Atul Ltd | Annual Report 2016-17

c) Cash flow hedging reserve

The Company uses hedging instruments as part of its management of foreign currency risk associated with its highly probable

forecast sale and inventory purchases and interest rate risk associated with variable interest rate borrowings. For hedging

foreign currency risk, the Company uses foreign currency forward contracts, foreign currency option contracts and Interest

rate swaps. They are designated as cash flow hedges to the extent these hedges are effective, the change in fair value of the

hedging instrument is recognised in the cash flow hedging reserve. Amounts recognised in the cash flow hedging reserve is

reclassified to profit or loss when the hedged item affects profit or loss (for example, sales and interest payments). When the

forecast transaction results in the recognition of a non-financial asset (for example, inventory), the amount recognised in the

cash flow hedging reserve is adjusted against the carrying amount of the non-financial asset.

(

`

cr)

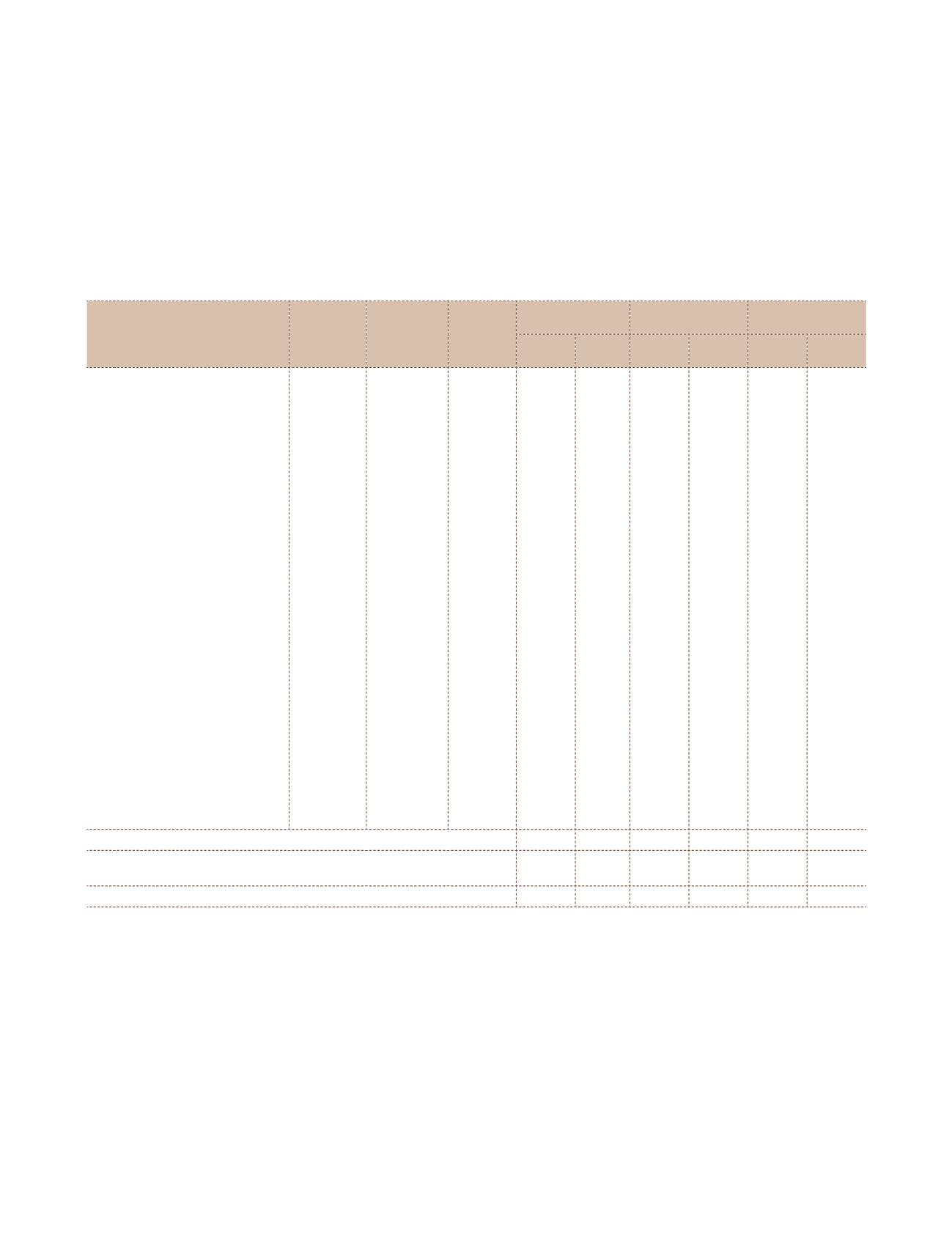

Note 15 Borrowings

Maturity Terms of

repayment

Effective

interest

rate p.a.

As at

March 31, 2017

As at

March 31, 2016

As at

April 01, 2015

Current Non-

current

Current Non-

current

Current Non-

current

a) Secured

i)

Rupee term loan from

a foreign financial

institution (refer Note a)

January,

2018

15 equal

half yearly

installments

6.99% -

7.46%

– 10.42

– 20.83

– 31.25

ii) Foreign currency term

loans from banks (refer

Note b and c)

September,

2017

12 equal

quarterly

installments

3 months

LIBOR +

2.90%

– 10.81

– 33.17

– 52.15

April, 2016 16 equal

quarterly

installments

3 months

LIBOR +

2.25%

–

–

– 2.07

– 9.78

iii) Foreign currency term

loan from a foreign

financial institution (refer

Note d)

January,

2016

16 equal

quarterly

installments

6 months

LIBOR +

2.25%

–

–

–

–

– 23.47

iv) Working capital loans

from banks (refer Note e)

1-6 months Repayable

on demand

2.43%-

10.40% 8.17

– 76.90

– 51.61

–

b) Unsecured

i)

Rupee term loans from a

