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014}

The Members

Atul Ltd

Atul House

G I Patel Marg

Ahmedabad 380014, Gujarat

India

I have conducted the Secretarial Audit of the compliance of applicable statutory provisions and the adherence to good corporate

practices by Atul Ltd (hereinafter called the Company). The Secretarial Audit was conducted in a manner that provided me a

reasonable basis for evaluating the corporate conducts | statutory compliances and expressing my opinion thereon.

Based on my verification of the books, papers, minute books, forms and returns filed and other records maintained by the

Company and also the information provided by the Company, its officers, agents and authorised representatives during the

conduct of the Secretarial Audit, I hereby report that in my opinion, the Company has, during the audit period covering the

financial year ended on March 31, 2015 complied with the statutory provisions listed hereunder and also that the Company

has proper board-processes and compliance mechanism in place to the extent, in the manner and subject to the reporting

made hereinafter:

I have examined the books, papers, minute books, forms and returns filed and other records maintained by the Company as per

Annexure I for the financial year ended on March 31, 2015 according to the provisions of:

i)

The Companies Act, 2013 (Act) and the rules made thereunder;

ii) The Securities Contracts (Regulation) Act, 1956 and the rules made thereunder;

iii) The Depositories Act, 1996 and the regulations and bye-laws framed thereunder;

iv) Foreign Exchange Management Act, 1999 and the rules and regulations made thereunder to the extent of foreign direct

investment, overseas direct investment and external commercial borrowings;