Atul Ltd | Annual Report 2015-16

(

`

cr)

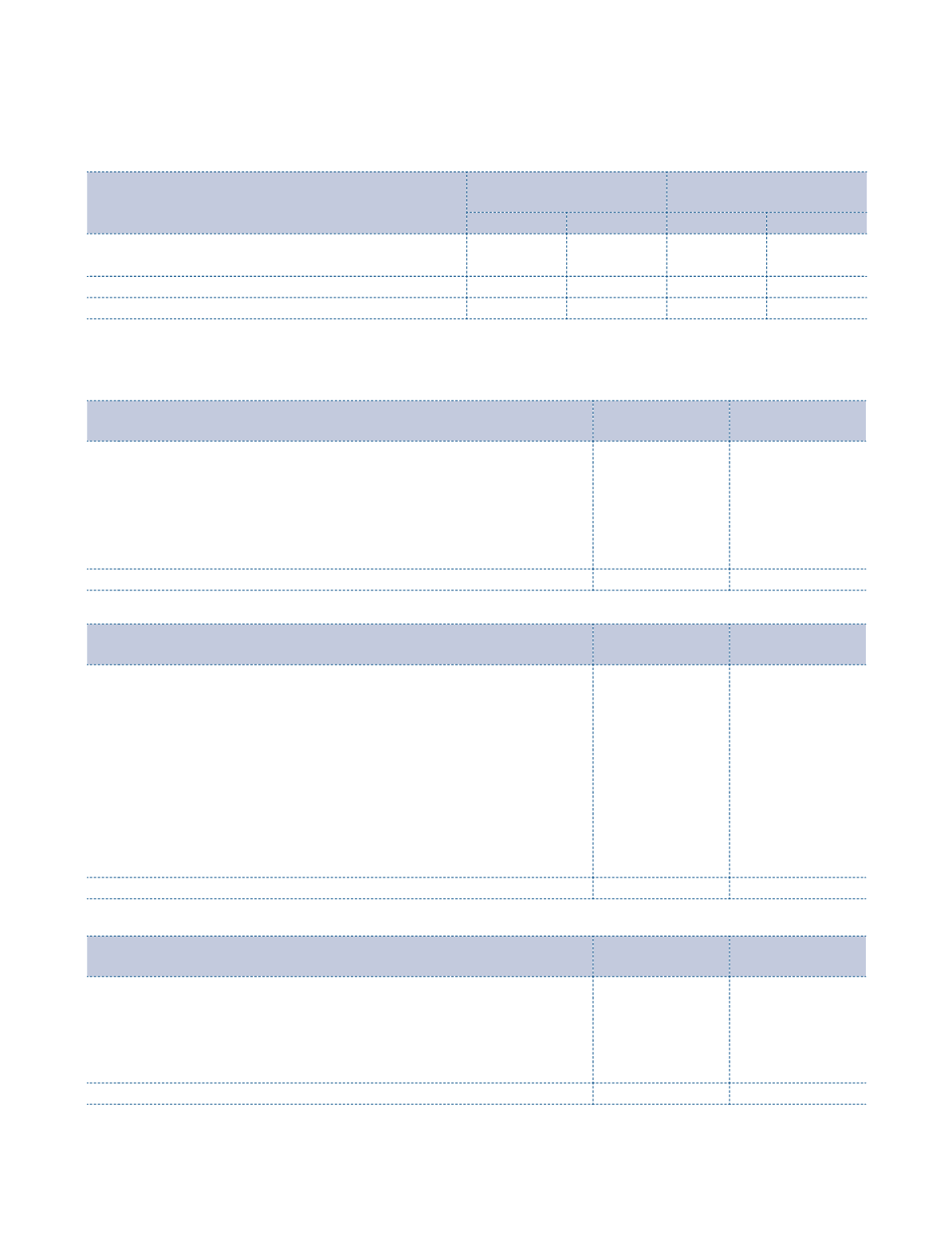

Particulars

Book value

As at March 31,

Market value

As at March 31,

2016

2015

2016

2015

Quoted

50.22

50.16

345.23

382.28

Unquoted

11.36

12.72

61.58

62.88

Aggregate provision for diminution

0.40

0.40

1

Valued at cost unless otherwise stated |

2

Became a subsidiary company during the previous year |

3

Received in terms of demerger scheme|

4

Due to restructuring of company

(

`

cr)

Note 14 Long-term loans and advances

As at

March 31, 2016

As at

March 31, 2015

a) Loans and advances to related parties: (refer Note 28.10)

i) Secured, considered good

11.29

11.29

ii) Unsecured, considered good

3.63

3.59

b) Others:

i) Capital advances

20.17

23.01

ii) Security deposits

0.71

0.62

35.80

38.51

(

`

cr)

Note 15 Other non-current assets

As at

March 31, 2016

As at

March 31, 2015

a) Balance with bank in fixed deposits, with maturity beyond 12 months

0.04

0.02

b) Balance with the Government departments:

Tax paid under protest

19.91

16.80

Tax paid in advance, net of provisions

3.26

0.50

VAT receivable

28.67

29.84

Prepaid expenses

0.04

0.05

Security deposit (refer Note 12

3

)

2.01

2.01

Deposit paid under protest

0.98

–

MAT Credit entitlement

0.07

–

c) Mark-to-Market gains on derivatives

2.37

5.47

57.35

54.69

(

`

cr)

Note 16 Current investments

As at

March 31, 2016

As at

March 31, 2015

Investment in Mutual Fund (unquoted) *

At cost or market value whichever is less

120.342 units (Previous year: Nil) of Birla Sun Life Cash Plus Fund

1.86

–

Nil units (Previous year: 18,21,827) of HDFC Liquid Fund

–

1.86

62.84 units (Previous year: 7,976.75) of SBI Premier Liquid Fund

0.01

0.80

1.87

2.66

NAV of current investments

1.87

2.66

*At cost or market value whichever is less.

Notes

to the Consolidated Financial Statements