bank (March 31, 2016:

`

30,112 )

May, 2016 20 equal

quarterly

installments

Base rate

+ 1.50%

–

–

–

– 0.14

ii) Loan from banks

including foreign banks

1-6 months 1-6 months 1.10%

51.87

– 53.07

– 12.52

–

iii) Loan from Related Parties 1-6 months 1-6 months

–

– 10.50

–

–

–

c) Buyers' credit

–

– 6.91

–

–

–

d) Commercial papers

1-3 months 1-3 months 6.50% 73.95

– 98.21

– 97.73

–

e) Deposit from the Directors

1-12 months 1-12 months 9.00% 0.01

– 0.01

– 0.01

–

134.00 21.23 245.60

56.07 161.87 116.79

Amount of current maturities of long-term debt disclosed under

the head 'Other financial liabilities' (refer Note 16)

– (21.23)

– (34.60)

– (62.71)

134.00

– 245.60 21.47 161.87 54.08

a) Rupee term loan from a foreign financial institution is secured by first

pari passu

charge by way of hypothecation of all

movable property, plant and equipment and mortgage of immovable properties of the Company, present and future,

excluding specific assets with first

pari passu

charge with other lenders and second charge on entire current assets of the

Company, both present and future.

b) Foreign currency term loan from a foreign bank is secured by first

pari passu

charge by way of hypothecation of all

movable property, plant and equipment and mortgage of immovable properties of the Company, present and future,

excluding specific assets with first

pari passu

charge and second charge on entire current assets of the Company, both

present and future.

c) Foreign currency term loan from a bank is secured by first

pari passu

charge on the entire movable and immovable

property, plant and equipment of the Company, both present and future.

d) Foreign currency term loan from a foreign bank is secured by first

pari passu

charge by way of hypothecation of all

movable property, plant and equipment and mortgage of immovable properties of the Company, present and future,

excluding specific assets with first

pari passu

charge with other lenders charge and second charge on entire current assets

of the Company, both present and future.

Notes

to the Financial Statements